Introduction: The equity market is marking time in the short term after a vertical uptrend since the beginning of April. There are many issues of fundamental concern, but one is currently front and center: the sustainability of US sovereign debt. Of course, it's far too early to talk about a US public debt crisis, but the new tax bill championed by the Trump Administration envisages raising the US debt ceiling by $4 trillion, putting short-term upward pressure on US bond yields on 10-, 20- and 30-year maturities. Is this a threat to the rebound in US equities since the beginning of April?

1) US bond yields reach macroeconomic warning zone

The Trump Administration's tax bill calls for tax cuts and, above all, an increase in the US public debt ceiling by US$4 trillion to allow the US federal government to continue its massive indebtedness.

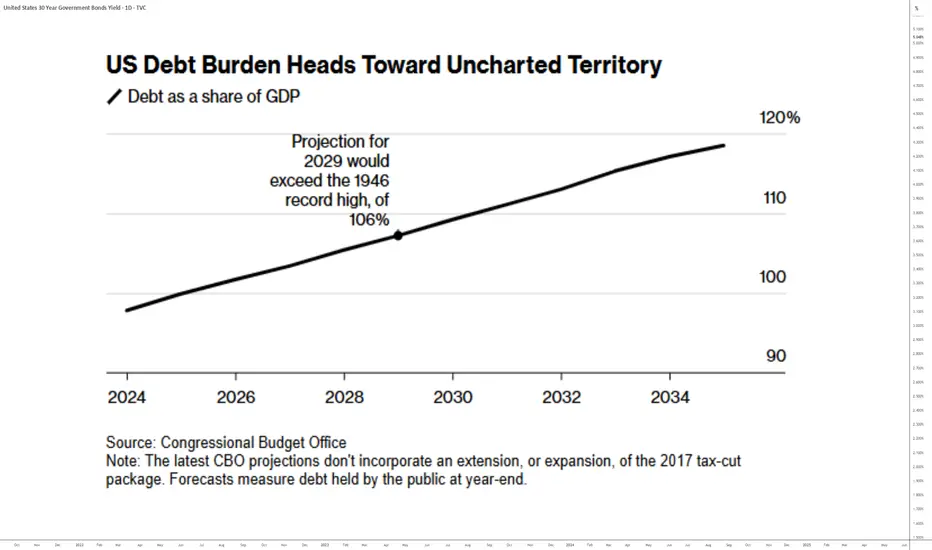

The market is beginning to worry about this situation, as US debt is on the verge of surpassing the 1946 record when expressed as a percentage of US GDP. The annual interest burden on existing debt has reached US$880 billion, equivalent to the US defense budget.

Chart showing the evolution of US public debt as a percentage of US GDP

As a result, financial markets are expressing their concern with rising US bond yields on the long end of the yield curve.

Chart showing Japanese candlesticks in daily data tu 10-year US bond yields

Graph showing monthly Japanese candlesticks for the 30-year US bond yield.

2) The market is hoping for activation of the FED put to ease bond tension

This upward pressure on US bond yields may represent a risk for the equity market, as higher US federal government yields will have a direct impact on US corporate borrowing rates.

S&P 500 companies have solid balance sheets and should be able to cope, but long-term bond yields must not rise above 5/6%, as the financial situation of small and medium-sized US companies would then become problematic. This 5/6% threshold has been identified as the macroeconomic warning threshold for the majority of US companies. In such a scenario, the FED would be obliged to intervene directly on the bond market to relieve the pressure.

3) The S&P 500 is overheating in the short term, but the underlying uptrend is technically intact, and remains supported by the new record high in global liquidity.

At this stage, technical analysis of the financial markets suggests that the upward rally since the beginning of April is not under threat. The market was overheated in the short term and needed to breathe. For the S&P 500 index, the consolidation is short-term in scope, and the recovery remains intact as long as the major technical support zone of 5700/5800 points remains intact. The 200-day moving average, shown in blue on the chart below, passes through this price range.

Chart showing Japanese candlesticks in daily data for the S&P 500 future contract

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

1) US bond yields reach macroeconomic warning zone

The Trump Administration's tax bill calls for tax cuts and, above all, an increase in the US public debt ceiling by US$4 trillion to allow the US federal government to continue its massive indebtedness.

The market is beginning to worry about this situation, as US debt is on the verge of surpassing the 1946 record when expressed as a percentage of US GDP. The annual interest burden on existing debt has reached US$880 billion, equivalent to the US defense budget.

Chart showing the evolution of US public debt as a percentage of US GDP

As a result, financial markets are expressing their concern with rising US bond yields on the long end of the yield curve.

Chart showing Japanese candlesticks in daily data tu 10-year US bond yields

Graph showing monthly Japanese candlesticks for the 30-year US bond yield.

2) The market is hoping for activation of the FED put to ease bond tension

This upward pressure on US bond yields may represent a risk for the equity market, as higher US federal government yields will have a direct impact on US corporate borrowing rates.

S&P 500 companies have solid balance sheets and should be able to cope, but long-term bond yields must not rise above 5/6%, as the financial situation of small and medium-sized US companies would then become problematic. This 5/6% threshold has been identified as the macroeconomic warning threshold for the majority of US companies. In such a scenario, the FED would be obliged to intervene directly on the bond market to relieve the pressure.

3) The S&P 500 is overheating in the short term, but the underlying uptrend is technically intact, and remains supported by the new record high in global liquidity.

At this stage, technical analysis of the financial markets suggests that the upward rally since the beginning of April is not under threat. The market was overheated in the short term and needed to breathe. For the S&P 500 index, the consolidation is short-term in scope, and the recovery remains intact as long as the major technical support zone of 5700/5800 points remains intact. The 200-day moving average, shown in blue on the chart below, passes through this price range.

Chart showing Japanese candlesticks in daily data for the S&P 500 future contract

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.