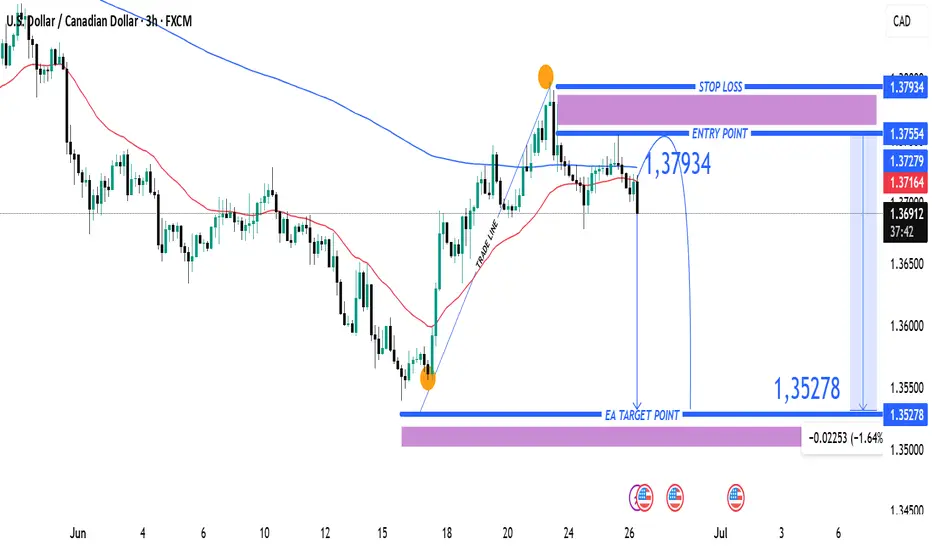

USDCAD Bearish Reversal Trade Setup – 3H Chart Analysis (June 26

Entry Zone: 1.37279 – 1.37554

🔹 Stop Loss: 1.37934

🔹 Target: 1.35278

🔹 Risk-to-Reward (RR): ~1:2.5

🧠 Technical Breakdown

Trend Overview:

Overall trend shows a downtrend from earlier June, followed by a corrective bullish move.

Price failed to sustain above the 200 EMA (blue line), indicating continued bearish pressure.

Trade Line Break:

A steep bullish trendline was broken, signaling a potential trend reversal or deeper pullback.

Bearish Rejection Zone:

The purple zone (1.37279 – 1.37554) acted as resistance.

Price formed a lower high and rejected this zone, confirming selling interest.

Entry Strategy:

Short entry is ideally within or just below the rejection zone.

Aggressive entry already in play at current market price (1.36909) after confirmation.

Target Zone:

Projected towards 1.35278, aligning with previous support and fib retracement zone.

Large purple support zone near the target suggests a potential reversal area.

⚠️ Risk Notes

Be cautious of USD volatility due to upcoming economic events (noted with icons on the chart).

Stop loss above previous swing high minimizes risk of fakeouts.

✅ Summary:

This is a bearish swing setup aiming for a significant drop toward 1.35278. The clean rejection from resistance and trendline break supports a high-probability short opportunity with favorable risk-reward.

🔹 Stop Loss: 1.37934

🔹 Target: 1.35278

🔹 Risk-to-Reward (RR): ~1:2.5

🧠 Technical Breakdown

Trend Overview:

Overall trend shows a downtrend from earlier June, followed by a corrective bullish move.

Price failed to sustain above the 200 EMA (blue line), indicating continued bearish pressure.

Trade Line Break:

A steep bullish trendline was broken, signaling a potential trend reversal or deeper pullback.

Bearish Rejection Zone:

The purple zone (1.37279 – 1.37554) acted as resistance.

Price formed a lower high and rejected this zone, confirming selling interest.

Entry Strategy:

Short entry is ideally within or just below the rejection zone.

Aggressive entry already in play at current market price (1.36909) after confirmation.

Target Zone:

Projected towards 1.35278, aligning with previous support and fib retracement zone.

Large purple support zone near the target suggests a potential reversal area.

⚠️ Risk Notes

Be cautious of USD volatility due to upcoming economic events (noted with icons on the chart).

Stop loss above previous swing high minimizes risk of fakeouts.

✅ Summary:

This is a bearish swing setup aiming for a significant drop toward 1.35278. The clean rejection from resistance and trendline break supports a high-probability short opportunity with favorable risk-reward.

Join my telegram (COPY_TRADE)

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join my telegram (COPY_TRADE)

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

t.me/TOP1INVEESTADMEN

Join my refrel broker link

one.exnesstrack.org/a/l1t1rf3p6v

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.