**UnitedHealth Group (UNH) - Healthcare Sector Heavyweight** 🩺

Managed care leader trading cheap post-regulatory noise, straight from Graham's discount playbook—evoking Buffett's healthcare forays like his DaVita stake, leveraging moats for enduring value.

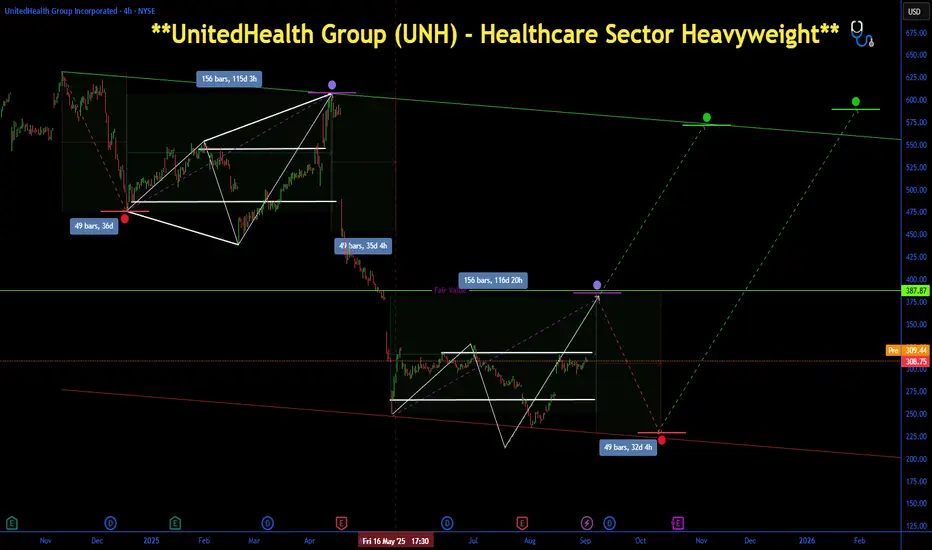

- **Key Metrics Showing Why It's Undervalued 💹**: At **$308.80**, trailing P/E **13.37** (below industry ~18), forward P/E **17.54**, P/B **2.95**, juicy yield **2.86%**. Market cap: **$279.67B**, ROE **21.65%** screams efficiency.

- **Potential Upside 🚀**: Analyst targets **$327.71** eye ~6% quick gain, but aging demographics could fuel 15-25% over 12 months—defensive sector moat buffers volatility.

- **How dcalpha.net Strategies Help 📈**: Leverage our portfolio tools with "Warren Buffett tips" on ROE filters—allocate 10-20% to healthcare, blending UNH for balanced growth and dividends, echoing value legends' resilience.

Managed care leader trading cheap post-regulatory noise, straight from Graham's discount playbook—evoking Buffett's healthcare forays like his DaVita stake, leveraging moats for enduring value.

- **Key Metrics Showing Why It's Undervalued 💹**: At **$308.80**, trailing P/E **13.37** (below industry ~18), forward P/E **17.54**, P/B **2.95**, juicy yield **2.86%**. Market cap: **$279.67B**, ROE **21.65%** screams efficiency.

- **Potential Upside 🚀**: Analyst targets **$327.71** eye ~6% quick gain, but aging demographics could fuel 15-25% over 12 months—defensive sector moat buffers volatility.

- **How dcalpha.net Strategies Help 📈**: Leverage our portfolio tools with "Warren Buffett tips" on ROE filters—allocate 10-20% to healthcare, blending UNH for balanced growth and dividends, echoing value legends' resilience.

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.