TSLA Downtrend Deepens — Key Gamma Floor at $300.41 Now in Sight

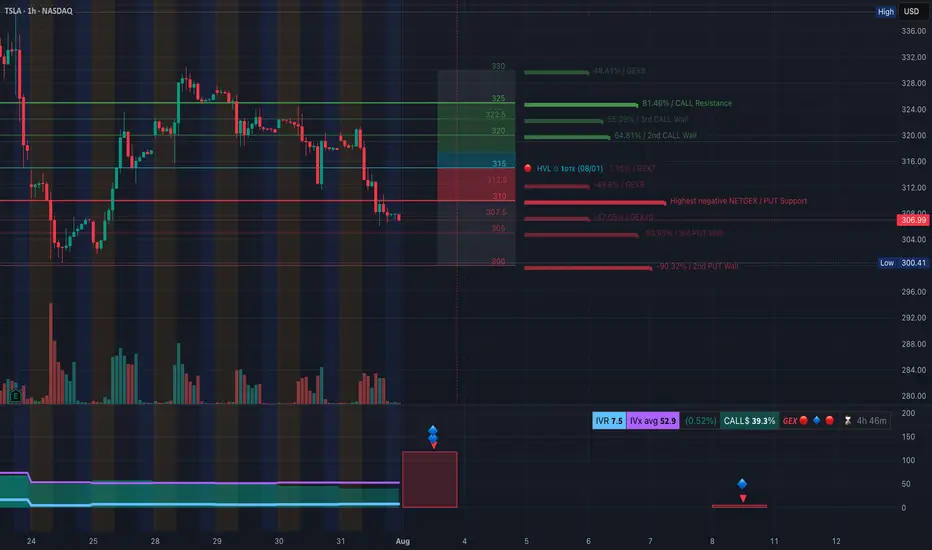

🔍 GEX & Options Flow Insight (1st Image Analysis)

TSLA continues to grind lower, breaking multiple gamma supports and staying pinned near the $306–$307 zone. The GEX profile shows a clear negative gamma environment, which means dealer hedging flows can intensify moves in either direction — but right now, momentum remains firmly bearish.

* Call Walls & Resistance:

* 📍 $321.36 → 2nd Call Wall (64.81% GEX2)

* 📍 $325.00 → Call wall resistance

* 📍 $330–$332 → Higher gamma resistance, unlikely in current structure without a strong reversal

* Put Walls & Support Zones:

* 🛡️ $306.99 → Current price zone, already tested multiple times

* 🚨 $300.41 → Highest negative NET GEX / hard gamma floor

* 📉 Below $300 → Opens quick downside to $295–$292

* Volatility Insight:

* IVR 7.5, IVx Avg 52.9 → Low relative IV in the context of a trending move down

* Call flow 39.3% → Bearish tilt despite modest call activity

* GEX sentiment: 🔴🔴🔴 = Strong negative gamma → price more sensitive to continued downside flows

✅ Option Trading Suggestion:

Bias: Bearish until a firm reclaim of $311–$315 Strategy: Bear put spread

* Entry Idea: Buy 305P / Sell 295P (Aug 2 or Aug 9 expiry)

* Invalidation: Strong hourly close above $315

* Target: $300 → $295

Why this works: Negative gamma positioning increases the likelihood of a push to $300. If $300 breaks, option dealer hedging can exacerbate selling.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* 🟥 Multiple CHoCH events confirming breakdown structure

* ❌ Lost prior BOS levels near $321, then $315, and now hovering above $306

* Trading firmly inside a downward-sloping channel

Trendline Dynamics:

* Well-defined descending channel from recent highs

* Lower bound points toward $300–$295 in coming sessions

SMC Zones:

* 🟩 Demand Zone: $300–$295 → Last defense before deeper drop

* 🟥 Supply Zone (Purple Box): $319–$325 → Major resistance cluster

🔄 Price Action & Key Levels

* Support:

