📊 COT Overview – CAD & USD Futures

🇨🇦 Canadian Dollar (CAD)

Asset Managers: Still net short, but recovering fast → from -150K to nearly -50K.

Leveraged Money: Strong bullish reversal from -100K to -30K and climbing.

✅ Interpretation: Institutions are flipping bullish on CAD → Bearish pressure on USDCAD.

🇺🇸 US Dollar (USD)

Asset Managers: Cutting long exposure since March.

Leveraged Money: Losing conviction → neutral to slightly long.

⚠️ Interpretation: USD is structurally weakening → adding to the USDCAD bearish bias.

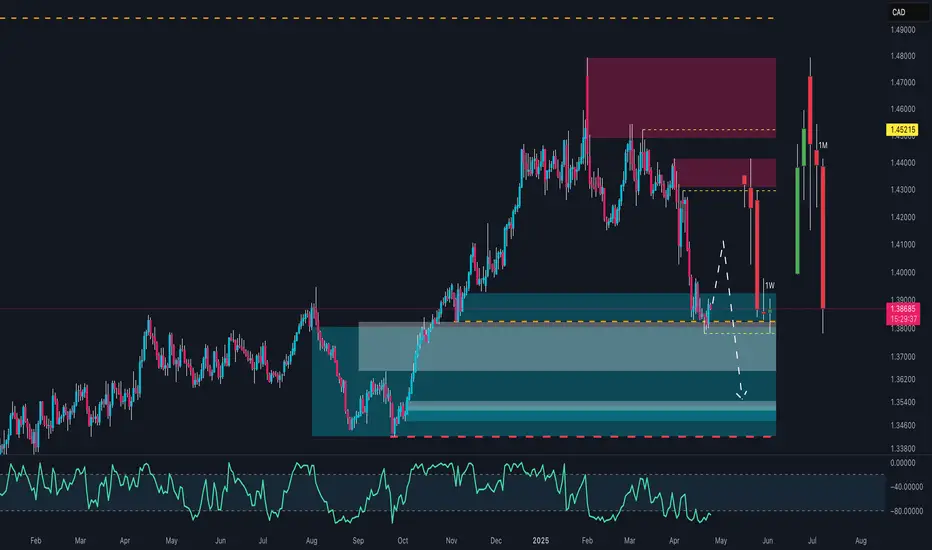

🧠 Technical Analysis

Price has returned to the key demand zone (1.3700–1.3850) for the third test.

Candles are compressing → signal of upcoming volatility.

RSI remains weak, no bullish divergence → no clear reversal yet.

📌 Key Levels:

Support: 1.3700 → A confirmed break opens space toward 1.3550–1.3480.

Resistance: 1.3950–1.4100

🎯 Trade Scenarios

🔻 Breakdown trade below 1.3700 → Target: 1.3480

🔁 Pullback short on rejection from 1.3950–1.4000 → SL above 1.4100

🔼 Long only with a bullish engulfing weekly close + RSI divergence

✅ Summary

COT Bias: Bearish USDCAD → CAD strengthening, USD weakening

Technical Structure: Support under pressure, breakout likely

Preferred Play: Short continuation on breakdown or pullback rejection

🇨🇦 Canadian Dollar (CAD)

Asset Managers: Still net short, but recovering fast → from -150K to nearly -50K.

Leveraged Money: Strong bullish reversal from -100K to -30K and climbing.

✅ Interpretation: Institutions are flipping bullish on CAD → Bearish pressure on USDCAD.

🇺🇸 US Dollar (USD)

Asset Managers: Cutting long exposure since March.

Leveraged Money: Losing conviction → neutral to slightly long.

⚠️ Interpretation: USD is structurally weakening → adding to the USDCAD bearish bias.

🧠 Technical Analysis

Price has returned to the key demand zone (1.3700–1.3850) for the third test.

Candles are compressing → signal of upcoming volatility.

RSI remains weak, no bullish divergence → no clear reversal yet.

📌 Key Levels:

Support: 1.3700 → A confirmed break opens space toward 1.3550–1.3480.

Resistance: 1.3950–1.4100

🎯 Trade Scenarios

🔻 Breakdown trade below 1.3700 → Target: 1.3480

🔁 Pullback short on rejection from 1.3950–1.4000 → SL above 1.4100

🔼 Long only with a bullish engulfing weekly close + RSI divergence

✅ Summary

COT Bias: Bearish USDCAD → CAD strengthening, USD weakening

Technical Structure: Support under pressure, breakout likely

Preferred Play: Short continuation on breakdown or pullback rejection

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.