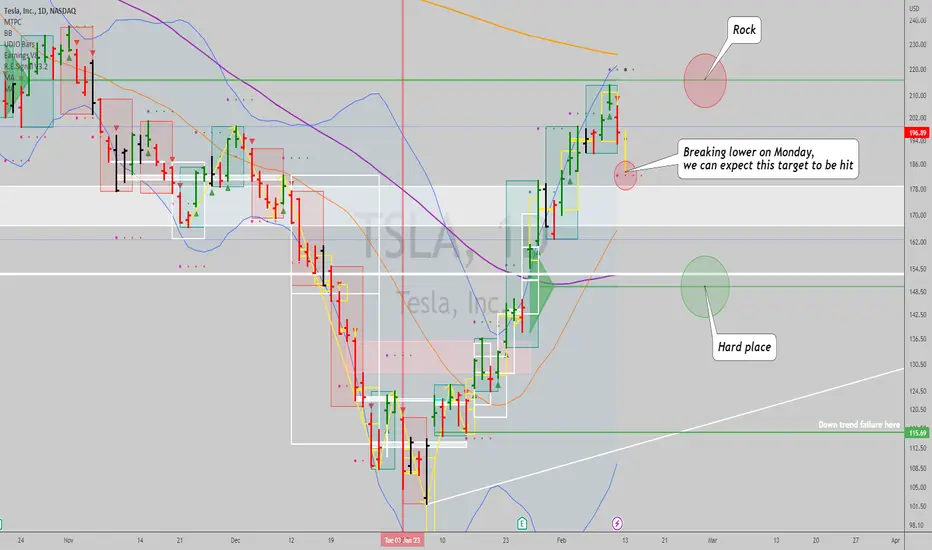

Tesla is stuck between a rock and a hard place, and the path going forward is likely mean reversion, price gravitating around the monthly mode area that sits below, with very well defined upper and lower barriers keeping price range bound for a while. Current short term setup is a short if price breaks into new lows on Monday pretty much, and we can already figure out the target for such action, but I would venture a guess that price needs to coil sideways next, before rallying higher over time, given fundamentals. I am cautious these days and rather trade swings, than try to hold long term positions stubbornly though. So, if you followed my last idea suggesting  TSLA was going through the last down swing before a bottom, now would be a decent time to secure gains or at least sell calls against holdings. Many ways to skin a cat, in this case the cat of volatility dampening. On the topic of guesswork, my long term guess for

TSLA was going through the last down swing before a bottom, now would be a decent time to secure gains or at least sell calls against holdings. Many ways to skin a cat, in this case the cat of volatility dampening. On the topic of guesswork, my long term guess for  TSLA was something like this, which I did when I talked about the first daily buy signal near 125.72:

TSLA was something like this, which I did when I talked about the first daily buy signal near 125.72:

The longest term trend in TSLA has expired already, so we should expect sideways and volatile action for 8 half-year bars, that's a long a$$ time...

TSLA has expired already, so we should expect sideways and volatile action for 8 half-year bars, that's a long a$$ time...

Best of luck!

Cheers,

Ivan Labrie.

The longest term trend in

Best of luck!

Cheers,

Ivan Labrie.

🔒Want to dive deeper? Check out my paid services below🔒

linktr.ee/ivanlabrie

linktr.ee/ivanlabrie

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔒Want to dive deeper? Check out my paid services below🔒

linktr.ee/ivanlabrie

linktr.ee/ivanlabrie

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.