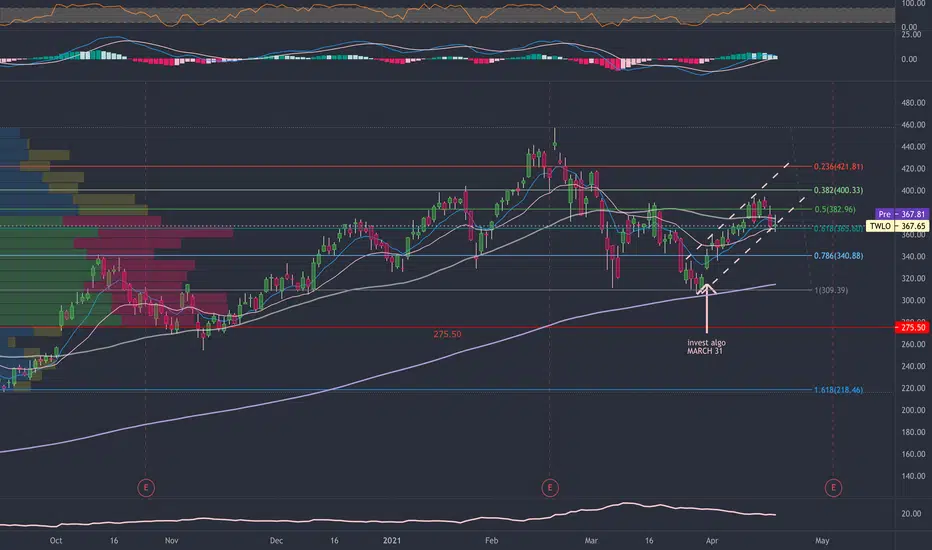

I am in TWLO call options

April 30 expiration $385 strike.

My calls are bloody.

I did not cut my losses since the pull back was nicely at the 60% retracement level.

Losing this level may result in me facing facts and booking a loss, because theta will begin to burn more than the option can handle into next week.

Looking for a strong reversal by tomorrow or I am cutting my losses.

Today is opex so I try to avoid making decisions on opex day about cutting a call, because it can reverse quickly the next day to mitigate the size of my loss.

Let's see what it does. It likes to march into earnings - I just do not know if I cut the expiration choice too close.

April 30 expiration $385 strike.

My calls are bloody.

I did not cut my losses since the pull back was nicely at the 60% retracement level.

Losing this level may result in me facing facts and booking a loss, because theta will begin to burn more than the option can handle into next week.

Looking for a strong reversal by tomorrow or I am cutting my losses.

Today is opex so I try to avoid making decisions on opex day about cutting a call, because it can reverse quickly the next day to mitigate the size of my loss.

Let's see what it does. It likes to march into earnings - I just do not know if I cut the expiration choice too close.

better not bitter

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

better not bitter

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.