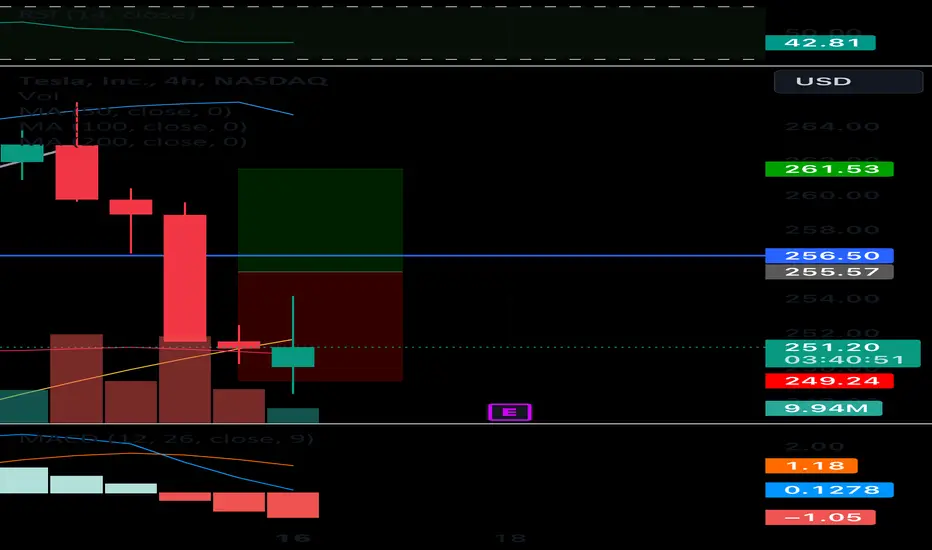

Tesla TSLA 0.51% earnings are on tap this week—and the stock isn’t making the bulls feel as bullish as they usually are. They would feel a lot better if profit margins looked like they were bottoming out.

Tesla (ticker: TSLA) is due to report third-quarter numbers Wednesday evening. Wall Street is looking for earnings per share of about 73 cents, down from 77 cents a couple of weeks ago. It’s coming in a little after the company delivered some 435,000 vehicles in the third quarter, missing Wall Street estimates by about 20,000 units.

Price targets are coming down with the estimates. On Monday, Piper Sandler analyst Alexander Potter cut his target on Tesla stock to $290 a share from $300, though he still has a Buy rating on Tesla stock. While Cybertruck is due to be delivered soon, he sees shares trading “sideways, at best, in the coming months.” He wants profit margins to bottom and delivery growth to accelerate before investors get more excited about the stock.

He has a point about margins. Automotive gross profit margins have been coming down with prices for new Tesla vehicles. The price for a new long-range Model Y is down roughly 25% from peak levels. Tesla’s automotive gross profit margin in the second quarter came in at about 18%, down from a peak of about 30% in the first quarter of 2022.

Wedbush analyst Dan Ives agrees that investors will be “laser-focused” on profit margins. He sees automotive gross profit margins coming in around 17% for the third quarter, but investors are probably ready for a weak third quarter. What they want is a sign from management that margins are bottoming out.

Tesla (ticker: TSLA) is due to report third-quarter numbers Wednesday evening. Wall Street is looking for earnings per share of about 73 cents, down from 77 cents a couple of weeks ago. It’s coming in a little after the company delivered some 435,000 vehicles in the third quarter, missing Wall Street estimates by about 20,000 units.

Price targets are coming down with the estimates. On Monday, Piper Sandler analyst Alexander Potter cut his target on Tesla stock to $290 a share from $300, though he still has a Buy rating on Tesla stock. While Cybertruck is due to be delivered soon, he sees shares trading “sideways, at best, in the coming months.” He wants profit margins to bottom and delivery growth to accelerate before investors get more excited about the stock.

He has a point about margins. Automotive gross profit margins have been coming down with prices for new Tesla vehicles. The price for a new long-range Model Y is down roughly 25% from peak levels. Tesla’s automotive gross profit margin in the second quarter came in at about 18%, down from a peak of about 30% in the first quarter of 2022.

Wedbush analyst Dan Ives agrees that investors will be “laser-focused” on profit margins. He sees automotive gross profit margins coming in around 17% for the third quarter, but investors are probably ready for a weak third quarter. What they want is a sign from management that margins are bottoming out.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Telegram >> t.me/DEXWireNews

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.