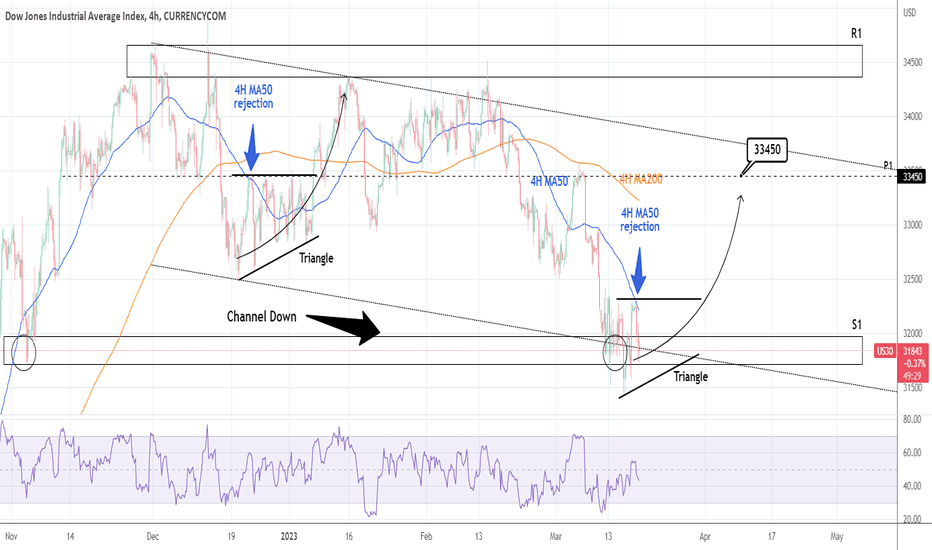

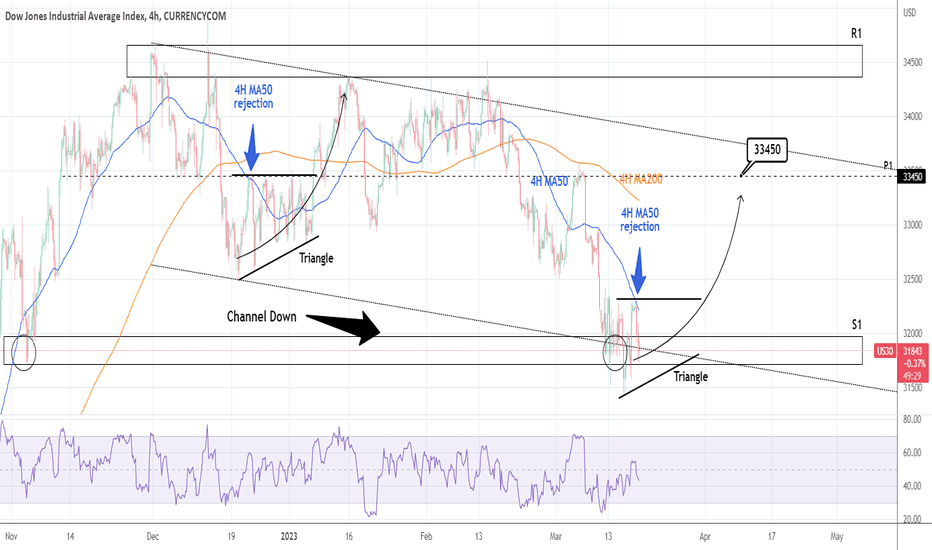

DOW JONES: Hit the 1D MA200 after almost 2 months.

Dow Jones touched today the 1D MA200 for the first time since March 29th, almost 2 months after the strong bullish break-out. The 1D timeframe is technically bearish (RSI = 38.438, MACD = -67.410, ADX = 30.240), indicating that we are approaching low enough levels to justify a long term buy. However we are only willing to open a buy position as long as the 1D candles close over the 1D MA200 and target R1 (TP = 33,600).

If a candle closes below the 1D MA200, we will open a sell and target the bottom of the dashed Channel Down (TP = 32,000). Once the 1D RSI gets oversold, we will again buy on the long term, aiming at the top of the seven month Channel Down (TP = 33,900).

Keep in mind that the 1D MA200 has held and provided excellent buy signals, three times and only once on March 9th it broke.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

If a candle closes below the 1D MA200, we will open a sell and target the bottom of the dashed Channel Down (TP = 32,000). Once the 1D RSI gets oversold, we will again buy on the long term, aiming at the top of the seven month Channel Down (TP = 33,900).

Keep in mind that the 1D MA200 has held and provided excellent buy signals, three times and only once on March 9th it broke.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.