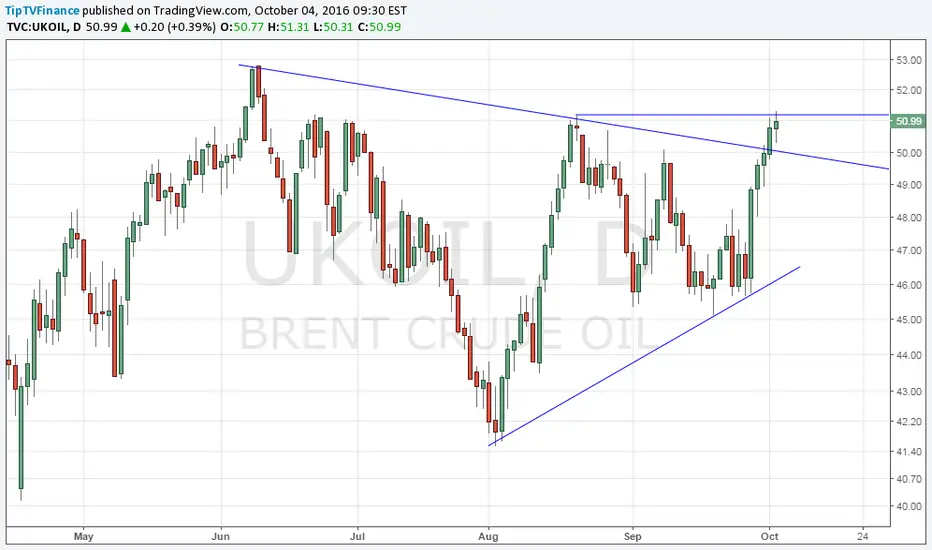

Brent’s failure to sustain above $51.19 (Aug 19 high) after having failed near the same on Monday suggests the bullish momentum has run out of steam.

When viewed in light of the falling monthly 50-MA around $50.70, it suggests the prices could head lower to $49.68 (Sep 9 high).

On the higher side, only a daily close above $51.19 would suggest continuation of the rally from last week’s low of $45.67.

When viewed in light of the falling monthly 50-MA around $50.70, it suggests the prices could head lower to $49.68 (Sep 9 high).

On the higher side, only a daily close above $51.19 would suggest continuation of the rally from last week’s low of $45.67.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.