Introduction: The Tale of Two Companies

You don’t need to be an economist to see it. Just compare Tesla and BYD.

BYD: Founded in 1995, Chinese, over $107 billion in revenue.

Tesla: Founded in 2003, American, with less revenue—but a market cap six times bigger.

The reason? Because one sells cars, and the other sells dreams. And Wall Street loves a good dream.

The Illusion Economy: When Hype Outweighs Reality

Tesla’s valuation isn’t tied to assets, production, or profits. It’s a ritual of collective belief—a performance act where branding replaces substance, and expectation outweighs reality.

It’s the same logic behind a $1,000 jacket that costs $100 to make. Put a fancy logo on it, and suddenly, it’s not overpriced—it’s "premium." You're not just buying a product; you're investing in a lifestyle. Sure. Keep telling yourself that.

Tesla is the $1,000 jacket. BYD is the actual tailor shop.

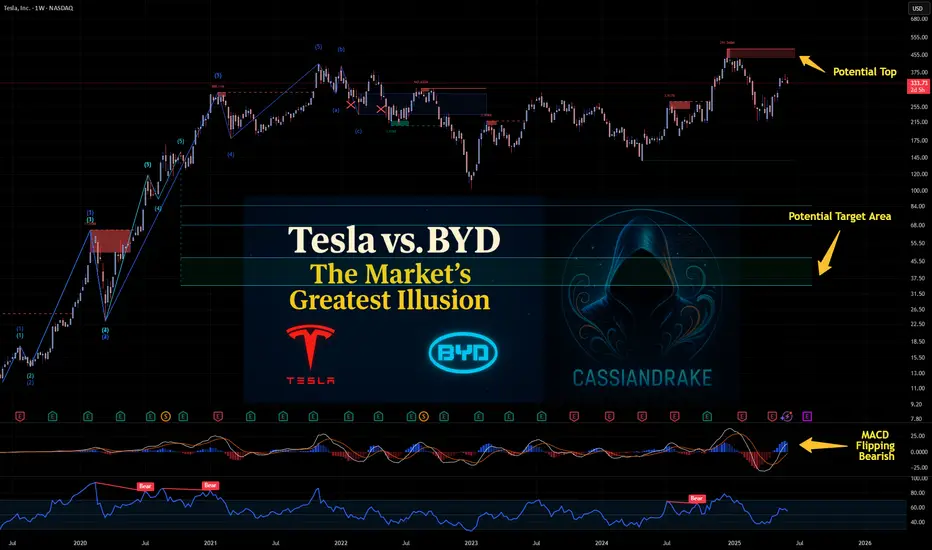

Tesla vs. BYD: The Numbers Tell the Story

Tesla’s market cap is over $1 trillion, while BYD’s is under $200 billion. Yet, BYD outsells Tesla globally, especially in China, where it dominates the EV market. Tesla’s valuation is built on brand perception, future promises, and speculative optimism, while BYD’s is grounded in actual production and revenue.

Financial Storytelling Over Business Reality

Tesla isn’t just a car company—it’s a financial illusion. Markets rise not on performance, but on promise. Stock prices reflect not what a company is, but what a hedge fund feels it might become. It’s not a business model—it’s mood swings with decimal points.

BYD’s Competitive Edge

Production Power: BYD manufactures more EVs than Tesla annually.

Battery Innovation: BYD’s Blade Battery is safer, lasts longer, and is cheaper than Tesla’s.

Affordability: BYD’s EVs are significantly cheaper, making them more accessible to global consumers.

Market Reach: BYD dominates China, the world’s largest EV market, while Tesla struggles with pricing and competition.

The Consequences of Buying the Dream

Tesla’s valuation isn’t creating better cars. It’s just creating dumber investors.

Investors who think they’re visionaries because they bought into the hype.

Consumers who think they’re elite because they bought the label.

Boards who think they’re gods because someone inflated their stock ticker.

But every illusion has an expiration date. Every bubble has its needle. And when dreams are sold on credit, reality always comes to collect.

Reality Always Comes to Collect

This isn’t growth. It’s speculative theater funded by your retirement account.

Real value doesn’t need hype. It appears in supply chains, production lines, tangible goods, and on profit sheets that make sense even without a TED Talk.

So next time you see Tesla’s trillion-dollar valuation, ask yourself: Are you investing in a business? Or are you just buying the dream—before it bursts?

You don’t need to be an economist to see it. Just compare Tesla and BYD.

BYD: Founded in 1995, Chinese, over $107 billion in revenue.

Tesla: Founded in 2003, American, with less revenue—but a market cap six times bigger.

The reason? Because one sells cars, and the other sells dreams. And Wall Street loves a good dream.

The Illusion Economy: When Hype Outweighs Reality

Tesla’s valuation isn’t tied to assets, production, or profits. It’s a ritual of collective belief—a performance act where branding replaces substance, and expectation outweighs reality.

It’s the same logic behind a $1,000 jacket that costs $100 to make. Put a fancy logo on it, and suddenly, it’s not overpriced—it’s "premium." You're not just buying a product; you're investing in a lifestyle. Sure. Keep telling yourself that.

Tesla is the $1,000 jacket. BYD is the actual tailor shop.

Tesla vs. BYD: The Numbers Tell the Story

Tesla’s market cap is over $1 trillion, while BYD’s is under $200 billion. Yet, BYD outsells Tesla globally, especially in China, where it dominates the EV market. Tesla’s valuation is built on brand perception, future promises, and speculative optimism, while BYD’s is grounded in actual production and revenue.

Financial Storytelling Over Business Reality

Tesla isn’t just a car company—it’s a financial illusion. Markets rise not on performance, but on promise. Stock prices reflect not what a company is, but what a hedge fund feels it might become. It’s not a business model—it’s mood swings with decimal points.

BYD’s Competitive Edge

Production Power: BYD manufactures more EVs than Tesla annually.

Battery Innovation: BYD’s Blade Battery is safer, lasts longer, and is cheaper than Tesla’s.

Affordability: BYD’s EVs are significantly cheaper, making them more accessible to global consumers.

Market Reach: BYD dominates China, the world’s largest EV market, while Tesla struggles with pricing and competition.

The Consequences of Buying the Dream

Tesla’s valuation isn’t creating better cars. It’s just creating dumber investors.

Investors who think they’re visionaries because they bought into the hype.

Consumers who think they’re elite because they bought the label.

Boards who think they’re gods because someone inflated their stock ticker.

But every illusion has an expiration date. Every bubble has its needle. And when dreams are sold on credit, reality always comes to collect.

Reality Always Comes to Collect

This isn’t growth. It’s speculative theater funded by your retirement account.

Real value doesn’t need hype. It appears in supply chains, production lines, tangible goods, and on profit sheets that make sense even without a TED Talk.

So next time you see Tesla’s trillion-dollar valuation, ask yourself: Are you investing in a business? Or are you just buying the dream—before it bursts?

TLDR? Watch the Video

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

TLDR? Watch the Video

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

MSTR: youtu.be/h7aZwtoZ3AI?si=c2rh7mdNp_c1qpHh

Tesla BYD: youtu.be/AD45kA1TXwQ?si=jwoSqkLTRPdkFANZ

Platinum: youtu.be/IAiq3x1x72s?si=KbD0LDPDpX4KeLR2

Gold youtube.com/watch?v=sT2v2vyhy7Q&t=10s

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.