US 10 YEAR TECHNICAL OUTLOOK FOR JUNE 9-13 (JUNE 9 UPDATE)

Overnight

U.S. Treasuries declined following a stronger-than-expected May employment report, signaling a robust labor market and sustained economic growth, reducing expectations for near-term Fed rate cuts. Investors sold across the yield curve, with the belly experiencing the most pressure. Meanwhile, the stock market rallied, likely benefiting from portfolio rebalancing from bonds to equities. The U.S. Dollar Index rose 0.4% to 99.18, reflecting the positive data and higher rates.

High Impact News this Week

myfxbook.com/forex-economic-calendar

Technical

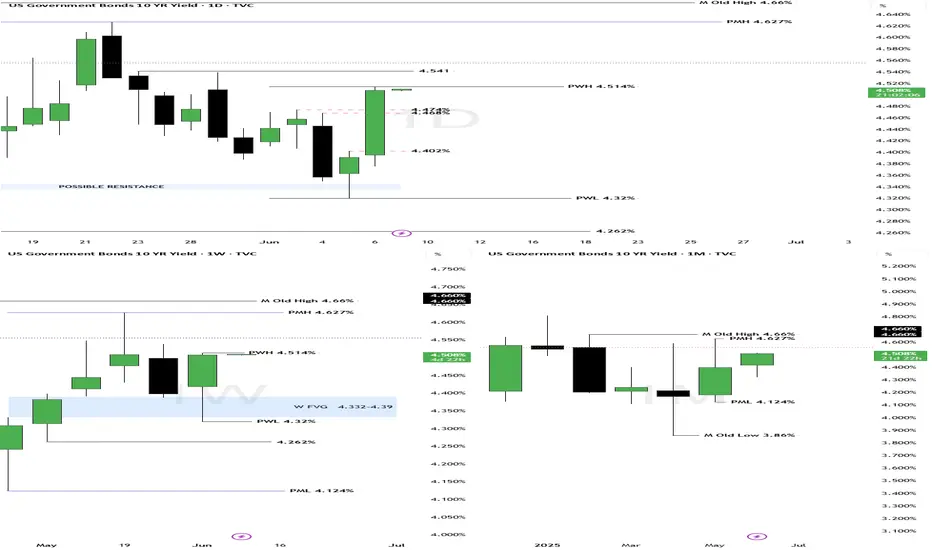

Sometime last week I mentioned this “I expect market to reach 4.47% yesterday’s high and making a bold call of 4.539% - 4.541% for the week. This is just a probability based on the price patterns I’m seeing. Resistance at 4.41% and 4.387% And I also mentioned last Friday the heavy news days like NFP or CPI creates moves that are unexpected and would rather stay away. As expected those levels we mentioned were closed through.

Bias

I am expecting previous week high of 4.51% to be targeted. For today if the candle closes through 4.514% I am looking at 4.541 as the next daily target. Wednesday could be the catalyst day when CPI is due to be released along with inflation rate. Another day to stay off for me.

DISCLAIMMER: This technical analysis is based on historical chart data, which may not predict future market outcomes. Any insights or interpretations I provide are for informational purposes only and should not be considered investment advice. Please conduct your own research and consult a qualified financial professional before making any investment decisions.

Overnight

U.S. Treasuries declined following a stronger-than-expected May employment report, signaling a robust labor market and sustained economic growth, reducing expectations for near-term Fed rate cuts. Investors sold across the yield curve, with the belly experiencing the most pressure. Meanwhile, the stock market rallied, likely benefiting from portfolio rebalancing from bonds to equities. The U.S. Dollar Index rose 0.4% to 99.18, reflecting the positive data and higher rates.

High Impact News this Week

myfxbook.com/forex-economic-calendar

Technical

Sometime last week I mentioned this “I expect market to reach 4.47% yesterday’s high and making a bold call of 4.539% - 4.541% for the week. This is just a probability based on the price patterns I’m seeing. Resistance at 4.41% and 4.387% And I also mentioned last Friday the heavy news days like NFP or CPI creates moves that are unexpected and would rather stay away. As expected those levels we mentioned were closed through.

Bias

I am expecting previous week high of 4.51% to be targeted. For today if the candle closes through 4.514% I am looking at 4.541 as the next daily target. Wednesday could be the catalyst day when CPI is due to be released along with inflation rate. Another day to stay off for me.

DISCLAIMMER: This technical analysis is based on historical chart data, which may not predict future market outcomes. Any insights or interpretations I provide are for informational purposes only and should not be considered investment advice. Please conduct your own research and consult a qualified financial professional before making any investment decisions.

Note

UST 10Y DAILY TECHNICAL JUNE 10Overnight

Overnight on June 9, 2025, U.S. Treasuries showed a mixed response to the New York Fed’s May Survey of Consumer Expectations, with shorter tenors outperforming. The survey, released overnight, reported lower inflation expectations: 1-year at 3.2% (down from 3.6%), 3-year at 3.0% (down from 3.2%), and 5-year at 2.6% (down from 2.7%). This data boosted demand for shorter maturities, with the 2-year Treasury yield falling 4 basis points to 4.00% and the 3-year yield dropping 5 basis points to 3.98%. The 30-year bond yield, after nearing last week’s high of 5.002%, stabilized, closing down 1 basis point at 4.95%. Treasuries traded in a narrow range, with yields steadying as no other significant U.S. economic data was released. The U.S. Dollar Index dipped 0.2% to 98.95, reflecting cautious market sentiment.

No High Impact news today but Inflation data will be due on Wednesday

Daily Bias

As expected yesterday, market targeted previous week high of 4.514% but did not close through so I’m expecting market will target yesterday’s low of 4.47 and possible retracing to 50% fib range of yesterday before resuming its bearish momentum. I have overlayed the fib levels for guide.

