Teladoc Health is a company specializing in telemedicine and virtual healthcare.

The company gained wide popularity during the covid-19 pandemic.

The company has historically expanded its operations through M&A:

In 2013 and 2014, the acquisition of Consult A Doctor, AmeriDoc allowed Teladoc to become one of the largest telemedicine companies in the United States.

Today, the company is valued by the market as value, although a few years ago the valuation was growth. Why did this happen?

As part of its strategy, the company's previous CEO had aggressive M&A deals on credit.

In 2021, TDOC's revenue growth began to slow rapidly. And in Growth companies, growth rates determine, if not everything, then a lot, including market valuation.

Price/Sales 2020 at its peak was over 30, which is very expensive. Before the company's triumph in 2020, the valuation was around 10. Today, P/S is only 0.5

It is necessary to separately touch upon such a parameter as the company's balance sheet and valuation through the prism of the P/B multiplier. The balance sheet grew rapidly in 2020, but it was done through the growth of goodwill, and not through the growth of fixed assets. In general, the growth of goodwill in the balance sheet is an extremely interesting thing and we will discuss this in the following posts. Starting in 2022, the company's balance sheet began to decline sharply, but the write-offs were NON-CASH, and there was a revision of that same goodwill.

On average, the company's P/B was around 4-5 and at its peak it reached 15. Today, the market values companies at 0.9, and this is despite the fact that the main write-offs have already occurred. The company has a debt of 0.99 B$

Cash and cash equivalents 0.67 B$

Which gives us a net debt of 314 M$

The company's revenue has been stagnating since 2023 and is 2.54 B$ TTM

The good thing is that starting from the same 2023, EBITDA began to grow from 0.066 B$ to 0.160 B$

OCF is positive

2022 193.99 M$

OCF today 303 M$ TTM

FCF is positive

2022 16 M$

2025 151 M$ TTM

The company today has a stable financial position with a net debt of 314 M$ and FCF 150 M$

In June 2024, Chuck Divita was appointed as the new CEO of the company, who is trying to put TDOC back on the rails of revenue growth and restart revenue growth while maintaining current margins. The first steps in this direction have already been taken and in February 2025 Teladoc acquired Catapult Health for 70 M$ in order to launch a sales funnel.

Also, in the near future, the Fed will begin to lower rates and since TDOC belongs to the small caps category, this will help in the revaluation of both the sector and Teladoc itself.

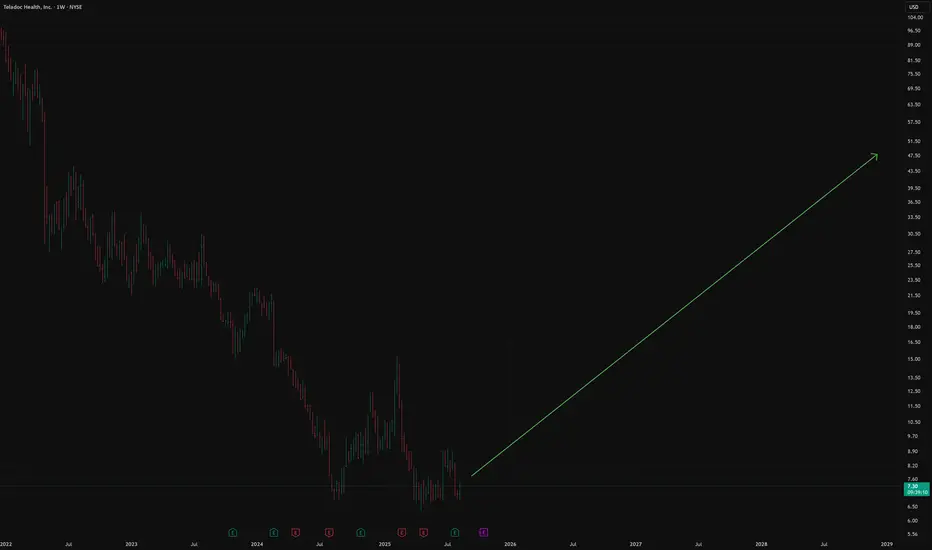

Conservative targets can be called 45-55$, closing the very gap when the company made a large write-off of goodwill in the report.

In general, we make the target 80-100$

The company gained wide popularity during the covid-19 pandemic.

The company has historically expanded its operations through M&A:

In 2013 and 2014, the acquisition of Consult A Doctor, AmeriDoc allowed Teladoc to become one of the largest telemedicine companies in the United States.

Today, the company is valued by the market as value, although a few years ago the valuation was growth. Why did this happen?

As part of its strategy, the company's previous CEO had aggressive M&A deals on credit.

In 2021, TDOC's revenue growth began to slow rapidly. And in Growth companies, growth rates determine, if not everything, then a lot, including market valuation.

Price/Sales 2020 at its peak was over 30, which is very expensive. Before the company's triumph in 2020, the valuation was around 10. Today, P/S is only 0.5

It is necessary to separately touch upon such a parameter as the company's balance sheet and valuation through the prism of the P/B multiplier. The balance sheet grew rapidly in 2020, but it was done through the growth of goodwill, and not through the growth of fixed assets. In general, the growth of goodwill in the balance sheet is an extremely interesting thing and we will discuss this in the following posts. Starting in 2022, the company's balance sheet began to decline sharply, but the write-offs were NON-CASH, and there was a revision of that same goodwill.

On average, the company's P/B was around 4-5 and at its peak it reached 15. Today, the market values companies at 0.9, and this is despite the fact that the main write-offs have already occurred. The company has a debt of 0.99 B$

Cash and cash equivalents 0.67 B$

Which gives us a net debt of 314 M$

The company's revenue has been stagnating since 2023 and is 2.54 B$ TTM

The good thing is that starting from the same 2023, EBITDA began to grow from 0.066 B$ to 0.160 B$

OCF is positive

2022 193.99 M$

OCF today 303 M$ TTM

FCF is positive

2022 16 M$

2025 151 M$ TTM

The company today has a stable financial position with a net debt of 314 M$ and FCF 150 M$

In June 2024, Chuck Divita was appointed as the new CEO of the company, who is trying to put TDOC back on the rails of revenue growth and restart revenue growth while maintaining current margins. The first steps in this direction have already been taken and in February 2025 Teladoc acquired Catapult Health for 70 M$ in order to launch a sales funnel.

Also, in the near future, the Fed will begin to lower rates and since TDOC belongs to the small caps category, this will help in the revaluation of both the sector and Teladoc itself.

Conservative targets can be called 45-55$, closing the very gap when the company made a large write-off of goodwill in the report.

In general, we make the target 80-100$

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.