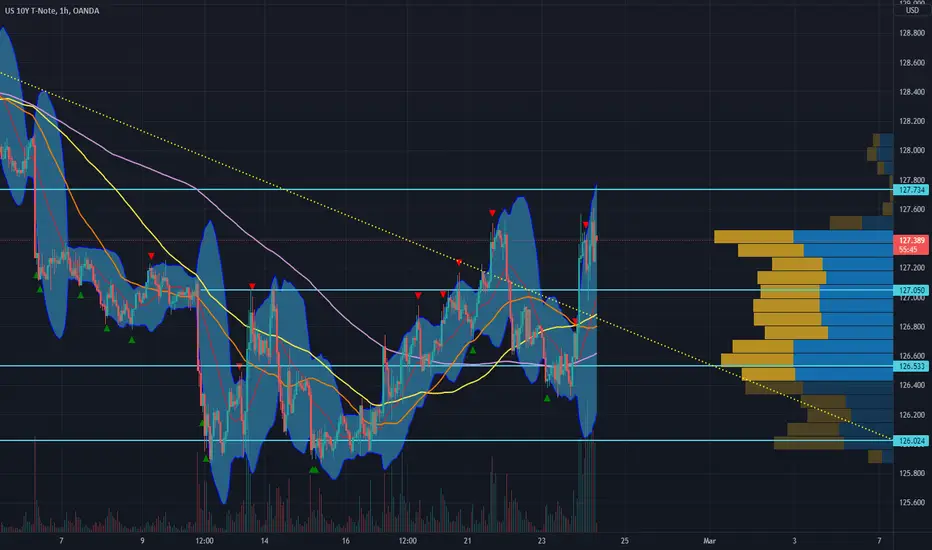

Bond market is acting as a safe haven asset and seeing an influx of money bidding it up on war risk. However, as any bond trader would be able to point out, the rally in the 10 year treasury isnt moving up as much. Almost suspiciously, the magnitude in bonds has been quite subdued for an event this big to take place. With that being said, buying bonds during times of crisis would be the trade to go with. Therefore we are looking for more upside levels for the bond market at 127.75, or even 131.68 if things really get out of hand. It is still to early to predict how much more we could go on these war trades.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.