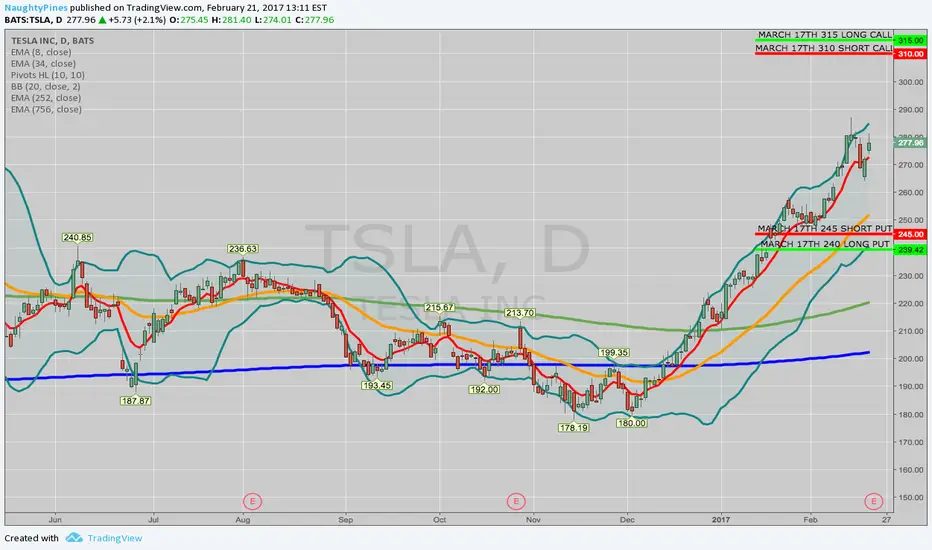

... for a 1.27 ($127)/contract credit.

Using the monthlies, since this isn't the most liquid thing options-wise in the world.

Metrics:

Probability of Profit: 67%

Max Profit: $127/contract

Max Loss/Buying Power Effect: $373/contract

Break Evens: 243.70/311.30

Delta: -.22/contract (neutral assumption)

Theta: 4.42/contract

Notes: I'll look to manage this at 50% max profit ... .

Using the monthlies, since this isn't the most liquid thing options-wise in the world.

Metrics:

Probability of Profit: 67%

Max Profit: $127/contract

Max Loss/Buying Power Effect: $373/contract

Break Evens: 243.70/311.30

Delta: -.22/contract (neutral assumption)

Theta: 4.42/contract

Notes: I'll look to manage this at 50% max profit ... .

Note

Looking good so far. Currently, AH price at 278, so it didn't move much ... .Note

Looked good. Then not so good. Rolling the 310/315 short call vert to the 260/265 for a .77 ($77)/contract credit. Scratch point is currently 1.27 + .77 = 2.04.Note

Well, this little fella's coming down to the wire with 8 DTE. Too little time to bother with rolling in the short call side for additional credit, so will look to close that out at near worthless, roll out the short put side/sell an oppositional side against if it's "too close for comfort" next week.Trade closed manually

Closing here for a 1.95 debit on this little bounce. I figured I'd close it out here as a "mini-winner" (.09/$9/contract), so that I wouldn't have to roll the put side down and out.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.