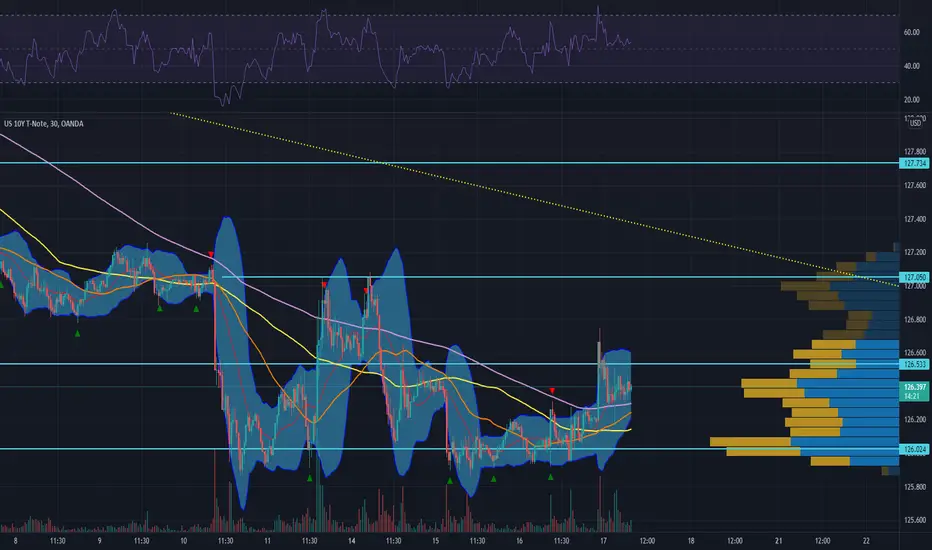

Bond market caught a bid in the overnight session as the potential breakout of war is ever increasing. Its interesting to note that the bond market is caught between to narratives are the moment; on one hand, bond acts as a safe haven product, rallying on any risk of geopolitical tension, while on the other hand, the bond market is selling off due to higher yields, inflation and rate hike expectation. It will be difficult to save in the short term where this market wants to head towards so we must take note of key levels on the charts to help us establish price action in the bond market. On the side, we have targets at, 126.53, 127.05 and 127.34 while on the downside we got that critical 2.15% on the yields which should bring the price to approx. 125.25.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.