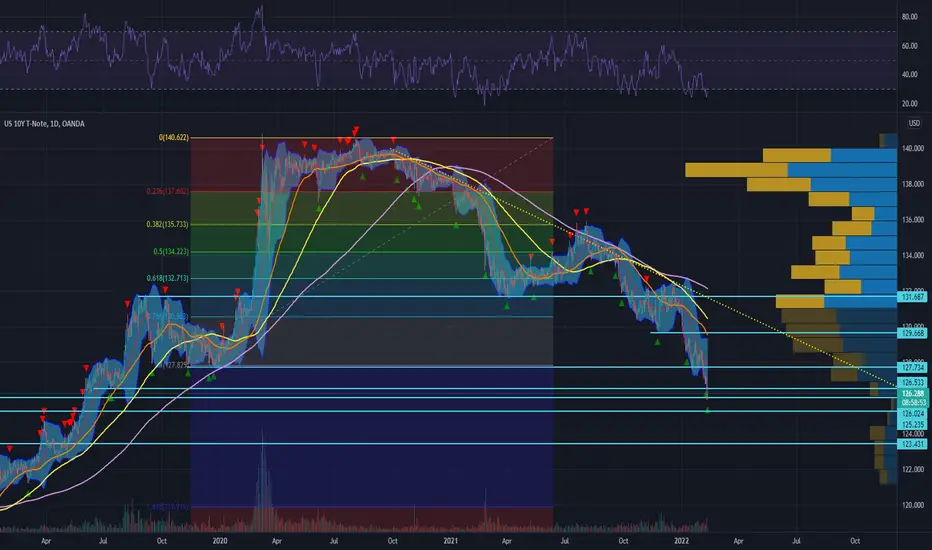

The 10 year notes have finally touch and traded over the 2% handle on the yields as inflation prints a 40 year high. With the strong momentum touching the 2% mark, and settling around there, we feel that how the bond market closes today will be a big sign of sentiment. With that being said, the march towards 2% has been a one way direction and we feel that it is due for a slight pull back. Watch out for 126.55 and the 127 POC zone as targets to the upside. While the market is on a strong downtrend, it would be wise to accumulate short positions on any rallies and so if the market does catch a bid, those resistance levels would serve as better short entry prices rather than going long into them. If we are wrong and the market continues to march lower, watch out for 125.90 and 125.30 to the downside.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.