🚗 Tata Motors – Breakout Setup from Monthly POI | Long-Term Opportunity Ahead!

🧭 Technical Context & Setup:

Tata Motors is shaping up as a high-probability breakout candidate after a ~55% correction from its all-time high of ₹1,168 to a recent low of ₹531.

✅ Monthly POI tapped: Strong bounce seen

✅ Liquidity Swept: Price swept the recent low zone and formed a hammer candle, a bullish reversal signal

✅ Change in State of Delivery (CISD) visible on weekly timeframe, showing fresh buying interest

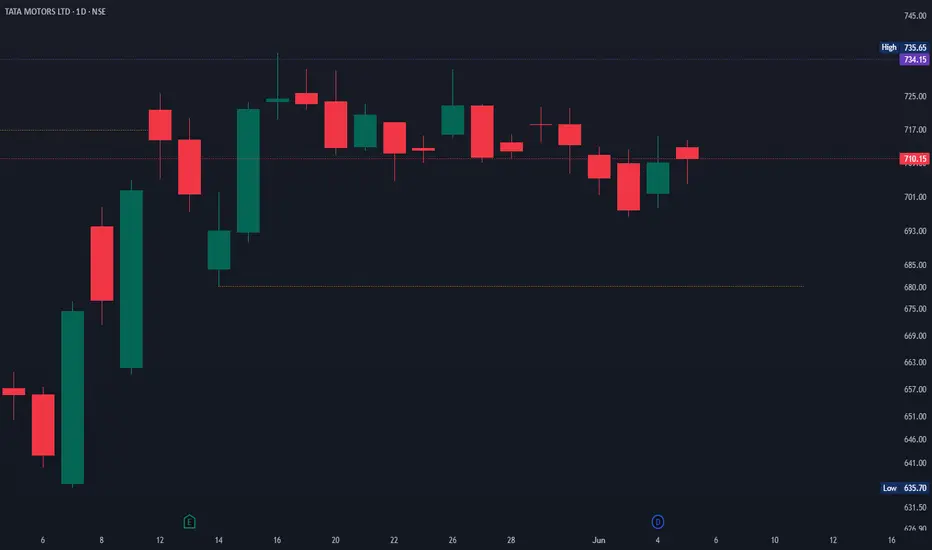

📉 Price Structure Observations:

Last 4 weeks (20 trading sessions) = clear sideways consolidation

This kind of compression often precedes a strong directional move

📍 Key Reference Levels:

All-Time High (ATH): ₹1,168

Recent Low: ₹531

Consolidation Range: ₹695 – ₹736

🚦 Trade Entry Plans:

✅ Entry Type 1: Breakout Entry

🔓 Entry Trigger: Breakout and close above ₹736 on 1H or Daily candle

🎯 Short-Term Targets:

Target 1: ₹803

Target 2: ₹950

📌 Expect possible pause/consolidation near ₹950 zone

✅ Entry Type 2: Sweep & Reversal Entry

🔄 Wait for price to sweep below ₹680 and show a reversal candle (engulfing, hammer, or bullish structure on 1H/4H)

Enter near ₹680–₹670 zone upon confirmation

🎯 Targets remain the same (₹803 / ₹950) with much better risk-reward

🛡️ Stop Loss Strategy:

🔻 Conservative SL: ₹620 (Recent lower time structural low)

🛠️ OR use trailing stop-loss as price moves upward — especially for long-term investors

🔮 Long-Term View:

Once this base breaks out, the next structural targets open up to previous swing highs.

🏁 Potential Long-Term Target: ₹1,168 (All-Time High retest)

💡 Price could consolidate near ₹950 before continuing its journey — patience is key for positional traders

🔎 Why This Trade Matters:

✅ Monthly POI reaction + liquidity grab

✅ Strong reversal signal (hammer)

✅ Tight consolidation = energy build-up

✅ Clear breakout structure = easy trade management

🧠 Quote to Remember:

“When price rests, it gains energy. When it moves, it releases that energy. Catch the move, not the noise.”

📢 Don’t Miss Out!

✅ Follow for more high-probability technical setups

👍 Like if you found this helpful

💬 Comment below your thoughts, let’s discuss this move together!

📊 See you in the next breakout 🚀

🧭 Technical Context & Setup:

Tata Motors is shaping up as a high-probability breakout candidate after a ~55% correction from its all-time high of ₹1,168 to a recent low of ₹531.

✅ Monthly POI tapped: Strong bounce seen

✅ Liquidity Swept: Price swept the recent low zone and formed a hammer candle, a bullish reversal signal

✅ Change in State of Delivery (CISD) visible on weekly timeframe, showing fresh buying interest

📉 Price Structure Observations:

Last 4 weeks (20 trading sessions) = clear sideways consolidation

This kind of compression often precedes a strong directional move

📍 Key Reference Levels:

All-Time High (ATH): ₹1,168

Recent Low: ₹531

Consolidation Range: ₹695 – ₹736

🚦 Trade Entry Plans:

✅ Entry Type 1: Breakout Entry

🔓 Entry Trigger: Breakout and close above ₹736 on 1H or Daily candle

🎯 Short-Term Targets:

Target 1: ₹803

Target 2: ₹950

📌 Expect possible pause/consolidation near ₹950 zone

✅ Entry Type 2: Sweep & Reversal Entry

🔄 Wait for price to sweep below ₹680 and show a reversal candle (engulfing, hammer, or bullish structure on 1H/4H)

Enter near ₹680–₹670 zone upon confirmation

🎯 Targets remain the same (₹803 / ₹950) with much better risk-reward

🛡️ Stop Loss Strategy:

🔻 Conservative SL: ₹620 (Recent lower time structural low)

🛠️ OR use trailing stop-loss as price moves upward — especially for long-term investors

🔮 Long-Term View:

Once this base breaks out, the next structural targets open up to previous swing highs.

🏁 Potential Long-Term Target: ₹1,168 (All-Time High retest)

💡 Price could consolidate near ₹950 before continuing its journey — patience is key for positional traders

🔎 Why This Trade Matters:

✅ Monthly POI reaction + liquidity grab

✅ Strong reversal signal (hammer)

✅ Tight consolidation = energy build-up

✅ Clear breakout structure = easy trade management

🧠 Quote to Remember:

“When price rests, it gains energy. When it moves, it releases that energy. Catch the move, not the noise.”

📢 Don’t Miss Out!

✅ Follow for more high-probability technical setups

👍 Like if you found this helpful

💬 Comment below your thoughts, let’s discuss this move together!

📊 See you in the next breakout 🚀

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.