⚡️ Hello, everyone! While Bitcoin is reaching new heights, crypto gurus everywhere are already predicting an altseason. Whether it will actually happen is anyone's guess. But it's definitely worth being prepared and keeping an eye on a couple of tokens.

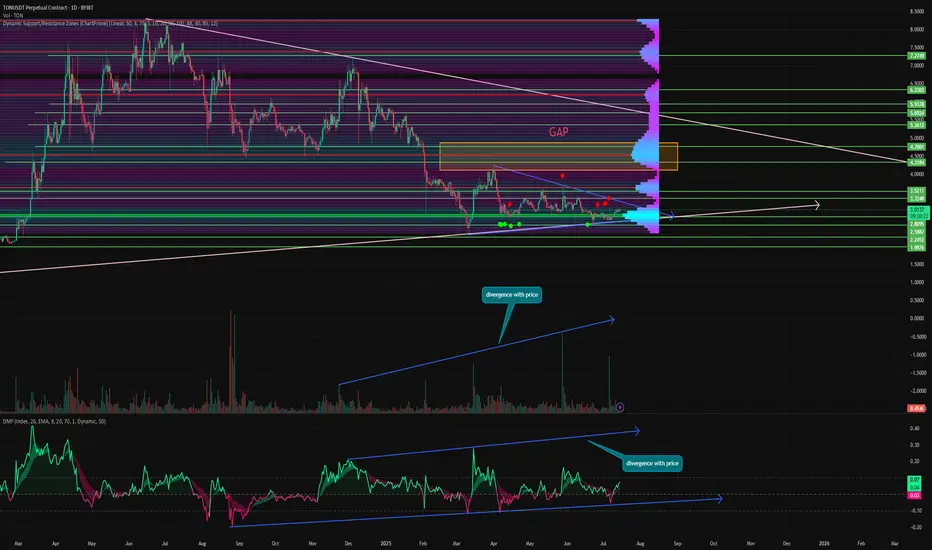

One such token is TON. After its hype on tapalki, the price corrected, forming a GAP at the top at $4.87 - $4.10. And as we know, 99% of GAPs close sooner or later.

An attempt was made to close it, but it was unsuccessful. And the token price reached its sloping support, which led to an 81% rebound in March.

Interestingly, did this coincide with a new wave of market growth? 🤔

⚙️ Let's take a deeper look at what the metrics and indicators are showing us:

Support/Resistance - the first thing to pay attention to. The price reached key support with the largest area of interest. At levels of $2.97 - $2.76. This, combined with other factors such as support and positivity in the market, could push for strong growth.

Volume - TON is one of the few tokens that did not experience a decline in sales during the correction. Instead, it experienced growing purchase volumes throughout the decline. This creates a large divergence with the price.

Money Flow - is also an extremely interesting indicator. In complete divergence with the price, an ascending flag pattern has formed here. This shows that liquidity continues to flow in. And the previous rebound to $4.22 saw an even greater influx of liquidity than the rebound to $7.22 in December 2024.

📌 Conclusion:

TON seems like an unremarkable token until you take a closer look. And I understand why investors have such faith in the asset.

1. Great growth potential. Almost 200% to ATH, which is simply fantastic for an asset with such a high capitalization.

2. TON could be the first real step towards the mass adoption of Web3 in society. They have their own messenger with a billion users, and they have already shown how easy it is to integrate them all into cryptocurrencies. All that remains is not to lose people this time.

➡️ Have a nice day, everyone, and write in the comments what you think about the future of TON!

One such token is TON. After its hype on tapalki, the price corrected, forming a GAP at the top at $4.87 - $4.10. And as we know, 99% of GAPs close sooner or later.

An attempt was made to close it, but it was unsuccessful. And the token price reached its sloping support, which led to an 81% rebound in March.

Interestingly, did this coincide with a new wave of market growth? 🤔

⚙️ Let's take a deeper look at what the metrics and indicators are showing us:

Support/Resistance - the first thing to pay attention to. The price reached key support with the largest area of interest. At levels of $2.97 - $2.76. This, combined with other factors such as support and positivity in the market, could push for strong growth.

Volume - TON is one of the few tokens that did not experience a decline in sales during the correction. Instead, it experienced growing purchase volumes throughout the decline. This creates a large divergence with the price.

Money Flow - is also an extremely interesting indicator. In complete divergence with the price, an ascending flag pattern has formed here. This shows that liquidity continues to flow in. And the previous rebound to $4.22 saw an even greater influx of liquidity than the rebound to $7.22 in December 2024.

📌 Conclusion:

TON seems like an unremarkable token until you take a closer look. And I understand why investors have such faith in the asset.

1. Great growth potential. Almost 200% to ATH, which is simply fantastic for an asset with such a high capitalization.

2. TON could be the first real step towards the mass adoption of Web3 in society. They have their own messenger with a billion users, and they have already shown how easy it is to integrate them all into cryptocurrencies. All that remains is not to lose people this time.

➡️ Have a nice day, everyone, and write in the comments what you think about the future of TON!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.