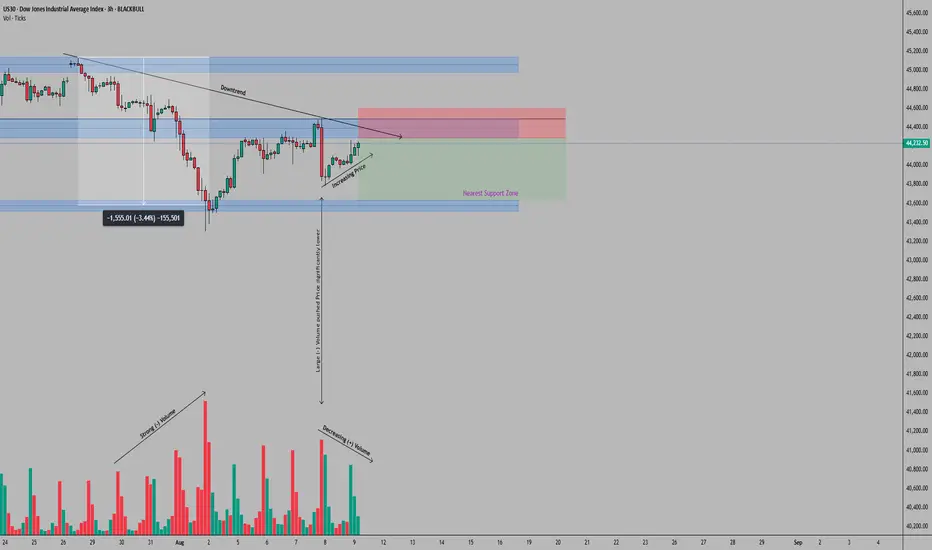

US30 (Dow Jones Industrial Index) Trade Setup – 3H Timeframe

On the 3-hour timeframe, US30 has established a clear bearish structure following its July 28, 2025 all-time high just above the 45,000 mark. The initial sharp decline from this level, characterized by strong negative volume, found support at 43,550 after a 3.44% correction. What's particularly noteworthy is the subsequent price action at the 44,400 level, which has transitioned from support to resistance, confirmed by a high-volume rejection on August 7.

The current market structure shows weakening momentum on recovery attempts, with declining positive volume as price tests the 44,400 barrier. This volume pattern, combined with the established downward trendline from the 45,126.50 ATH, suggests sellers remain in control of the short-term price action.

Illustrative Setup: A Sell Limit order at 44,290 aligns with the lower boundary of the resistance zone. The Stop Loss placement at 44,605 provides protection above both the 44,400 resistance and the descending trendline, offering clear invalidation if breached. The Take Profit target at 43,550 corresponds with the recent support level, where strong buying interest previously emerged, pushing price back up. This configuration yields a risk-reward ratio of 2.1:1, respecting the recent price action dynamics.

Key consideration: The high-volume rejection at 44,400 and subsequent declining volume on recovery attempts suggest institutional selling pressure remains dominant. However, traders should remain mindful that the broader market structure is still bullish despite this correction phase.

This analysis is provided solely for educational and entertainment purposes and does not constitute any form of financial or investment advice. Always manage your risk and trade responsibly.

The current market structure shows weakening momentum on recovery attempts, with declining positive volume as price tests the 44,400 barrier. This volume pattern, combined with the established downward trendline from the 45,126.50 ATH, suggests sellers remain in control of the short-term price action.

Illustrative Setup: A Sell Limit order at 44,290 aligns with the lower boundary of the resistance zone. The Stop Loss placement at 44,605 provides protection above both the 44,400 resistance and the descending trendline, offering clear invalidation if breached. The Take Profit target at 43,550 corresponds with the recent support level, where strong buying interest previously emerged, pushing price back up. This configuration yields a risk-reward ratio of 2.1:1, respecting the recent price action dynamics.

Key consideration: The high-volume rejection at 44,400 and subsequent declining volume on recovery attempts suggest institutional selling pressure remains dominant. However, traders should remain mindful that the broader market structure is still bullish despite this correction phase.

This analysis is provided solely for educational and entertainment purposes and does not constitute any form of financial or investment advice. Always manage your risk and trade responsibly.

Trade closed: stop reached

After an initial decline along the bearish trendline initiated right after the ATH printed on July 28, US30 bounced back sharply from the intermediate support zone around 44,000, supported by high positive volume further to the release of major news on August 12. The 44,300 - 44,500 resistance zone was then broken to the upside and the protective stop was activated at 44,605 for a loss of -1R. This trade is over.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.