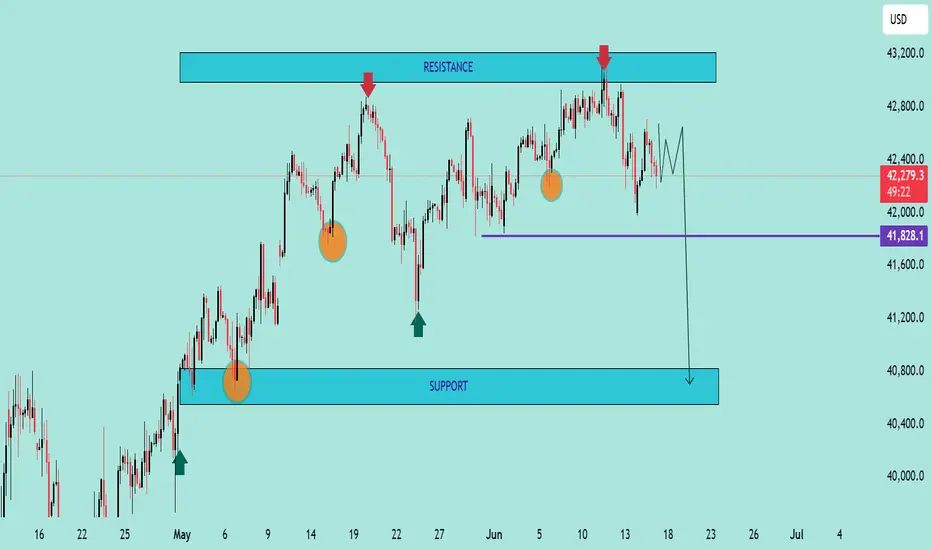

US30 – Bearish Setup Below Resistance Zone 🚨🟥

The US30 index is exhibiting signs of bearish momentum after repeated rejections from the key resistance zone near 43,200. Let's break down the technical picture:

🔍 Technical Analysis

📌 Resistance Zone (🟥 43,200 area)

Price was rejected twice from this resistance (marked by red arrows), showing strong seller presence.

Bearish candlesticks followed each touch, confirming exhaustion near this level.

📌 Support Zone (🟦 40,800 area)

The area around 40,800 has acted as a strong demand zone in the past (highlighted with green arrows and orange circles).

Price might revisit this area if current bearish structure continues.

📌 Intermediate Support (🟪 41,828)

This level serves as short-term support.

If broken, it could accelerate the decline toward the major support.

📌 Market Structure

Lower highs forming after each bounce indicate weakening bullish strength.

A potential bearish breakout pattern is forming (highlighted by the projected path).

📈 Conclusion & Trade Outlook

Bias: Bearish 📉

Trigger: Break below 41,828 support

Target: 40,800 zone

Invalidation: Break and close above 43,200 resistance

The US30 index is exhibiting signs of bearish momentum after repeated rejections from the key resistance zone near 43,200. Let's break down the technical picture:

🔍 Technical Analysis

📌 Resistance Zone (🟥 43,200 area)

Price was rejected twice from this resistance (marked by red arrows), showing strong seller presence.

Bearish candlesticks followed each touch, confirming exhaustion near this level.

📌 Support Zone (🟦 40,800 area)

The area around 40,800 has acted as a strong demand zone in the past (highlighted with green arrows and orange circles).

Price might revisit this area if current bearish structure continues.

📌 Intermediate Support (🟪 41,828)

This level serves as short-term support.

If broken, it could accelerate the decline toward the major support.

📌 Market Structure

Lower highs forming after each bounce indicate weakening bullish strength.

A potential bearish breakout pattern is forming (highlighted by the projected path).

📈 Conclusion & Trade Outlook

Bias: Bearish 📉

Trigger: Break below 41,828 support

Target: 40,800 zone

Invalidation: Break and close above 43,200 resistance

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.