1️⃣ Insight Summary

Cable TV legacy player

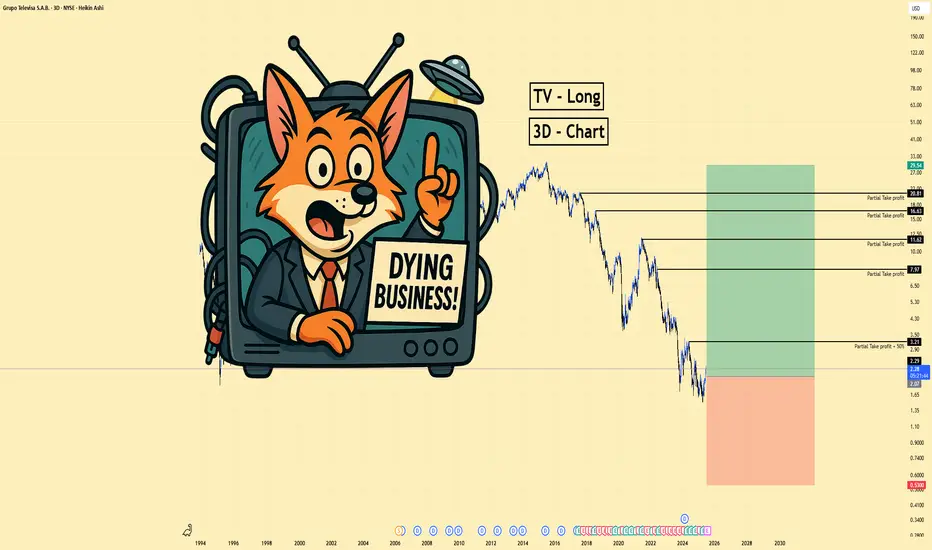

2️⃣ Trade Parameters

Bias: Short or cautious long (if playing oversold, which is risky)

Entry: Near $7.97 (recent bounce)

Stop Loss: Above $10.00, ideally around $11–12 based on structure

Take Profit 1: $3.21 (50% retracement target)

Take Profit 2 / Hold Zone: Down toward the $0.53 level, where price structure may find long-term support

3️⃣ Key Notes

✅ Historical backbone – Founded mid-century,

❌ Structural decline – Cable subscriber base shrinking rapidly as audiences shift to streaming (YouTube, TikTok, Instagram).

❌ Weak fundamentals – Market cap ~ $1B; negative earnings (–$500M); high debt ($5B); free cash flow ~ $80M—not enough to offset liabilities.

✅ Signs of improvement – Debt margin slightly easing, FCF edge marginally growing, and revenues up from ~$400M to ~$500M since 2015—yet still minimal.

❌ Outlook dim – The business is shrinking faster than turnaround efforts. Any bounce is likely dead money unless a major strategic shift occurs.

4️⃣ Follow‑up Note

Monitor sentiment and streaming adoption trends. If

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is the best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always do your own research. This content may include enhancements made using AI.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

2 Ways I Help Serious Traders Win | Real Trades. Ruthless Edge.

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

1️⃣ Fix Your Trading Fast – My 4-step:

tradinggen.services/mohamad-link/

2️⃣ Get My Weekly Recap and Setup Drops here:

t.me/TradeSimple_with_Mo

P.S. Mentor MO❤️

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.