Hello, traders.

If you "Follow" us, you'll always get the latest information quickly.

Have a great day.

-------------------------------------

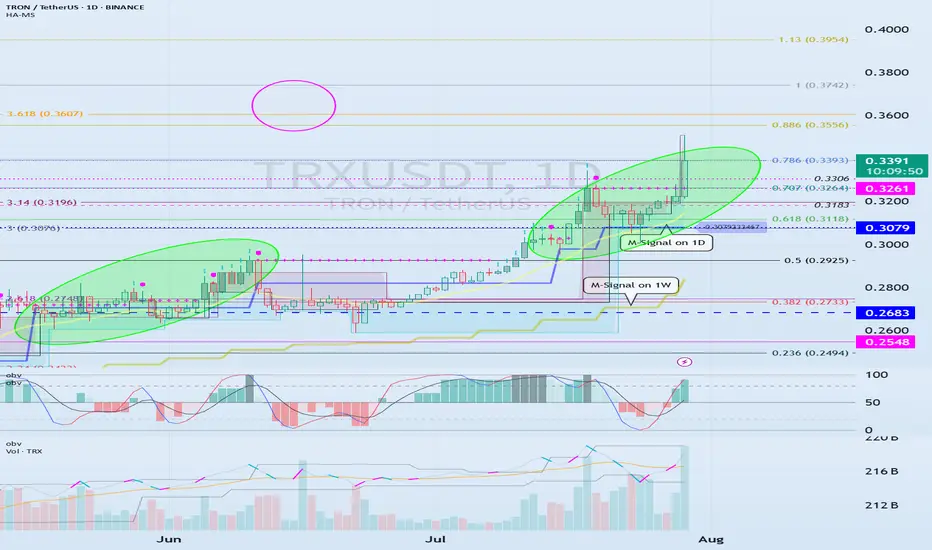

(TRXUSDT 1M Chart)

We need to see if the price can sustain itself by rising above the left Fibonacci level 3.618 (0.3607) and the right Fibonacci level 1 (0.3742).

When the next monthly candlestick is formed, we need to check the movements of the supporting indicators.

-

(1W Chart)

The DOM (60) indicator on the 1W chart is showing signs of forming a new trend.

Accordingly, we need to examine whether a rise above the left Fibonacci level of 3.618 (0.3607) will trigger a new wave.

The left Fibonacci level was created during the first rising wave.

Therefore, if the price rises above the left Fibonacci level of 3.618 (0.3607), a new wave is expected to form.

Since the HA-High indicator on the 1W chart is formed at 0.2683, if the price declines, support near 0.2683 will be crucial.

-

(1D chart)

If the price maintains above the 0.3079-0.3261 range, further upside is expected.

For the price to rise above the left Fibonacci ratio of 3.618 (0.3607) and the right Fibonacci ratio of 1 (0.3742), the OBV indicator of the Low Line ~ High Line channel must rise above the High Line and remain above it.

However, since the StochRSI indicator has entered an overbought zone, the upward movement may be limited.

Therefore, we need to consider how to reset the indicator.

-

The price is continuing a stepwise upward trend, rising above the HA-HIgh indicator.

It is currently in its second stepwise upward movement.

Therefore, the key is whether the price can sustain above the HA-High indicator.

Whether a third stepwise upward movement occurs will depend on whether the price can sustain itself around or above the 0.3079-0.3261 level.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

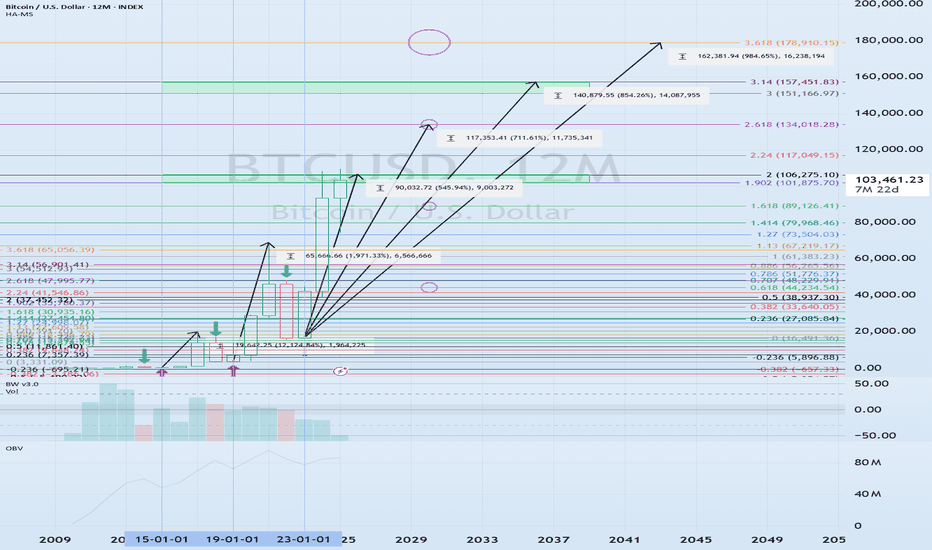

- Here's an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I'll explain more in detail when the bear market begins.

------------------------------------------------------

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Other content (coins, stocks, etc.) is frequently posted on X.

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

X에 다른 내용(코인, 주식 등)이 자주 게시.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.