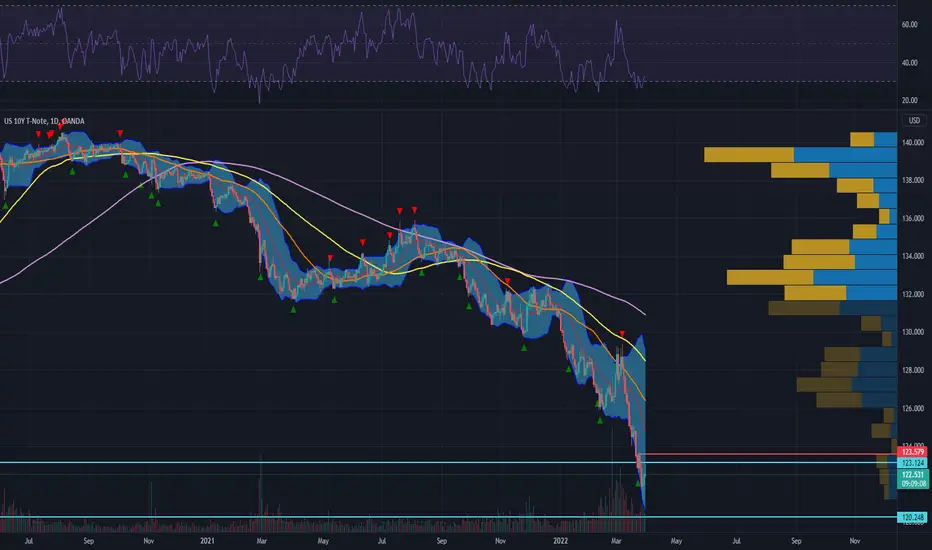

The 2-10 year spread inverted for the first time since 2019 and is suggesting a recession is imminent. The 10 year treasury note catch a bounce back to the 123.12 level in the overnight trading session and has since pulled back from resistance. With a slew of data being released this morning, its hard to pin point which direction the bond market wants to trade in, however, if we expand or timeframe further out we can see that the trend is clearly down. Watch out for event volatility that can drive prices back up to the 123.12 or 123.58 level. Both of which would be good levels to short at.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.