Fundamental approach:

- US30 has been pushing toward a fresh high this week, aided by softer CPI and growing confidence in a Sep Fed cut. On Wed, it was within about 1% of a record and posted substantial gains earlier in the week.

- The US Jul PPI rose 0.9% MoM and 3.3% YoY, well above forecasts, reviving tariff-driven inflation worries and pressuring cyclicals. Earlier CPI relief had supported a midweek bounce and fresh risk-on tone in parts of the market. Headlines flagged mixed mega-cap moves, and Dow heavies like Apple (AAPL) and Caterpillar (CAT) fluctuated with growth and trade sensitivity as traders reassessed the rate path.

- US30 could remain supportive as markets weigh amid Fed policy expectations that could shift based on next week's flash PMIs and further data signals on pricing and activity. Traders may also react to guidance updates and sector rotations if inflation surprises persist, potentially delaying aggressive easing prospects.

Technical approach:

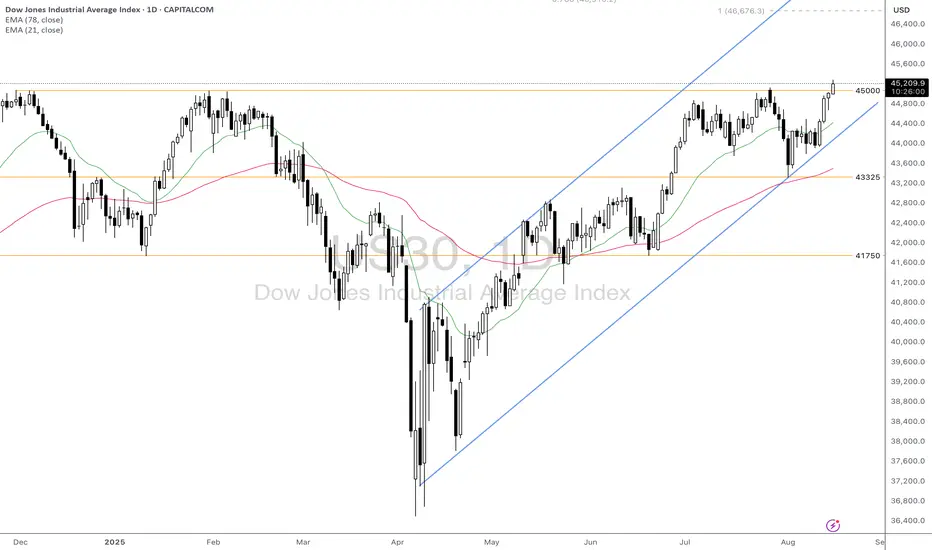

- US30 created a new swing high, closing above the resistance at 45000. The index is above both EMAs, indicating upward momentum.

- If US30 remains above 45000, it may approach the 100% Fibonacci Extension at around 46670.

- On the contrary, staying below 45000 may prompt a retest of the EMA21 and the ascending channels' lower bound.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

- US30 has been pushing toward a fresh high this week, aided by softer CPI and growing confidence in a Sep Fed cut. On Wed, it was within about 1% of a record and posted substantial gains earlier in the week.

- The US Jul PPI rose 0.9% MoM and 3.3% YoY, well above forecasts, reviving tariff-driven inflation worries and pressuring cyclicals. Earlier CPI relief had supported a midweek bounce and fresh risk-on tone in parts of the market. Headlines flagged mixed mega-cap moves, and Dow heavies like Apple (AAPL) and Caterpillar (CAT) fluctuated with growth and trade sensitivity as traders reassessed the rate path.

- US30 could remain supportive as markets weigh amid Fed policy expectations that could shift based on next week's flash PMIs and further data signals on pricing and activity. Traders may also react to guidance updates and sector rotations if inflation surprises persist, potentially delaying aggressive easing prospects.

Technical approach:

- US30 created a new swing high, closing above the resistance at 45000. The index is above both EMAs, indicating upward momentum.

- If US30 remains above 45000, it may approach the 100% Fibonacci Extension at around 46670.

- On the contrary, staying below 45000 may prompt a retest of the EMA21 and the ascending channels' lower bound.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.