📉📊 S&P 500 ETF & Index at Resistance – Technicals Hint at a Possible Correction 🔍⚠️

Everything here is pure technicals—but sometimes, the market whispers loud and clear if you know how to listen. 🧠📐

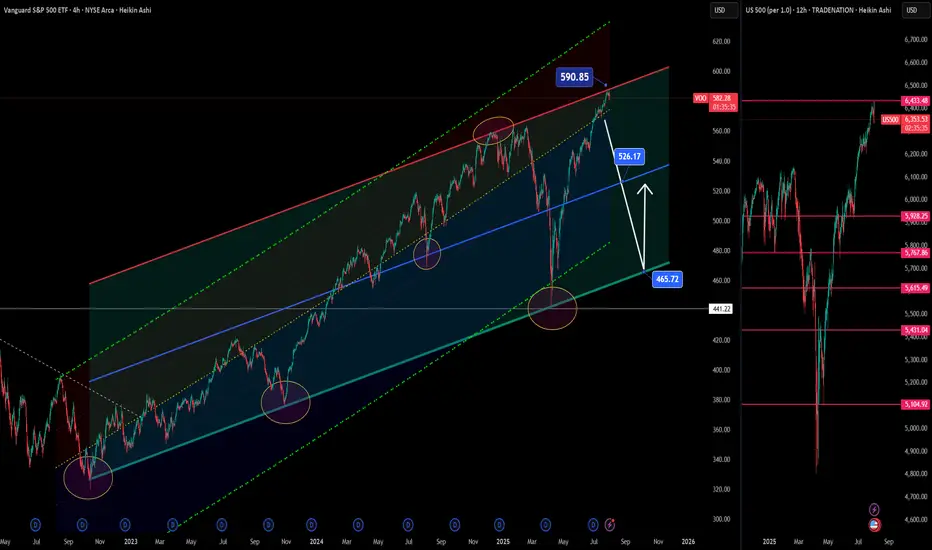

The VOO ETF, which tracks the S&P 500, has now reached the upper boundary of a long-term ascending channel, once again brushing against resistance near 590.85. This zone has consistently led to major pullbacks in the past.

On the right panel, the US500 Index mirrors this move—pushing toward all-time highs, right as broader sentiment turns euphoric. Technically, both charts are overextended and pressing into key zones.

👀 Potential Path:

🔻 Rejection from current zone ➝ Down toward 526.17, then 465.72 (green support channel)

🔁 Possible bounce after correction — trend still intact long term

And while we’re keeping it technical, it’s worth noting that the Buffett Indicator (Stocks-to-GDP) is currently screaming “overvaluation.” This doesn't predict timing—but it adds macro context to an already overheated chart setup.

The lesson? Price respects structure. Whether or not the fundamentals are in agreement, the charts are warning that now may not be the time to chase.

History doesn’t repeat, but it often rhymes. Stay sharp, stay technical. 🎯

One Love,

The FXPROFESSOR 💙

ps. the beauty of these levels? Tight Stop loss- excellent R/R

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Everything here is pure technicals—but sometimes, the market whispers loud and clear if you know how to listen. 🧠📐

The VOO ETF, which tracks the S&P 500, has now reached the upper boundary of a long-term ascending channel, once again brushing against resistance near 590.85. This zone has consistently led to major pullbacks in the past.

On the right panel, the US500 Index mirrors this move—pushing toward all-time highs, right as broader sentiment turns euphoric. Technically, both charts are overextended and pressing into key zones.

👀 Potential Path:

🔻 Rejection from current zone ➝ Down toward 526.17, then 465.72 (green support channel)

🔁 Possible bounce after correction — trend still intact long term

And while we’re keeping it technical, it’s worth noting that the Buffett Indicator (Stocks-to-GDP) is currently screaming “overvaluation.” This doesn't predict timing—but it adds macro context to an already overheated chart setup.

The lesson? Price respects structure. Whether or not the fundamentals are in agreement, the charts are warning that now may not be the time to chase.

History doesn’t repeat, but it often rhymes. Stay sharp, stay technical. 🎯

One Love,

The FXPROFESSOR 💙

ps. the beauty of these levels? Tight Stop loss- excellent R/R

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

🐾 TOP DOGS TEAM is LIVE! 🚀 Join the $6M KCGI 2025 battle — Signals, Charts & Coaching included.

💰 Min: $100 | 🎯 Register by July 23

🔗 fxprofessor.com/top-dogs-team

📣 Telegram: t.me/fxprofessor88

🌍 fxprofessor.com

💰 Min: $100 | 🎯 Register by July 23

🔗 fxprofessor.com/top-dogs-team

📣 Telegram: t.me/fxprofessor88

🌍 fxprofessor.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🐾 TOP DOGS TEAM is LIVE! 🚀 Join the $6M KCGI 2025 battle — Signals, Charts & Coaching included.

💰 Min: $100 | 🎯 Register by July 23

🔗 fxprofessor.com/top-dogs-team

📣 Telegram: t.me/fxprofessor88

🌍 fxprofessor.com

💰 Min: $100 | 🎯 Register by July 23

🔗 fxprofessor.com/top-dogs-team

📣 Telegram: t.me/fxprofessor88

🌍 fxprofessor.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.