Hello Traders tomorrow we have 10-Year Note Auction data and I wanted to prepare a nice little information for you about this topic because the data released last month showed an immediate 10% increase and from what I saw, many people had no idea what was happening.

📌 What is the 10-Year Note Auction?

The U.S. government regularly issues 10-year Treasury notes to finance its budget. The auction result reflects investor demand and long-term interest rate expectations. The yield (interest rate) that results from the auction is a key benchmark for financial markets globally.

🔄 Connection to U.S. Stocks and EUR/USD

🟢 If Demand Is Strong (Yields Stay Low):

🔴 If Demand Is Weak (Yields Rise):

💱 Effect on EUR/USD

🟢 If Yields Rise:

🔴 If Yields Fall:

🗓️ Latest 10-Year Treasury Auction – April 9, 2025

📊 Post-Auction Market Reactions

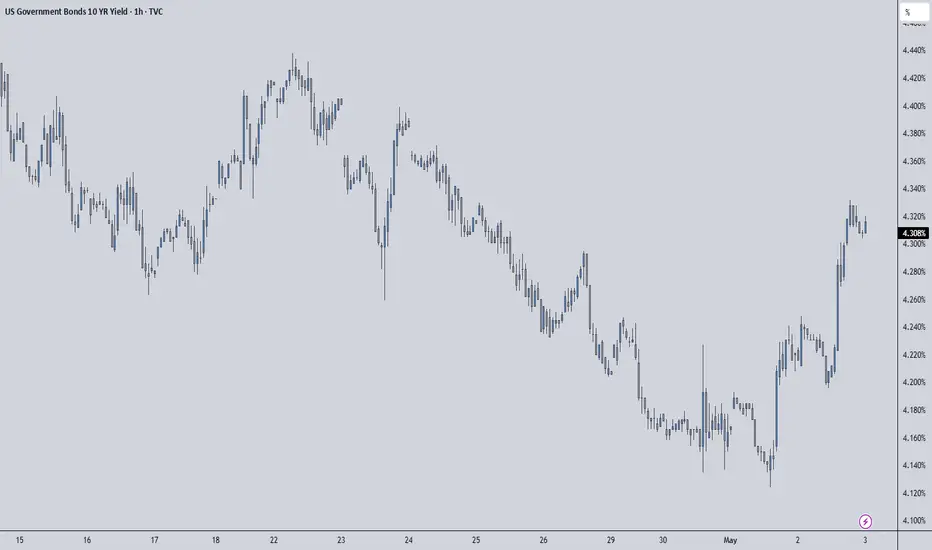

🔹 10Y Treasury Yield:

🔹 S&P 500 Index:

🔹 EUR/USD:

✅ Conclusion

The April 9, 2025, 10-year Treasury auction showed strong demand with a yield lower than market expectations. This led to a drop in yields, a positive reaction in U.S. stock markets, and potential downward pressure on the dollar, which may support EUR/USD.

📌 What is the 10-Year Note Auction?

The U.S. government regularly issues 10-year Treasury notes to finance its budget. The auction result reflects investor demand and long-term interest rate expectations. The yield (interest rate) that results from the auction is a key benchmark for financial markets globally.

🔄 Connection to U.S. Stocks and EUR/USD

🟢 If Demand Is Strong (Yields Stay Low):

- Investors are eager to buy U.S. debt, pushing prices up and yields down.

- This indicates confidence in the U.S. economy and little concern about inflation or rate hikes.

- Stock markets generally react positively.

🔴 If Demand Is Weak (Yields Rise):

- Investors require higher returns, possibly due to inflation fears or policy tightening expectations.

- This pushes yields up, increasing borrowing costs and reducing the attractiveness of risk assets.

- Stocks typically decline, and the dollar strengthens.

💱 Effect on EUR/USD

🟢 If Yields Rise:

- U.S. dollar becomes more attractive due to higher returns.

- Investors buy USD to invest in Treasuries.

- EUR/USD typically falls.

🔴 If Yields Fall:

- Lower yields reduce the appeal of the dollar.

- Investors may move capital elsewhere.

- EUR/USD tends to rise.

🗓️ Latest 10-Year Treasury Auction – April 9, 2025

- Auction Size: $39 billion

- High Yield: 4.435%

- Expected (WI) Yield: 4.465%

- Outcome: Strong demand – yield came in lower than expected.

📊 Post-Auction Market Reactions

🔹 10Y Treasury Yield:

- Before auction: ~4.466%

- After auction: Dropped to ~4.38%

- ➝ Reflects strong investor demand and confidence in long-term stability.

🔹 S&P 500 Index:

- Lower yields reduce borrowing costs and support equity valuations.

- Investors often shift toward riskier assets like stocks when yields fall.

- The S&P 500 responded positively after the auction.

🔹 EUR/USD:

- Falling yields reduce the dollar's relative appeal.

- This may push EUR/USD higher, depending on other macroeconomic influences (like ECB policy or geopolitical risks).

✅ Conclusion

The April 9, 2025, 10-year Treasury auction showed strong demand with a yield lower than market expectations. This led to a drop in yields, a positive reaction in U.S. stock markets, and potential downward pressure on the dollar, which may support EUR/USD.

Professional Day Trader

Microstructure Practicioner

t.me/umuttrades

kick.com/umuttrades live everyday.

Microstructure Practicioner

t.me/umuttrades

kick.com/umuttrades live everyday.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Professional Day Trader

Microstructure Practicioner

t.me/umuttrades

kick.com/umuttrades live everyday.

Microstructure Practicioner

t.me/umuttrades

kick.com/umuttrades live everyday.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.