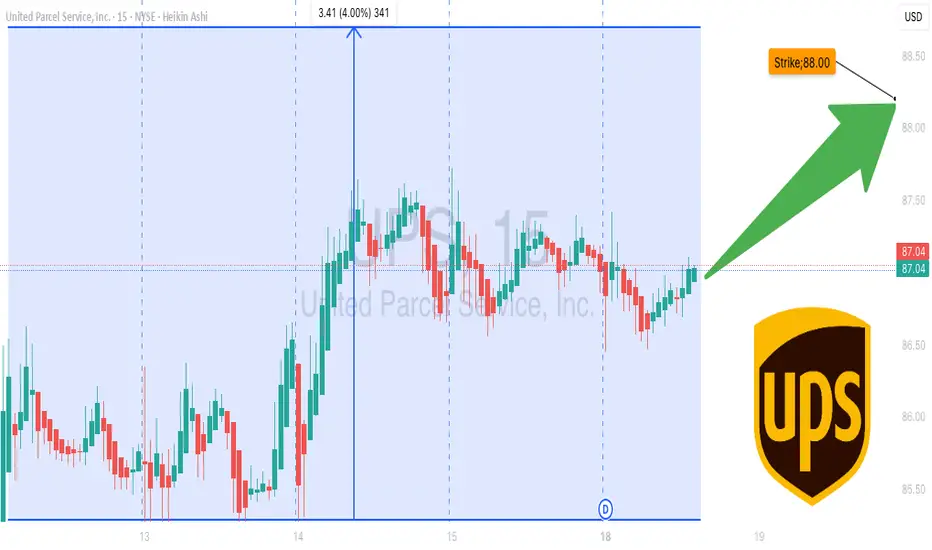

# 🚚 UPS Weekly Options Setup (8/18 – 8/22)

🔥 **Institutional Flow Signals a Bullish Week** 🔥

All major AI reports (xAI, DeepSeek, Google, Anthropic) are calling **MODERATE BULLISH**, backed by:

* 📊 **Call/Put Ratio = 3.47** → Strong institutional bias

* 📉 **VIX < 22** → Premiums favorable for long calls

* ⚠️ **RSI Bearish** → Risk of reversal, so keep stops tight

---

## 🎯 Trade Setup

* **Instrument**: UPS

* **Direction**: CALL (LONG)

* **Strike**: \$88.00

* **Expiry**: 2025-08-22

* **Entry**: \$0.92

* **Stop Loss**: \$0.46 (-50%)

* **Target**: \$1.38 – \$1.84 (+50% to +100%)

* **Confidence**: 65%

* **Timing**: Enter at open → Exit by Thursday (avoid gamma burn!)

---

## 📈 Breakeven @ Expiry

👉 \$88.92 (Strike + Premium)

UPS must close above **\$88.92 by 8/22** for profit at expiry.

But plan is **exit early** on IV move → don’t hold into Friday risk!

---

## 🧠 Key Risks

* Macro shock headlines 📰

* RSI weakness → possible fakeouts ⚠️

* Volatility spike → premium whipsaw 🎢

---

# ⚡ UPS 88C WEEKLY PLAY ⚡

🎯 In: \$0.92 → Out: \$1.38–\$1.84

🛑 Stop: \$0.46

📅 Exp: 8/22

📈 Flow > RSI → Betting with the whales 🐋

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.