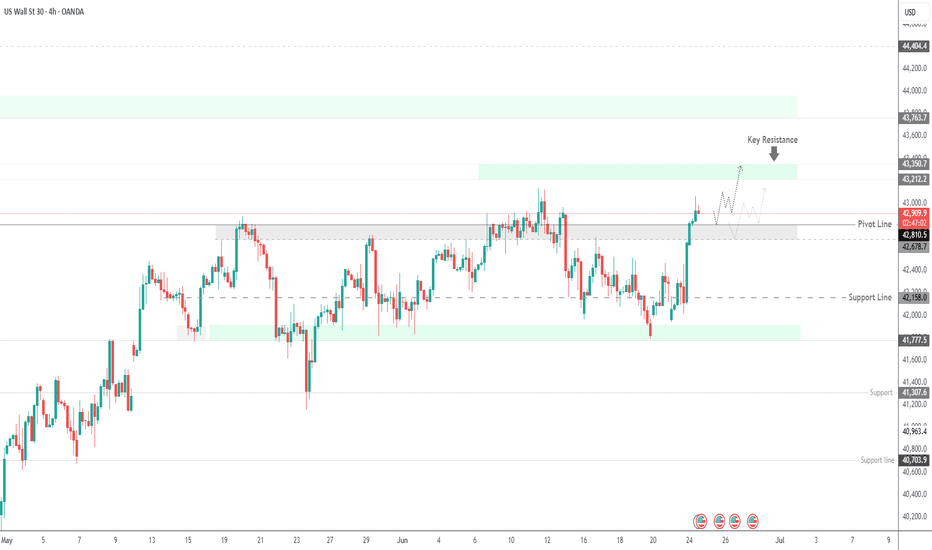

US30 OVERVIEW

Dow Jones Holds Bullish Momentum | Eyes on Retest and Continuation

US30 (Dow Jones) remains under bullish pressure, supported by recent macro developments and improving sentiment.

The price appears to be forming a retest toward 43,020, which could act as a springboard for further upside.

As long as the index trades above 42,810, the bullish trend remains intact, targeting 43,350, and potentially 43,765.

However, a confirmed break below 42,810 would shift the outlook to bearish in the short term.

Resistance Levels: 43,350 → 43,765

Support Levels: 43,020 → 42,810

Previous idea:

Dow Jones Holds Bullish Momentum | Eyes on Retest and Continuation

US30 (Dow Jones) remains under bullish pressure, supported by recent macro developments and improving sentiment.

The price appears to be forming a retest toward 43,020, which could act as a springboard for further upside.

As long as the index trades above 42,810, the bullish trend remains intact, targeting 43,350, and potentially 43,765.

However, a confirmed break below 42,810 would shift the outlook to bearish in the short term.

Resistance Levels: 43,350 → 43,765

Support Levels: 43,020 → 42,810

Previous idea:

Trade active

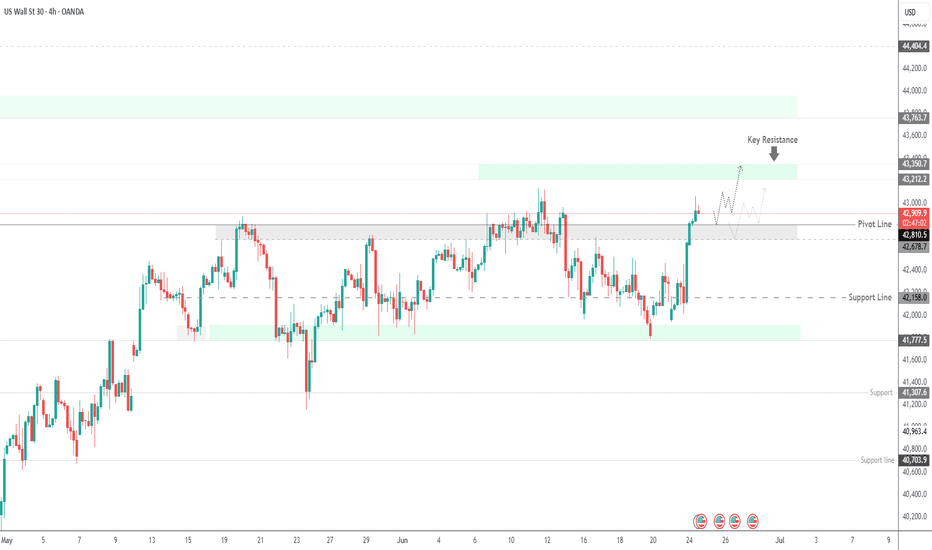

US30 TECHNICAL OVERVIEW | updateDow Jones Retests Support and Rebounds – Consolidation Continues

US30 successfully retested the previously highlighted 43,020 support level and has since pushed higher, maintaining its bullish momentum.

Currently, the price is consolidating between 43,020 and 43,210. A breakout from this range will define the next directional move.

- A 1H candle close above 43,210 will confirm continuation toward 43,350 and potentially 43,760.

- A break below 43,020 would suggest a bearish move toward the next support at 42,810.

Key Levels

Resistance: 43,210 → 43,350

Support: 42,810 → 42,670

Trade closed: target reached

US30 TECHNICAL OVERVIEWDow Jones Extends Bullish Trend | Eyes on 43,760

Moving Well +350 points

US30 continues its bullish momentum, as expected, after successfully breaking above 43,020.

The current movement suggests a continued push toward the next key resistance at 43,760.

Once that level is reached, a short-term correction toward 43,480 and 43,350 may occur.

A break above 43,760 would confirm further bullish continuation toward 43,980

A break below 43,210 would shift momentum and open the path to 43,020

Key Levels

Resistance: 43,760 → 43,980

Support: 43,350 → 43,210 → 43,020

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Technical analyst focused on gold, indices, and forex.

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Providing regular updates with structure, entry/exit clarity, and real-time outlooks.

More at: sroshmayi.com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.