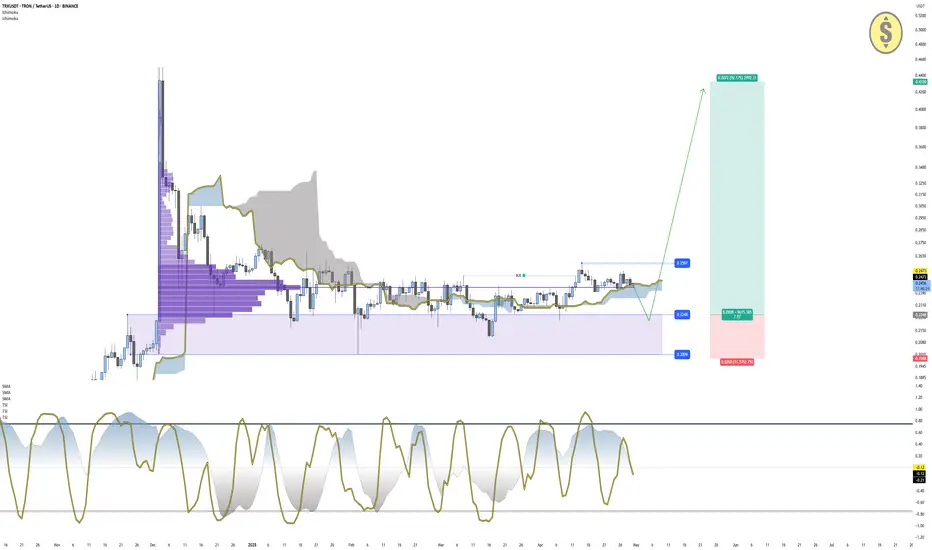

TRON recently broke market structure to the upside, which confirms a potential shift out of the long-term accumulation range. This bullish break is technically supported by several elements that suggest continuation, as long as price action respects key levels.

Price is currently:

Above the Ichimoku cloud, with Span A at $0.2473 and Span B at $0.2404, which confirms the directional bias is shifting in favor of the bulls.

Above the Point of Control (POC) of the entire accumulation range, it is now trading where the highest traded volume occurred — a strong base for further expansion.

The Trend Strength Index (TSI 20) is turning positive (0.22), showing the beginning of a momentum shift. Meanwhile, TSI 10 is at -0.13, suggesting short-term momentum is still neutral or cooling, which aligns with the idea of a possible pullback before continuation.

Scenarios to Watch:

Optimal Entry (Pullback):

The zone between $0.2248 and $0.2009 is an important support level where price has previously reacted and where resistance was once found. This structural shift from resistance to support adds significance to the area. Even though it is currently below the Ichimoku cloud, the price's historical behavior makes it a key zone to watch for potential bullish entries during a pullback.

Breakout Confirmation:

A clean break and close above $0.2597 (previous swing high) would confirm bullish continuation.

A retest of $0.2597 following a breakout would provide a secondary entry opportunity.

Upside Target:

The projected move points to $0.44, based on the measured range expansion from the breakout, which also coincides with the next major resistance area.

Trade Setup Summary:

Buy Zone 1: $0.2248 – $0.2009

Buy Zone 2 (break and retest): Above $0.2597

Target: $0.44

Invalidation: Close below $0.2000

Trend Bias: Bullish while above $0.2000

TRON remains one of the most active Layer 1 blockchains in terms of daily transactions and stablecoin usage, especially USDT transfers. While it doesn't enjoy the same spotlight as Ethereum or Solana, TRON has been quietly expanding its DeFi ecosystem and maintaining strong on-chain activity. Recently, its growing integration with BitTorrent and cross-chain interoperability initiatives have boosted sentiment. Additionally, the recent stabilization of broader market conditions increases the likelihood that breakout plays like TRX can attract renewed capital rotation during altcoin cycles.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

Price is currently:

Above the Ichimoku cloud, with Span A at $0.2473 and Span B at $0.2404, which confirms the directional bias is shifting in favor of the bulls.

Above the Point of Control (POC) of the entire accumulation range, it is now trading where the highest traded volume occurred — a strong base for further expansion.

The Trend Strength Index (TSI 20) is turning positive (0.22), showing the beginning of a momentum shift. Meanwhile, TSI 10 is at -0.13, suggesting short-term momentum is still neutral or cooling, which aligns with the idea of a possible pullback before continuation.

Scenarios to Watch:

Optimal Entry (Pullback):

The zone between $0.2248 and $0.2009 is an important support level where price has previously reacted and where resistance was once found. This structural shift from resistance to support adds significance to the area. Even though it is currently below the Ichimoku cloud, the price's historical behavior makes it a key zone to watch for potential bullish entries during a pullback.

Breakout Confirmation:

A clean break and close above $0.2597 (previous swing high) would confirm bullish continuation.

A retest of $0.2597 following a breakout would provide a secondary entry opportunity.

Upside Target:

The projected move points to $0.44, based on the measured range expansion from the breakout, which also coincides with the next major resistance area.

Trade Setup Summary:

Buy Zone 1: $0.2248 – $0.2009

Buy Zone 2 (break and retest): Above $0.2597

Target: $0.44

Invalidation: Close below $0.2000

Trend Bias: Bullish while above $0.2000

TRON remains one of the most active Layer 1 blockchains in terms of daily transactions and stablecoin usage, especially USDT transfers. While it doesn't enjoy the same spotlight as Ethereum or Solana, TRON has been quietly expanding its DeFi ecosystem and maintaining strong on-chain activity. Recently, its growing integration with BitTorrent and cross-chain interoperability initiatives have boosted sentiment. Additionally, the recent stabilization of broader market conditions increases the likelihood that breakout plays like TRX can attract renewed capital rotation during altcoin cycles.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.