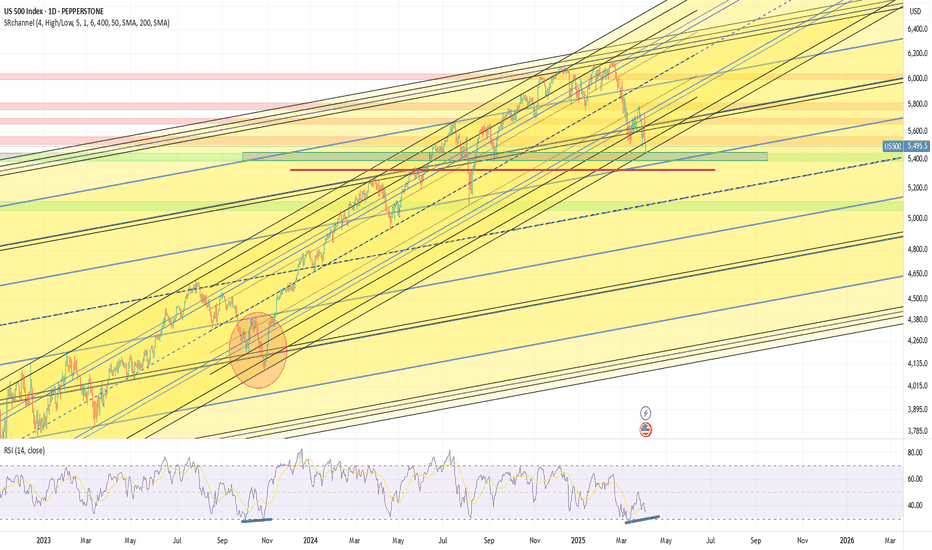

The upper trendline starts from Jan 2022 peak. It was broken on normal scale but still holds on log scale. The price may top here or may go higher. In a very bullish scenario the price may bounce much higher from an upper 1W FVG, but I think it will be broken soon. In any case I see a strong support at 6050-6150 area - a horizontal support and 1M/1W FVG are there. The price should return there sooner or later. No negative daily RSI divergence at the moment, but the price can make 4% correction on 2-4h divergence, which will appear at any new ATH. I gonna hold and increase my short position with low leverage untill the price makes a pullback into this area.

Note

I will make some hedges at 6350 area with stop-losses. SPX and US100 made 2h divergences while US500 and NDX show no divergences - the price is likely in a small correction right now and will go to new highs.Note

Sorry, NDX actually does have a solid 4h negative divergence. US500 also made 4h negative divergence at the top, but it's very extended, and it's actually showing 4h hidden positive divergence right now. So it will keep going sideways like in the first half of July untill some catalyst pushes it in either direction. I would say the sooner it goes down for a correction, the sooner it will keep a healthy trend up. Really nothing good in going higher for anyone at this point - it will just fall harder to the support area later.Trade active

Here we goNote

The price is at the support area (6216-6280). it will likely bounce from here. But I expect this support to be broken next week.Note

Wow, looks like it's breaking todayNote

Nope, still holds. I expect a bounce next week to close the gap and continuation of the fall. 6060 level is 1.618 fib retracement from July7/July 16 low to the top, so the price will likely reach it.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.