As mentioned earlier, let's dive into the latest developments regarding USDCAD's market dynamics. Get ready for insightful updates and potential trading opportunities. 🚀📈

📉 Downward Trend Forecast:

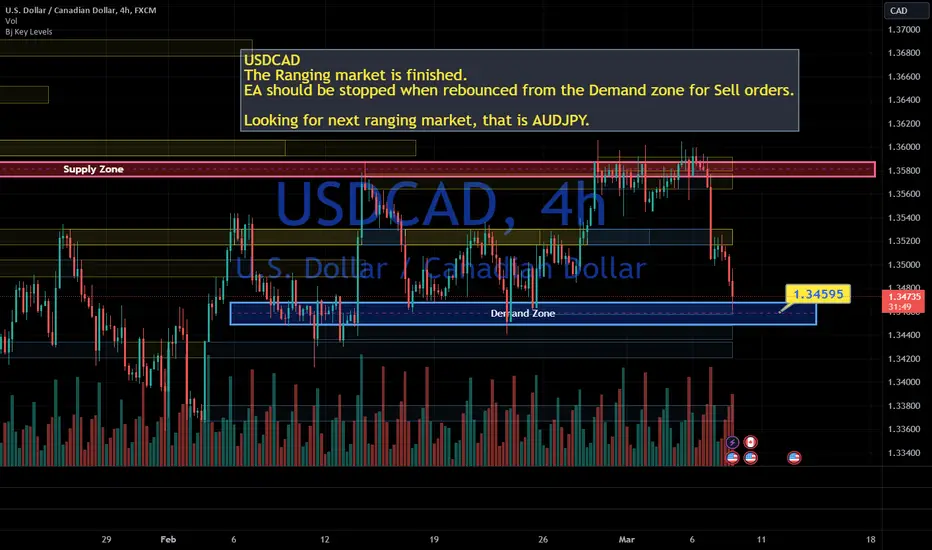

Our analysis suggests that USDCAD is poised to transition into a downtrend. Why? Because we anticipate further downward movement in the DXY (Dollar Index), which could influence the direction of USDCAD. Stay tuned for potential bearish opportunities! 👇📉💰

⚠️ Managing Sell Orders:

If you have active Sell orders through your EA, it's advisable to consider adjusting your strategy. Specifically, you may want to halt new sell orders when USDCAD experiences a rebound from the demand zone (1.3456), as illustrated. This adjustment can help you navigate the evolving market conditions effectively. ⚙️📉💡

🔄 Next Up: AUDJPY Ranging Market:

Looking ahead to next week, we shift our focus to a new ranging market opportunity—AUDJPY. Stay tuned for our next post, where we'll provide valuable insights and analysis on this currency pair. Get ready for another exciting trading prospect! 📆🔍🌍

Embrace the updates, adapt your strategies accordingly, and seize the potential within USDCAD's ranging market. Don't forget to join us for the upcoming post on AUDJPY, where we'll uncover more trading possibilities. Let's make the most of these opportunities and aim for profitable trades! 💪💼💹

#USDCAD #RangingMarketUpdate #DownwardTrendForecast #AUDJPYNextWeek #TradingOpportunities 📈🔍💱

📉 Downward Trend Forecast:

Our analysis suggests that USDCAD is poised to transition into a downtrend. Why? Because we anticipate further downward movement in the DXY (Dollar Index), which could influence the direction of USDCAD. Stay tuned for potential bearish opportunities! 👇📉💰

⚠️ Managing Sell Orders:

If you have active Sell orders through your EA, it's advisable to consider adjusting your strategy. Specifically, you may want to halt new sell orders when USDCAD experiences a rebound from the demand zone (1.3456), as illustrated. This adjustment can help you navigate the evolving market conditions effectively. ⚙️📉💡

🔄 Next Up: AUDJPY Ranging Market:

Looking ahead to next week, we shift our focus to a new ranging market opportunity—AUDJPY. Stay tuned for our next post, where we'll provide valuable insights and analysis on this currency pair. Get ready for another exciting trading prospect! 📆🔍🌍

Embrace the updates, adapt your strategies accordingly, and seize the potential within USDCAD's ranging market. Don't forget to join us for the upcoming post on AUDJPY, where we'll uncover more trading possibilities. Let's make the most of these opportunities and aim for profitable trades! 💪💼💹

#USDCAD #RangingMarketUpdate #DownwardTrendForecast #AUDJPYNextWeek #TradingOpportunities 📈🔍💱

🔥my free signals and AI trading indicators channel telegram

t.me/strengthboosters

~1 Forex setup per day. With ICT setup for intraday trading —— Accuracy +80%

-Booster highlight:

US stocks and Crypto watch list update each weekend.

t.me/strengthboosters

~1 Forex setup per day. With ICT setup for intraday trading —— Accuracy +80%

-Booster highlight:

US stocks and Crypto watch list update each weekend.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🔥my free signals and AI trading indicators channel telegram

t.me/strengthboosters

~1 Forex setup per day. With ICT setup for intraday trading —— Accuracy +80%

-Booster highlight:

US stocks and Crypto watch list update each weekend.

t.me/strengthboosters

~1 Forex setup per day. With ICT setup for intraday trading —— Accuracy +80%

-Booster highlight:

US stocks and Crypto watch list update each weekend.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.