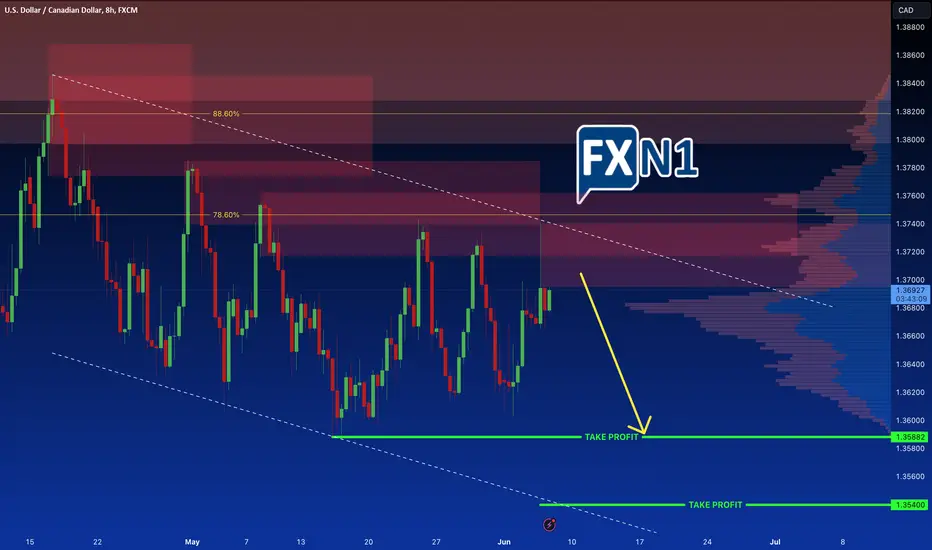

Since April 17, the USD/CAD pair has been trading within a range, characterized by a pattern of lower highs and lows. Recently, the price bounced from the resistance of the previous high. After the release of the US ISM Services PMI yesterday, the price initially pushed down before stabilizing. Today, the pair is attempting to push higher, but we anticipate a potential new bearish impulse, especially if the upcoming US Unemployment Claims data comes out negative.

Key Economic Data and Market Reactions

US Economic Data:

ISM Services PMI: The ISM Services PMI unexpectedly rose to a nine-month high in June, initially driving the USD higher.

Unemployment Claims: Today's focus will be on the US Unemployment Claims. A negative report could weigh on the USD, reinforcing our bearish outlook for the USD/CAD pair.

Canadian Economic Data:

Bank of Canada (BoC) Rate Cut: The BoC recently delivered a widely expected quarter-point rate cut. This move was already priced in by the market, but it has set the stage for upcoming economic data to take center stage.

Canadian Labor Figures: Traders are also eyeing Friday's Canadian labor figures, though the release of the US Nonfarm Payrolls (NFP) report on the same day is likely to overshadow Canadian employment data.

Technical Analysis

From a technical standpoint, the USD/CAD pair remains within a range, with the price action exhibiting lower highs and lows. Currently, the price is testing resistance levels formed by previous highs. Despite today's attempt to move higher, the overall technical setup suggests a bearish bias, particularly if key data releases support this outlook.

The price has bounced off resistance from previous highs, indicating a struggle to break higher.

The lower highs and lows pattern indicates a bearish trend within the range.

Potential Bearish Impulse: Given the negative sentiment expected from the upcoming US Unemployment Claims data, a bearish impulse is likely.

Given the current technical setup and the fundamental backdrop, our strategy involves looking for a bearish setup. The combination of resistance testing, bearish price patterns, and potential negative economic data from the US supports this approach.

Key Economic Data and Market Reactions

US Economic Data:

ISM Services PMI: The ISM Services PMI unexpectedly rose to a nine-month high in June, initially driving the USD higher.

Unemployment Claims: Today's focus will be on the US Unemployment Claims. A negative report could weigh on the USD, reinforcing our bearish outlook for the USD/CAD pair.

Canadian Economic Data:

Bank of Canada (BoC) Rate Cut: The BoC recently delivered a widely expected quarter-point rate cut. This move was already priced in by the market, but it has set the stage for upcoming economic data to take center stage.

Canadian Labor Figures: Traders are also eyeing Friday's Canadian labor figures, though the release of the US Nonfarm Payrolls (NFP) report on the same day is likely to overshadow Canadian employment data.

Technical Analysis

From a technical standpoint, the USD/CAD pair remains within a range, with the price action exhibiting lower highs and lows. Currently, the price is testing resistance levels formed by previous highs. Despite today's attempt to move higher, the overall technical setup suggests a bearish bias, particularly if key data releases support this outlook.

The price has bounced off resistance from previous highs, indicating a struggle to break higher.

The lower highs and lows pattern indicates a bearish trend within the range.

Potential Bearish Impulse: Given the negative sentiment expected from the upcoming US Unemployment Claims data, a bearish impulse is likely.

Given the current technical setup and the fundamental backdrop, our strategy involves looking for a bearish setup. The combination of resistance testing, bearish price patterns, and potential negative economic data from the US supports this approach.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅ TELEGRAM CHANNEL: t.me/+VECQWxY0YXKRXLod

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

🔥 USA ZERO SPREAD BROKER: forexn1.com/usa/

🔥 UP to 4000$ BONUS: forexn1.com/broker/

🟪 Instagram: instagram.com/forexn1_com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.