Short

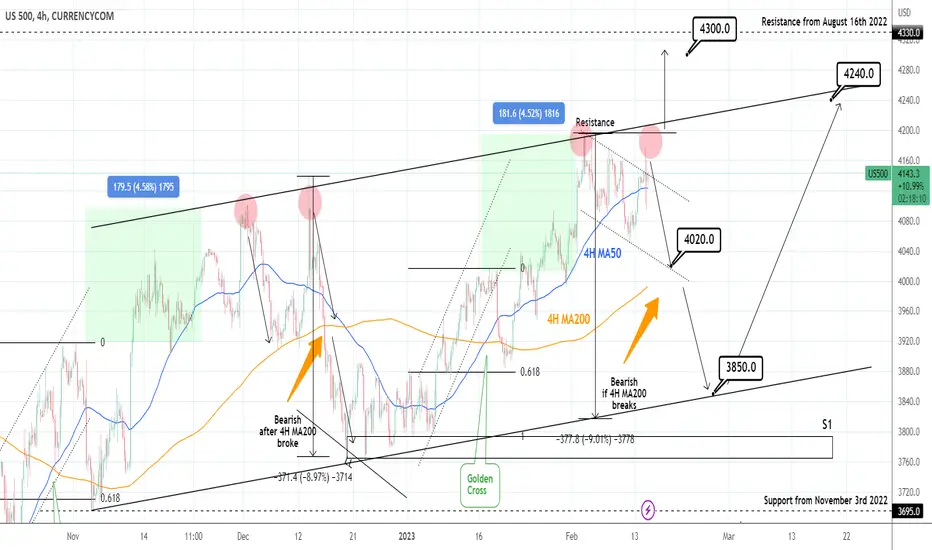

S&P500: Selling aimed at the 4H MA200

The S&P500 index remains neutral on the 4H time-frame (RSI = 54.250, MACD = 4.390, ADX = 29.647) and without any technical buying pressure, especially following the higher than expected CPI report today, may be have made a Double Top similar to December 13th. If the 4,200 Resistance breaks, we will buy and TP = 4,300 (under 4,330 August 16th High). Until then, we will follow the technical pressure as suggested by the previous Double Top and sell aiming at the 4H MA200 (TP = 4,020).

Consider a full daily close below the 4H MA200 a sell trigger aiming at the bottom of the long term Channel Up (TP = 3,850). Then we can buy relatively safely again for the long term (TP = 4,240).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Consider a full daily close below the 4H MA200 a sell trigger aiming at the bottom of the long term Channel Up (TP = 3,850). Then we can buy relatively safely again for the long term (TP = 4,240).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Telegram: t.me/investingscope

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

investingscope.com

Over 65% accuracy on Private Signals Channel.

Over 15% return monthly on our Account Management Plan.

Account RECOVERY services.

Free Channel: t.me/investingscopeofficial

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.