Uber is on the verge of a major transformation, with robotaxis set to become a game-changing profit engine.

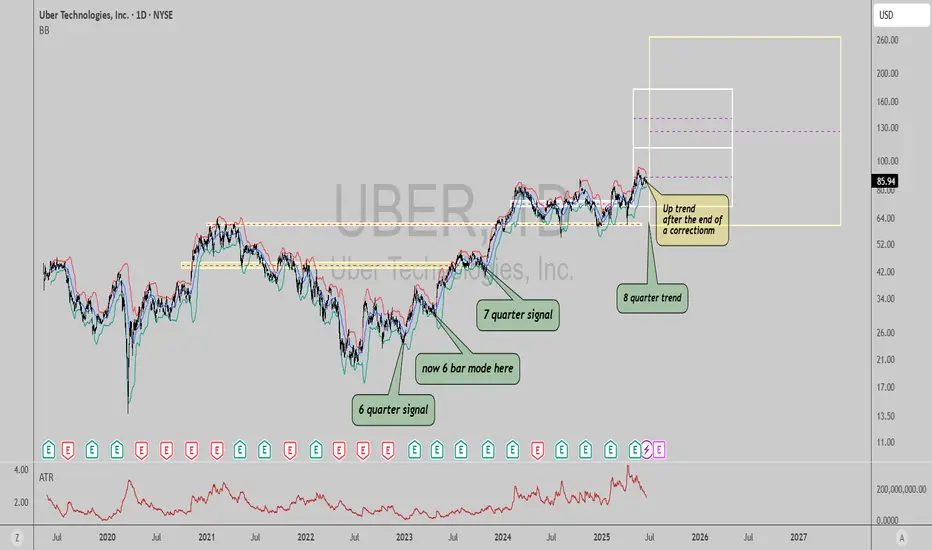

Technical charts indicate we can enter a long position today with low risk, while aiming for a long term rally resumption from here. Monthly and quarterly timeframe Timemode trends are bullish, suggesting price can reach heights between $111, $176 and $265 per share long term.

Here’s why the future looks bright for Uber investors from a fundamental perspective:

Uber is uniquely positioned to lead the robotaxi revolution, leveraging its platform, partnerships, and financial strength. As AVs scale, expect a step-change in profitability and long-term shareholder value.

Best of luck!

Cheers,

Ivan Labrie.

Technical charts indicate we can enter a long position today with low risk, while aiming for a long term rally resumption from here. Monthly and quarterly timeframe Timemode trends are bullish, suggesting price can reach heights between $111, $176 and $265 per share long term.

Here’s why the future looks bright for Uber investors from a fundamental perspective:

- The global robotaxi market is projected to surge from $0.4B in 2023 to $45.7B by 2030, with Uber aggressively expanding its autonomous fleet in the U.S. and Europe through partnerships.

- Uber’s approach is to integrate autonomous vehicles from partners (Waymo, May Mobility, Momenta, Avride, Volkswagen) into its platform, avoiding the massive costs and risks of building its own AVs.

- Autonomous vehicles will slash Uber’s largest expense -driver payments- unlocking higher margins and scalability. CEO Dara Khosrowshahi calls AVs Uber’s “greatest future opportunity” for profit expansion.

- Robotaxi pilots are already live in cities like Austin, with plans to expand to Atlanta, Dallas, and Europe by 2026. The average Waymo vehicle on Uber is busier than 99% of human drivers, showing strong demand and efficiency.

- Uber’s core business is robust: Q1 2025 gross bookings up 14% to $42.8B, net income of $1.8B, and adjusted EBITDA up 35% to $1.9B. This profitability funds AV investments without sacrificing financial health.

Uber is uniquely positioned to lead the robotaxi revolution, leveraging its platform, partnerships, and financial strength. As AVs scale, expect a step-change in profitability and long-term shareholder value.

Best of luck!

Cheers,

Ivan Labrie.

Trade active

So far, so good, hodl!🔒Want to dive deeper? Check out my paid services below🔒

linktr.ee/ivanlabrie

linktr.ee/ivanlabrie

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔒Want to dive deeper? Check out my paid services below🔒

linktr.ee/ivanlabrie

linktr.ee/ivanlabrie

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.