DISCLAIMMER: This technical analysis is based on historical chart data, which may not predict future market outcomes. Any insights or interpretations I provide are for informational purposes only and should not be considered investment advice. Please conduct your own research and consult a qualified financial professional before making any investment decisions.

Note

UST 10Y DAILY TECHNICAL JUNE 10Overnight

U.S. Treasuries closed Tuesday with slight gains in longer tenors; the 2-year note dipped after early gains ahead of May CPI (consensus 0.2%). Strong opening in longer tenors followed weak U.K. jobs data, boosting hopes for a September Bank of England rate cut. Treasuries later eased, with the 2-year note turning negative and longer tenors holding prior levels.

Economic Release today myfxbook.com/forex-economic-calendar

Just a reminder, the data to be released tonight could trigger strong volatility. I would stay out before the release of the news.

Daily Bias

As mentioned yesterday we were expecting a retrace to the 50% fib level of Friday’s range before deciding the direction for the week. Today could set the tone when Inflation numbers are released. Today I have no bias but I would watch the previous, Monday, low and high as a target of liquidity. Reason behind this is because of the news due tonight.

DISCLAIMMER: This technical analysis is based on historical chart data, which may not predict future market outcomes. Any insights or interpretations I provide are for informational purposes only and should not be considered investment advice. Please conduct your own research and consult a qualified financial professional before making any investment decisions.

Note

UST 10Y DAILY TECHNICAL JUNE 12Overnight (from the treasury trader)

- USTs bull-steepened Weds following soft May inflation data; extending gains in the afternoon following a solid 10y auction and modest risk-off.

-Core CPI rounded down to 0.1% m/m (0.139% unrounded) vs the +0.3% m/m est. y/y was 2.8% vs 2.9% est; Headline was +0.1% m/m vs +0.2% est with y/y 2.4%.

-2y yields were trading above the 200d MA (4.025%) ahead of the data before rallying through 3.95%

-UST futs consolidated just off the highs through mid-day, ahead of the $39b 10y reopening.

-10y yields were >4.50% pre-CPI before rallying through 4.43% ahead of the bidding deadline

-Despite the rally heading in, the auction still stopped 0.7bps through (4.421%) with non-dealers taking ~91% of the issue.

-Long-end led as USTs took another leg higher on the results with the curve retracing some of the post-NFP steepening.

-price action turned more ‘risk off’ in the afternoon amid reports US was closing the US embassy in Iraq amid mounting regional tension.

-Stocks turned negative as UST futs squeezed to session highs before fading a bit into the pit close.

-SOFR; Strip flattened through the late reds-greens which bounced 10-12-ticks from intraday lows after CPI

-VOL reset lower once through the data; 3m10y gapped below 94.00, taking out the early march lows.

-Oil: Middle east tension was the focus as crude continues to bounce; CL was up another 4.4%, trading above $68.00, the highest since early April.

-Stocks saw an initial boost from positive trade headlines and tame inflation data; ESA traded a local high near 6075 before dropping to 6025 in the afternoon.

-Trade: 2-day US/China negotiations in London resulted in an agreement on a framework to adhere to the Geneva deal; China pledged to speed up shipments of rare earth materials.

US Economic release June 12 myfxbook.com/forex-economic-calendar

Daily bias

For today I am expecting a continuous rally to target previous day low of 4.406% with further target of 4.32%

Note

UST 10Y DAILY TECHNICAL JUNE 13Overnight (From Treasury Dealer)

- USTs extended recent gains amid a combination of softer data, geopolitical tension, and another well-received auction

-Modest risk-off conditions overnight with focus on rising middle east tension (potential Israel strike on Iran)

-USTs would take another leg higher into the US session as PPI came in a little softer while jobless claims topped estimates

-The initial bid faded with USTs peaking ahead of the cash equity open as stocks bounced and focus turned to the afternoons 30y supply.

-Despite limited intraday concession, the 30y auction saw strong demand; sopping about 1.4bps through (4.844%) with non-dealer allotments highest since November

-Long-end futs were lifted above the earlier highs following the auction with 10y yields falling below 4.35% while 30y tested last Thursday’s 4.83% low.

-The front-end failed to recapture the earlier highs as the curve continued flatter through the afternoon with 2s10s & 5s30s trading session lows into the close

-VOL bounced from local lows through 93.5 NV to 95.5. Flows included a buyer in 11k TY 111 straddles.

-SOFR: continued rebound on the date; SFRZ5 traded above 96.20 (pre-NFP levels) before fading a bit into the close; Peak contracts in the reds were >96.75 after PPI before closing off session highs.

-Stocks were pressured overnight with ESA dipping back below 6000 before recovering into NY; Rebound continued into the afternoon with ESA re-testing the 6050 level while NQ was +0.30%.

-Dollar continued to slide with BBDXY taking out the April lows before testing the July 2023 lows ~1198 before recovering later in the session.

-Data: Initial jobless claims held at 248k vs 242k est with the 4-wk MA moving to 240k which is highest Sep 2023. Continuing claims was 1956k – highest since Nov 2021

-Headline PPI was +0.1% m/m vs +0.2% est. with y/y in-line at 2.6%; core PPU was +0.1% m/m vs +0.3% est with y/y dipping to 3.0% vs 3.1% est.

-Following the PPI data, econ estimates for May core PCE were coming in around 0.1-0.15% with the y/y expected at 2.6%..

Daily Bias

With the strong move overnight I’m expecting yield to have a little correction but liquidate the previous week low 4.32%. Taking note of possible support zone of 4.44%-4.42% .

tradingview.com/chart/j941q1Sa/?symbol=SP:SPX

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.