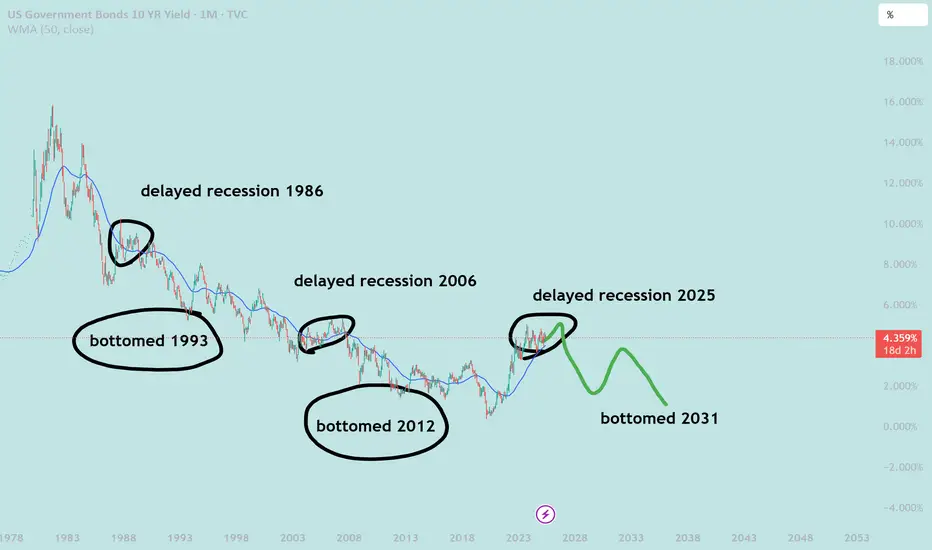

yield inverted, usually a signal for recession, but there is a case that the recession delayed

It's during the recession of 1992, 2009, and now it should happen this year, but the chance has dropped from 70% to 30%

delayed recession moght be delayed for 4 year or until yield making higher high

after making higher high will see recession within 2 years, rest for 1 year then bottomed for 2 years

So we need to see

1. higher high 10-year yield in 2026-2027

2. recession within 2 years (2028-2029)

3. Resting for 1 year (2030)

4. bottomed yield for 2 years (2031-2032)

It's during the recession of 1992, 2009, and now it should happen this year, but the chance has dropped from 70% to 30%

delayed recession moght be delayed for 4 year or until yield making higher high

after making higher high will see recession within 2 years, rest for 1 year then bottomed for 2 years

So we need to see

1. higher high 10-year yield in 2026-2027

2. recession within 2 years (2028-2029)

3. Resting for 1 year (2030)

4. bottomed yield for 2 years (2031-2032)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.