Union Bank just flashed a powerful confluence of 3 bullish patterns and smart money could already be moving in. Let’s break it down simply, but sharply

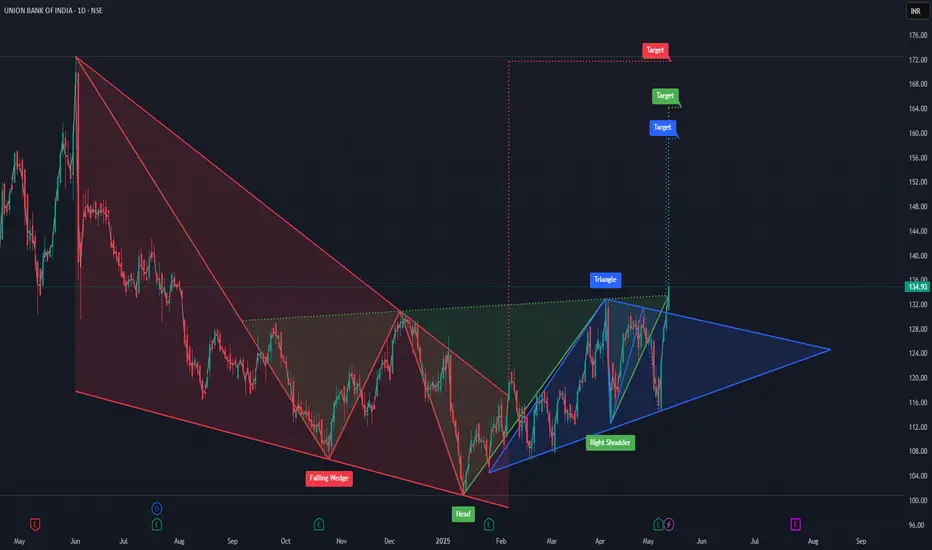

1. Falling Wedge Breakout (Aug ‘24 – Feb ‘25)

Falling Wedge is one of the strongest bullish reversal signals in technical analysis.

✔️ Price kept dipping but volume dropped — a sign of seller exhaustion.

✔️ It broke out with power in Feb, confirming buyers are gaining control.

2. Inverse Head & Shoulders (Smart Money Footprint)

This classic bottoming pattern shows how institutions trap retail:

Left Shoulder: ₹113

Head: ₹103

Right Shoulder: ₹116

Neckline breakout: ₹130

The breakout signals the start of a new uptrend. smart money behavior.

3. Symmetrical Triangle (Mar–May 2025)

After the breakout, price consolidated in a triangle squeezing between bulls and bears.

Last week? Boom. Breakout confirmed and volume backed it up.

This is volatility contraction expansion in motion. Momentum incoming.

Targets Based on Pattern Math:

Triangle Target ₹148

Head & Shoulders Target ₹157

Full Wedge Reversal Target ₹172+

This setup isn’t just about price. It’s about psychology, positioning & timing.

The market is showing its hand — now it’s your move.

Smart money already played the game. Retail is still watching?

Like it? Share it. Save it. Don’t miss it.

1. Falling Wedge Breakout (Aug ‘24 – Feb ‘25)

Falling Wedge is one of the strongest bullish reversal signals in technical analysis.

✔️ Price kept dipping but volume dropped — a sign of seller exhaustion.

✔️ It broke out with power in Feb, confirming buyers are gaining control.

2. Inverse Head & Shoulders (Smart Money Footprint)

This classic bottoming pattern shows how institutions trap retail:

Left Shoulder: ₹113

Head: ₹103

Right Shoulder: ₹116

Neckline breakout: ₹130

The breakout signals the start of a new uptrend. smart money behavior.

3. Symmetrical Triangle (Mar–May 2025)

After the breakout, price consolidated in a triangle squeezing between bulls and bears.

Last week? Boom. Breakout confirmed and volume backed it up.

This is volatility contraction expansion in motion. Momentum incoming.

Targets Based on Pattern Math:

Triangle Target ₹148

Head & Shoulders Target ₹157

Full Wedge Reversal Target ₹172+

This setup isn’t just about price. It’s about psychology, positioning & timing.

The market is showing its hand — now it’s your move.

Smart money already played the game. Retail is still watching?

Like it? Share it. Save it. Don’t miss it.

LOW RISK? PLAY HUGE!

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

LOW RISK? PLAY HUGE!

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.