What I’m Watching:

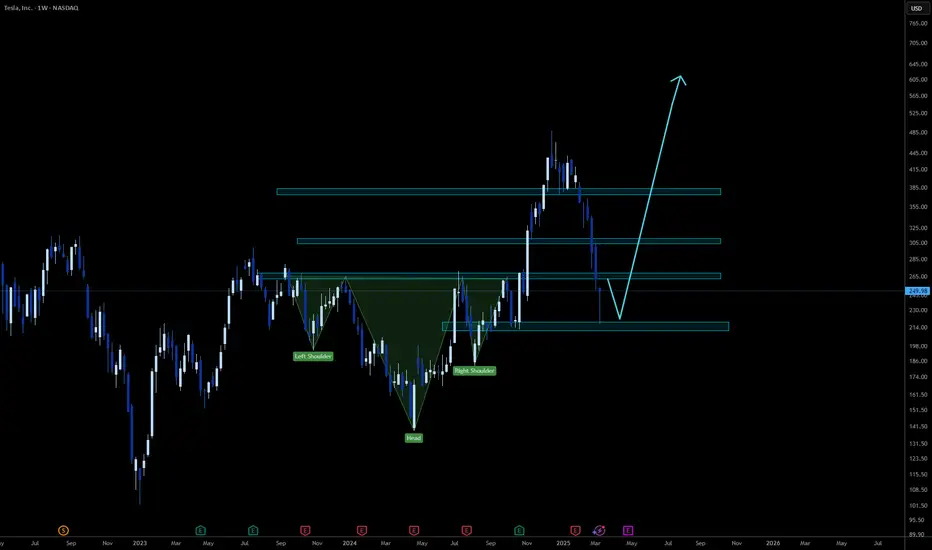

I’m focusing on the 245–250 neckline for a decisive reaction. If buyers defend this level, it could signal a continuation of the bullish trend from the inverted pattern’s breakout. If sellers break below, the bullish bias could change, leading to a potential correction.

A strong bounce from the neckline would align with the prior uptrend, while a break below could shift the short-term bias to bearish.

Bullish Bounce:

If buyers hold the 245–250 neckline and push the price higher, expect to resume the bullish trend, targeting the recent high of 490, with potential to push toward 500–510 if momentum builds. A break above 300 would confirm buyer strength and support the inverted pattern’s bullish target.

Bearish Correction:

If sellers break below the 245 neckline and sustain the move, it could indicate a failure of the inverted head-and-shoulders pattern, leading to a correction. A break below this level might target the 215 - 210 zone (right shoulder support) or lower to 210–180 if selling pressure intensifies. External factors, such as negative Tesla news or a broader market downturn, could drive this decline.

I’m focusing on the 245–250 neckline for a decisive reaction. If buyers defend this level, it could signal a continuation of the bullish trend from the inverted pattern’s breakout. If sellers break below, the bullish bias could change, leading to a potential correction.

A strong bounce from the neckline would align with the prior uptrend, while a break below could shift the short-term bias to bearish.

Bullish Bounce:

If buyers hold the 245–250 neckline and push the price higher, expect to resume the bullish trend, targeting the recent high of 490, with potential to push toward 500–510 if momentum builds. A break above 300 would confirm buyer strength and support the inverted pattern’s bullish target.

Bearish Correction:

If sellers break below the 245 neckline and sustain the move, it could indicate a failure of the inverted head-and-shoulders pattern, leading to a correction. A break below this level might target the 215 - 210 zone (right shoulder support) or lower to 210–180 if selling pressure intensifies. External factors, such as negative Tesla news or a broader market downturn, could drive this decline.

Note

Bullish Scenario (Still in Play): If the price breaks above 283 and the downward trendline, it would confirm the bullish continuation. The next targets would be the previous high near 490, potentially extending towards 500-510.Bearish Scenario (Less Likely but Possible): If the price fails to break above 283 and falls below 245-250, the bearish correction scenario becomes more probable. The initial target would be the 215-210 zone, with a potential extension to 210-180 if selling intensifies.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.