Perfect — now we’re on the 4H timeframe, which is great for refining entries. Let’s break this down again with the three frameworks:

⸻

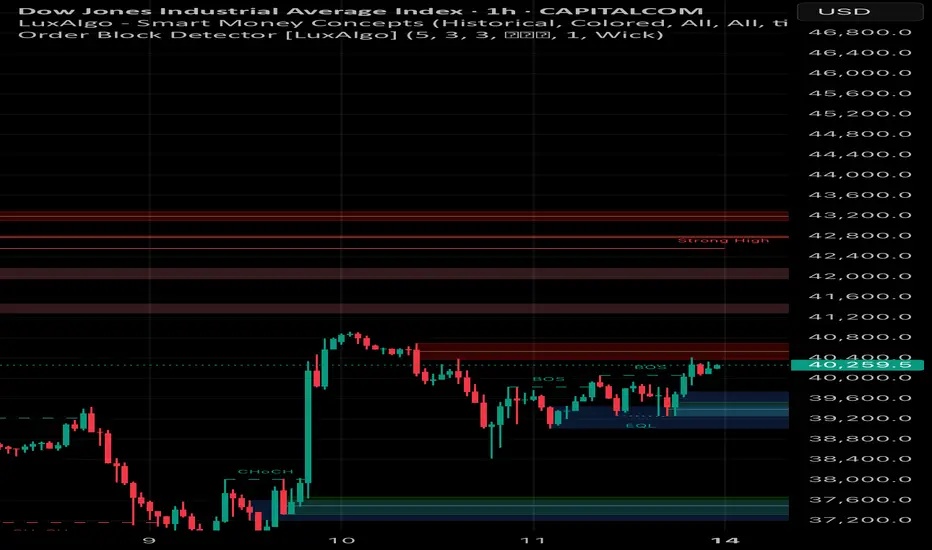

1. Smart Money Concept (SMC)

Key Elements:

• CHoCH (Change of Character) — clearly marked after price broke above a short-term structure, shifting market sentiment bullish on 4H.

• EQH (Equal Highs) — potential liquidity resting above; smart money may target these.

• BOS (Break of Structure) — further confirms internal bullish structure.

• Order Block (OB) or Demand Zone in the green box (~17,700–18,200)** — price respected this zone strongly after BOS, indicating smart money accumulation.

SMC Bias (4H):

• Currently bullish, moving from demand to premium pricing.

• Price is forming higher highs and higher lows post-CHoCH.

• Liquidity pool above EQH near 19,000 is likely next target.

• Potential long re-entry if price returns to demand zone (18,000–18,200).

⸻

2. Elliott Wave View (Micro Count on 4H)

• If this is part of Wave 4 retracement on the Daily, this current 4H rally could be subwave A or B of the corrective structure (flat, zigzag, triangle).

• Alt. view: This may be Wave 1 of a new impulsive move upward if macro bearish bias gets invalidated.

• Current price action looks impulsive — strong vertical move (potential Wave 1 or 3).

If impulsive structure:

• Wave 1: 17,000 → 18,900

• Wave 2: pullback to ~18,100 (near OB)

• Wave 3 underway — targetting >19,000

⸻

3. Dow Theory (on 4H)

• Short-term trend is now up: Higher high confirmed post-BOS, and higher low formed.

• To maintain bullish structure, price must not break below 17,900 (demand zone).

• Confirmation of strength if we break above 19,000 — forming a higher high again.

⸻

Trade Idea (4H Setup) — Bullish SMC Entry

Entry (Buy Limit): 18,150 (mid-demand zone)

SL: 17,750 (below OB)

TP1: 19,000 (liquidity above EQH)

TP2: 19,800 – 20,200 (Daily supply zone)

RR Ratio: ~1:3+

⸻

⸻

1. Smart Money Concept (SMC)

Key Elements:

• CHoCH (Change of Character) — clearly marked after price broke above a short-term structure, shifting market sentiment bullish on 4H.

• EQH (Equal Highs) — potential liquidity resting above; smart money may target these.

• BOS (Break of Structure) — further confirms internal bullish structure.

• Order Block (OB) or Demand Zone in the green box (~17,700–18,200)** — price respected this zone strongly after BOS, indicating smart money accumulation.

SMC Bias (4H):

• Currently bullish, moving from demand to premium pricing.

• Price is forming higher highs and higher lows post-CHoCH.

• Liquidity pool above EQH near 19,000 is likely next target.

• Potential long re-entry if price returns to demand zone (18,000–18,200).

⸻

2. Elliott Wave View (Micro Count on 4H)

• If this is part of Wave 4 retracement on the Daily, this current 4H rally could be subwave A or B of the corrective structure (flat, zigzag, triangle).

• Alt. view: This may be Wave 1 of a new impulsive move upward if macro bearish bias gets invalidated.

• Current price action looks impulsive — strong vertical move (potential Wave 1 or 3).

If impulsive structure:

• Wave 1: 17,000 → 18,900

• Wave 2: pullback to ~18,100 (near OB)

• Wave 3 underway — targetting >19,000

⸻

3. Dow Theory (on 4H)

• Short-term trend is now up: Higher high confirmed post-BOS, and higher low formed.

• To maintain bullish structure, price must not break below 17,900 (demand zone).

• Confirmation of strength if we break above 19,000 — forming a higher high again.

⸻

Trade Idea (4H Setup) — Bullish SMC Entry

Entry (Buy Limit): 18,150 (mid-demand zone)

SL: 17,750 (below OB)

TP1: 19,000 (liquidity above EQH)

TP2: 19,800 – 20,200 (Daily supply zone)

RR Ratio: ~1:3+

⸻

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.