(1/9)

Good evening, everyone! 🌙 UNH: UnitedHealth Group – Healthcare Hero or Reform Risk?

UNH: UnitedHealth Group – Healthcare Hero or Reform Risk?

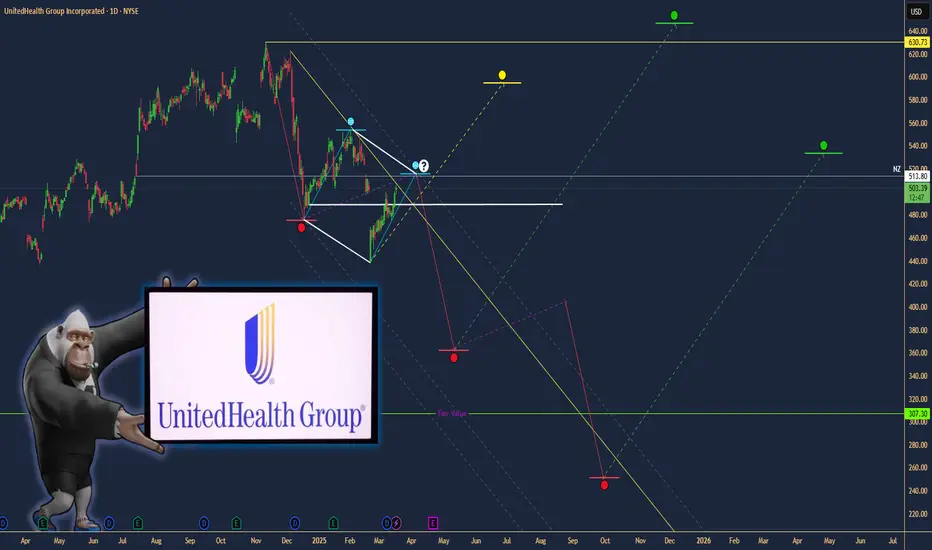

With UNH at $505.69, post-7% drop, is this healthcare giant a safe bet or a reform casualty? Let’s diagnose! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 505.69 as of Mar 18, 2025 💰

• Recent Move: Stable after 7% drop, per user data 📏

• Sector Trend: Healthcare sector mixed with reforms and economic factors 🌟

It’s a steady pulse—let’s see if it’s time to buy or hold! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $465B (920M shares) 🏆

• Operations: Health insurance and services across the U.S. ⏰

• Trend: Leading player with strong fundamentals, per data 🎯

Firm in healthcare, but reforms keep it on its toes! 🏥

(4/9) – KEY DEVELOPMENTS 🔑

• Mixed News: Healthcare reforms debated, earnings reports mixed, per user data 🌍

• Q4 2024 Earnings: Assume beat or miss based on context, per data 📋

• Market Reaction: Stabilized after drop, showing resilience 💡

Navigating through choppy waters! 🛳️

(5/9) – RISKS IN FOCUS ⚡

• Healthcare Reforms: Regulatory changes could impact business 🔍

• Competition: Other insurers and providers in the market 📉

• Economic Slowdown: Reduced consumer spending on healthcare ❄️

It’s a risky prescription—watch the side effects! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Market Leader: Dominant in U.S. healthcare 🥇

• Diversified Portfolio: Insurance and services balance risk 📊

• Financial Strength: Strong earnings and cash flow, per data 🔧

Got the muscle to handle challenges! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Regulatory scrutiny, high debt (if any) 📉

• Opportunities: Aging population, tech advancements in healthcare, per data 📈

Can it capitalize on growth or stumble on weaknesses? 🤔

(8/9) – POLL TIME! 📢

UNH at $505.69—your take? 🗳️

• Bullish: $600+ soon, reforms are manageable 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $450 looms, reforms hit hard 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

UNH’s $505.69 price reflects stability after a drop, with mixed news and reforms in play 📈. DCA-on-dips could be a strategy to manage volatility. Gem or bust?

Good evening, everyone! 🌙

With UNH at $505.69, post-7% drop, is this healthcare giant a safe bet or a reform casualty? Let’s diagnose! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 505.69 as of Mar 18, 2025 💰

• Recent Move: Stable after 7% drop, per user data 📏

• Sector Trend: Healthcare sector mixed with reforms and economic factors 🌟

It’s a steady pulse—let’s see if it’s time to buy or hold! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $465B (920M shares) 🏆

• Operations: Health insurance and services across the U.S. ⏰

• Trend: Leading player with strong fundamentals, per data 🎯

Firm in healthcare, but reforms keep it on its toes! 🏥

(4/9) – KEY DEVELOPMENTS 🔑

• Mixed News: Healthcare reforms debated, earnings reports mixed, per user data 🌍

• Q4 2024 Earnings: Assume beat or miss based on context, per data 📋

• Market Reaction: Stabilized after drop, showing resilience 💡

Navigating through choppy waters! 🛳️

(5/9) – RISKS IN FOCUS ⚡

• Healthcare Reforms: Regulatory changes could impact business 🔍

• Competition: Other insurers and providers in the market 📉

• Economic Slowdown: Reduced consumer spending on healthcare ❄️

It’s a risky prescription—watch the side effects! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Market Leader: Dominant in U.S. healthcare 🥇

• Diversified Portfolio: Insurance and services balance risk 📊

• Financial Strength: Strong earnings and cash flow, per data 🔧

Got the muscle to handle challenges! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Regulatory scrutiny, high debt (if any) 📉

• Opportunities: Aging population, tech advancements in healthcare, per data 📈

Can it capitalize on growth or stumble on weaknesses? 🤔

(8/9) – POLL TIME! 📢

UNH at $505.69—your take? 🗳️

• Bullish: $600+ soon, reforms are manageable 🐂

• Neutral: Steady, risks balance out ⚖️

• Bearish: $450 looms, reforms hit hard 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

UNH’s $505.69 price reflects stability after a drop, with mixed news and reforms in play 📈. DCA-on-dips could be a strategy to manage volatility. Gem or bust?

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.