Let's see:

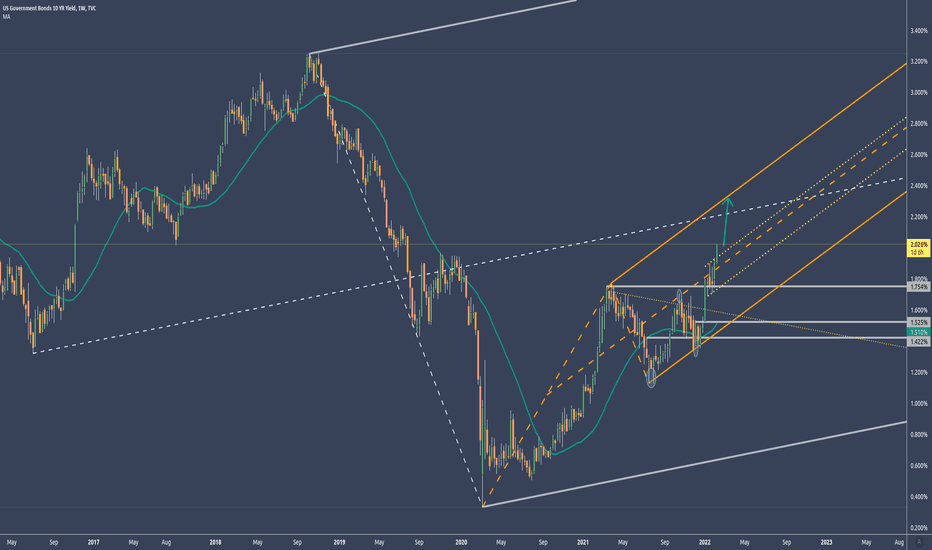

This was the chart I posted this year:

We reached the U-MLH.

This is the stretch to the upside. How ever, it could go further towards the Moon.

But usually, if price get rejected at the MLH's, we see the opposite move. In this case to the downside, to the Centerline.

This is a great opportunity, the second time this year in the 10Y Bonds, which I clearly will not miss.

Additionally this would indicate a bounce in the index markets (S&P500, Nasdaq etc.).And if you pay attention to my S&P Chart, then you know that the Centerline is reached too there.

So prepare for a possible bounce, even it's just temporarily.

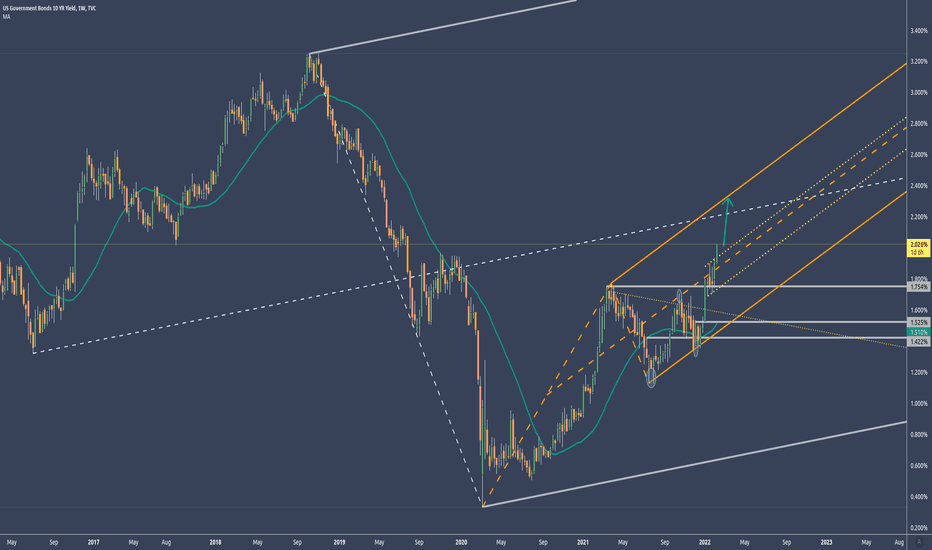

This was the chart I posted this year:

We reached the U-MLH.

This is the stretch to the upside. How ever, it could go further towards the Moon.

But usually, if price get rejected at the MLH's, we see the opposite move. In this case to the downside, to the Centerline.

This is a great opportunity, the second time this year in the 10Y Bonds, which I clearly will not miss.

Additionally this would indicate a bounce in the index markets (S&P500, Nasdaq etc.).And if you pay attention to my S&P Chart, then you know that the Centerline is reached too there.

So prepare for a possible bounce, even it's just temporarily.

Note

Another attempt to fall to the CL?Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.