📊 Technical Analysis (TA):

1. Trend & Structure:

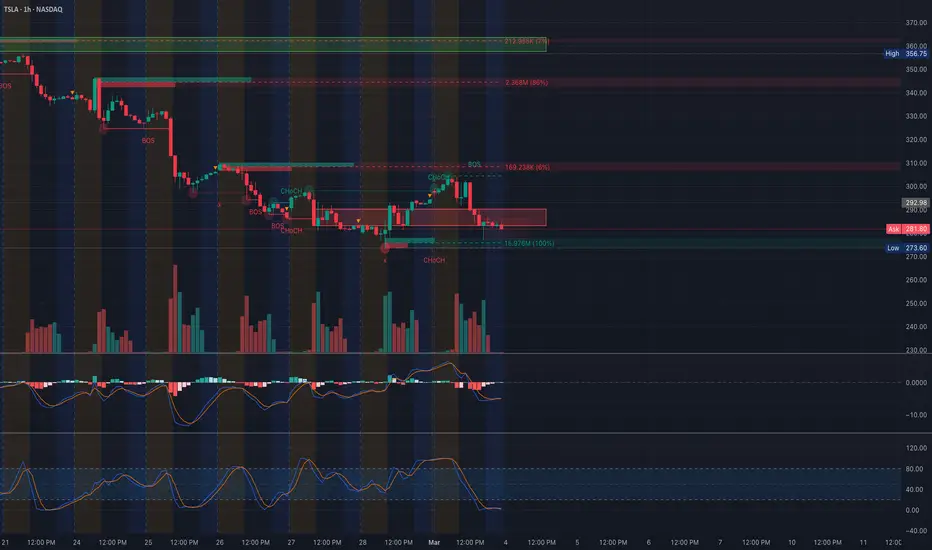

* TSLA remains in a clear downtrend, confirmed by multiple BOS (Break of Structure) signals.

* Recent ChoCH (Change of Character) suggests a temporary range-bound phase before further downside or a potential reversal.

* Key Resistance: ~290-300 (prior BQS level)

* Support Zone: ~273-275 (critical liquidity zone)

2. Indicators:

* MACD & Stochastics show weakness, confirming bearish momentum.

* Volume spikes suggest institutional interest, but it's mainly on down moves, reinforcing bearish bias.

🔹 GEX & Options Flow:

1. Call Walls (Resistance) 🚧

* 300-310: Heavy resistance, potential rejections.

* 350: Second major call wall, unlikely to reach unless a strong rally occurs.

2. Put Walls (Support) 🛑

* 270: Strong put wall, may act as a floor for a potential bounce.

* 250: Highest negative NETGEX, which means a gamma squeeze could push TSLA further down if this level breaks.

3. IV Rank & Skew:

* IVR 89.7, indicating high implied volatility.

* IV skew positive, meaning puts are being favored over calls.

* Calls only 21.8%, suggesting market bias is bearish.

📌 Trading Plan & Suggestions:

* Bullish Scenario:

* A reclaim above 290-300 could trigger a short squeeze toward 310-315.

* Calls or spreads with April expiry could benefit from a bounce.

* Bearish Scenario:

* Breakdown below 270 could open a flush to 250, where puts would see exponential gains.

* Ideal Put Play: Buy March-April 270P or 260P targeting 250-260.

⚠️ Key Warning: If TSLA holds 270, a sharp bounce is possible due to put covering.

🔥 Conclusion: Big Move Coming for TSLA!

Tesla is trapped between strong put support (270) and overhead resistance (290-300). The next few sessions will decide if this bounces or heads straight to 250. Options flow favors downside, but gamma unwinding could cause short-term reversals.

Watch price action carefully before making a move! 🚀📉

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

1. Trend & Structure:

* TSLA remains in a clear downtrend, confirmed by multiple BOS (Break of Structure) signals.

* Recent ChoCH (Change of Character) suggests a temporary range-bound phase before further downside or a potential reversal.

* Key Resistance: ~290-300 (prior BQS level)

* Support Zone: ~273-275 (critical liquidity zone)

2. Indicators:

* MACD & Stochastics show weakness, confirming bearish momentum.

* Volume spikes suggest institutional interest, but it's mainly on down moves, reinforcing bearish bias.

🔹 GEX & Options Flow:

1. Call Walls (Resistance) 🚧

* 300-310: Heavy resistance, potential rejections.

* 350: Second major call wall, unlikely to reach unless a strong rally occurs.

2. Put Walls (Support) 🛑

* 270: Strong put wall, may act as a floor for a potential bounce.

* 250: Highest negative NETGEX, which means a gamma squeeze could push TSLA further down if this level breaks.

3. IV Rank & Skew:

* IVR 89.7, indicating high implied volatility.

* IV skew positive, meaning puts are being favored over calls.

* Calls only 21.8%, suggesting market bias is bearish.

📌 Trading Plan & Suggestions:

* Bullish Scenario:

* A reclaim above 290-300 could trigger a short squeeze toward 310-315.

* Calls or spreads with April expiry could benefit from a bounce.

* Bearish Scenario:

* Breakdown below 270 could open a flush to 250, where puts would see exponential gains.

* Ideal Put Play: Buy March-April 270P or 260P targeting 250-260.

⚠️ Key Warning: If TSLA holds 270, a sharp bounce is possible due to put covering.

🔥 Conclusion: Big Move Coming for TSLA!

Tesla is trapped between strong put support (270) and overhead resistance (290-300). The next few sessions will decide if this bounces or heads straight to 250. Options flow favors downside, but gamma unwinding could cause short-term reversals.

Watch price action carefully before making a move! 🚀📉

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.