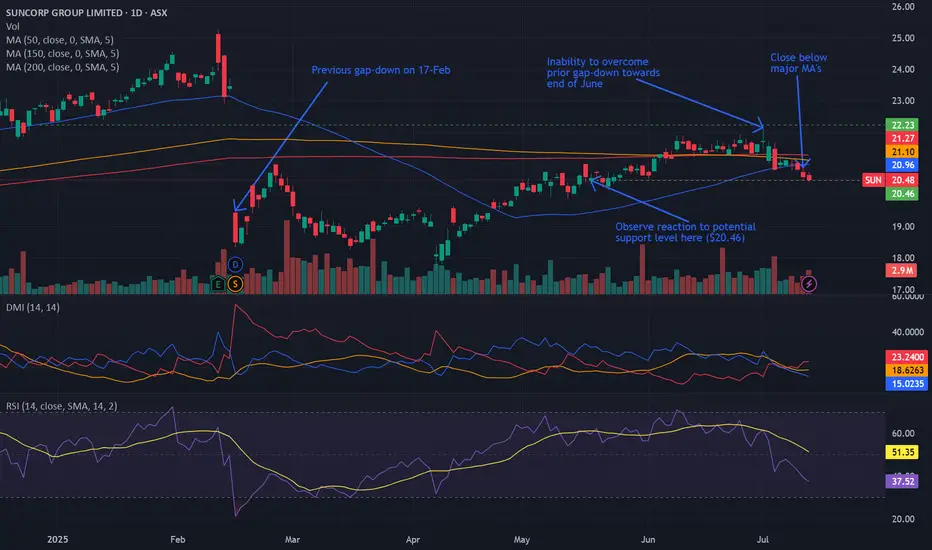

Entry conditions:

(i) lower share price for SUN along with swing of DMI indicator towards bearishness and RSI downwards, and

SUN along with swing of DMI indicator towards bearishness and RSI downwards, and

(ii) observing market reaction around the share price of $20.46 (open of 19th May).

Stop loss for the trade would be:

(i) above the potential prior resistance of $21.36 from the open of 5th June, or

(i) above the high of the recent swing high once the trade is activated (currently $22.14 from the high of 1st July), depending on risk tolerance.

(i) lower share price for

(ii) observing market reaction around the share price of $20.46 (open of 19th May).

Stop loss for the trade would be:

(i) above the potential prior resistance of $21.36 from the open of 5th June, or

(i) above the high of the recent swing high once the trade is activated (currently $22.14 from the high of 1st July), depending on risk tolerance.

Trade active

UPDATE (week ending 18-Jul): A 'cautious activation' occurred on 16th July with the entry conditions noted above being satisfied, although the share price closed just slightly above $20.46 at the end of the trading day. The share price closed below the 10 and 30 day MA's at the end of the trading week, however there appears to be some respect of this $20.46 level as a potential support level at the present time, as evidenced by the closure above this price at the end of the trading week. For those traders who wish to be more conservative, consider utilising the more conservative stop loss just above the potential prior resistance of $21.36 from the open of 5th June, or be even more conservative by placing a stop loss just above the potential prior resistance of $20.99 from the open of 16th May, depending on risk tolerance.Note

UPDATE (week ending 25-Jul): Share price closed below both declining 10 and 30 day MA's at the end of the trading week, with further respect of the previous $20.46 support level. Charts suggest improving stop loss position to an area just above the potential prior resistance of $20.99 from the open of 16th May.Note

UPDATE (week ending 01-Aug): Share price drifted higher during the week to the test the $20.99 resistance level and close between the 10 and 30 day MA's after successfully testing the $20.46 support level at the beginning of the week. Observe whether the share price breaks out one way or the other - of course, remembering that the trade is over should the share price break to the upside of the channel that has now formed here (this aggression works well, considering upcoming earnins on 13th August for SUN).Trade closed manually

UPDATE (week ending 08-Aug): Share price initially tested the $20.46 support level at the beginning of the week and then tested the $20.99 resistance level towards the end of the week, failing to breach either of these upon first attempt. Friday's price action followed through from the failure of the attempt to breach the resistance level, leading to a breach to the downside to close beneath both 10 and 30 day MA's at the end of the trading week. With earnings scheduled on Wednesday of this upcoming week, it is suggested by the charts to close out this trade for a small profit for anyone still remaining in this trade since (as we all know) earnings are essentially a 'coin flip' and can be either amazing for the share price, or absolutely appalling - risk management is key for your capital. Be grateful to the market for the profit and move on the next trade.Detailed commentary/updates about trades (stocks, crypto & bonds) available:

ivorywolf.start.page/ (Facebook / Telegram / YouTube / personal web-page)

Like/join/subscribe for the latest!

...

ivorywolf.start.page/ (Facebook / Telegram / YouTube / personal web-page)

Like/join/subscribe for the latest!

...

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Detailed commentary/updates about trades (stocks, crypto & bonds) available:

ivorywolf.start.page/ (Facebook / Telegram / YouTube / personal web-page)

Like/join/subscribe for the latest!

...

ivorywolf.start.page/ (Facebook / Telegram / YouTube / personal web-page)

Like/join/subscribe for the latest!

...

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.