* ✅ $306.99 → Current defense

* 🚨 $300.41 → Critical gamma floor

* 📉 $295 → Lower channel target

* Resistance:

* 🚩 $311.64 → First reclaim needed for relief

* 🚩 $319–$321.36 → Key supply & call wall zone

🧭 Scalping / Intraday Trade Setup

🟥 Bearish Setup (Preferred):

* Entry: Breakdown below $306

* Target 1: $300.41

* Target 2: $295

* Stop: Above $311

🟩 Bullish Reversal Setup:

* Entry: Reclaim of $315 with volume

* Target 1: $321

* Target 2: $325

* Stop: Below $311

🔁 Summary Thoughts

* TSLA remains in a clear downtrend with a negative gamma backdrop.

* $300.41 is the key gamma floor — holding it may see a short-term bounce, breaking it risks a fast flush to $295.

* Until bulls reclaim $315, all rallies remain suspect.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

🔍 GEX & Options Flow Insight (1st Image Analysis)

TSLA continues to grind lower, breaking multiple gamma supports and staying pinned near the $306–$307 zone. The GEX profile shows a clear negative gamma environment, which means dealer hedging flows can intensify moves in either direction — but right now, momentum remains firmly bearish.

* Call Walls & Resistance:

* 📍 $321.36 → 2nd Call Wall (64.81% GEX2)

* 📍 $325.00 → Call wall resistance

* 📍 $330–$332 → Higher gamma resistance, unlikely in current structure without a strong reversal

* Put Walls & Support Zones:

* 🛡️ $306.99 → Current price zone, already tested multiple times

* 🚨 $300.41 → Highest negative NET GEX / hard gamma floor

* 📉 Below $300 → Opens quick downside to $295–$292

* Volatility Insight:

* IVR 7.5, IVx Avg 52.9 → Low relative IV in the context of a trending move down

* Call flow 39.3% → Bearish tilt despite modest call activity

* GEX sentiment: 🔴🔴🔴 = Strong negative gamma → price more sensitive to continued downside flows

✅ Option Trading Suggestion:

Bias: Bearish until a firm reclaim of $311–$315 Strategy: Bear put spread

* Entry Idea: Buy 305P / Sell 295P (Aug 2 or Aug 9 expiry)

* Invalidation: Strong hourly close above $315

* Target: $300 → $295

Why this works: Negative gamma positioning increases the likelihood of a push to $300. If $300 breaks, option dealer hedging can exacerbate selling.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* 🟥 Multiple CHoCH events confirming breakdown structure

* ❌ Lost prior BOS levels near $321, then $315, and now hovering above $306

* Trading firmly inside a downward-sloping channel

Trendline Dynamics:

* Well-defined descending channel from recent highs

* Lower bound points toward $300–$295 in coming sessions

SMC Zones:

* 🟩 Demand Zone: $300–$295 → Last defense before deeper drop

* 🟥 Supply Zone (Purple Box): $319–$325 → Major resistance cluster

🔄 Price Action & Key Levels

* Support:

* ✅ $306.99 → Current defense

* 🚨 $300.41 → Critical gamma floor

* 📉 $295 → Lower channel target

* Resistance:

* 🚩 $311.64 → First reclaim needed for relief

* 🚩 $319–$321.36 → Key supply & call wall zone

🧭 Scalping / Intraday Trade Setup

🟥 Bearish Setup (Preferred):

* Entry: Breakdown below $306

* Target 1: $300.41

* Target 2: $295

* Stop: Above $311

🟩 Bullish Reversal Setup:

* Entry: Reclaim of $315 with volume

* Target 1: $321

* Target 2: $325

* Stop: Below $311

🔁 Summary Thoughts

* TSLA remains in a clear downtrend with a negative gamma backdrop.

* $300.41 is the key gamma floor — holding it may see a short-term bounce, breaking it risks a fast flush to $295.

* Until bulls reclaim $315, all rallies remain suspect.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.