In the market, some zones act like magnets, pulling the price back to them. After a powerful move down, USDCHF has left behind a critical manipulation zone—a place where large capital needs to return to close their books before the real trend continues. This analysis is about waiting patiently at that exact spot.

The USDCHF pair continues to be in a global downtrend. After another powerful impulse down on the higher timeframe, the instrument corrected to the 78.6% Fibonacci level of the daily structure. This level, in conjunction with a daily order block, acted as strong resistance and pushed the price down, breaking the 4H corrective structure (BOS).

The interaction with the 78.6% level was accompanied by a manipulation in the form of a new daily order block, with a 4H order block residing inside it. If large capital intends to continue the downtrend, they will first need to close the losing long positions used to conduct the Buy-to-Sell (BTS) manipulation. This makes it a strong Point of Interest (POI) and a magnet for the price.

An additional argument for a short setup forming in this POI is that an untouched daily FVG remains slightly below. The mitigation of this FVG will be the minimum target if a setup is confirmed according to one of the two scenarios, provided the price reaches the POI before this rebalancing occurs.

Two Potential Short Scenarios

► Invalidation: A break of this level with the price finding acceptance above it would invalidate the short idea from this POI. In that case, the correction on the higher timeframe would continue higher, aiming to capture additional liquidity, at least from the June 19th high, which is also the daily structure's break level.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

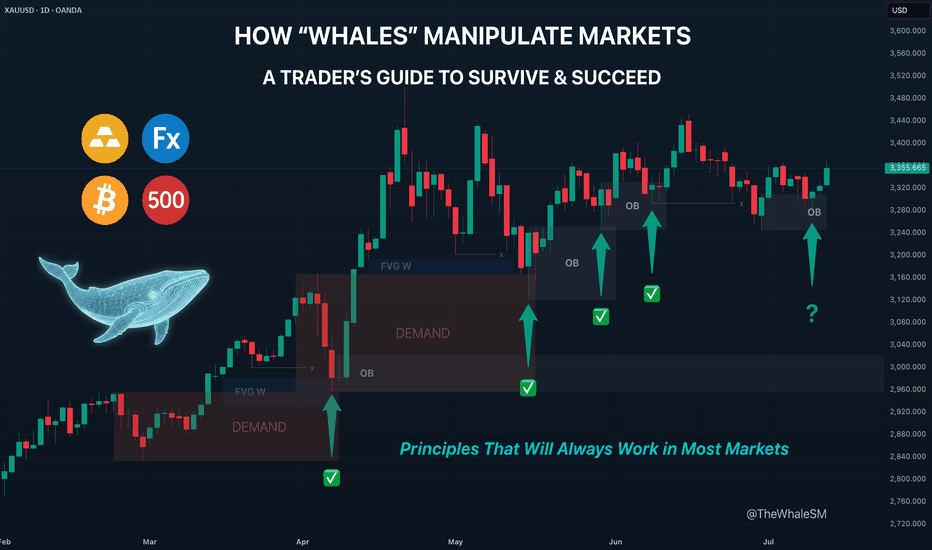

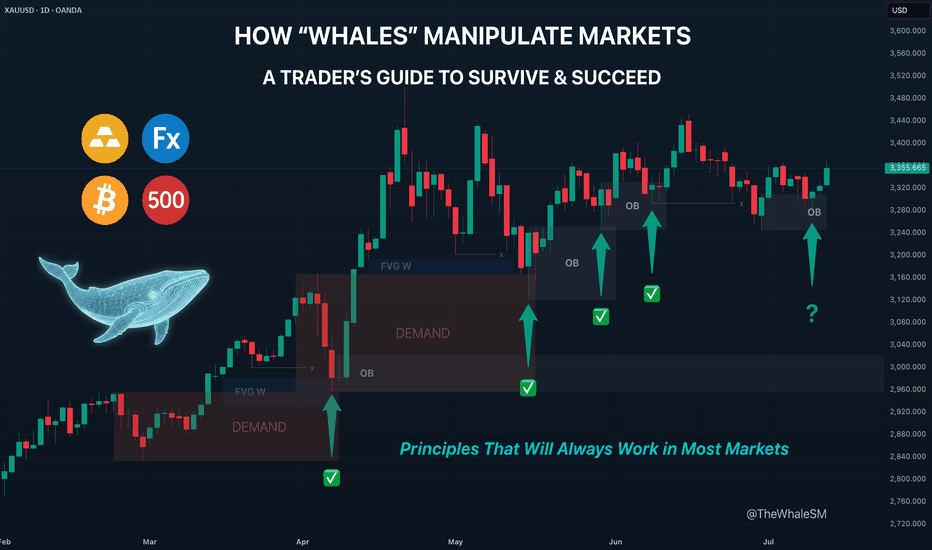

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this insightful trading community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always apply a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView to get real-time updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The USDCHF pair continues to be in a global downtrend. After another powerful impulse down on the higher timeframe, the instrument corrected to the 78.6% Fibonacci level of the daily structure. This level, in conjunction with a daily order block, acted as strong resistance and pushed the price down, breaking the 4H corrective structure (BOS).

The interaction with the 78.6% level was accompanied by a manipulation in the form of a new daily order block, with a 4H order block residing inside it. If large capital intends to continue the downtrend, they will first need to close the losing long positions used to conduct the Buy-to-Sell (BTS) manipulation. This makes it a strong Point of Interest (POI) and a magnet for the price.

An additional argument for a short setup forming in this POI is that an untouched daily FVG remains slightly below. The mitigation of this FVG will be the minimum target if a setup is confirmed according to one of the two scenarios, provided the price reaches the POI before this rebalancing occurs.

Two Potential Short Scenarios

- SCENARIO 1: Entry from the 61.8% Local Fib

This scenario involves the mitigation of the lower boundary of the daily order block in conjunction with reaching the 61.8% level of the local correction, and a reversal reaction from this confluence. - SCENARIO 2: Entry from the 78.6% Local Fib

If the 61.8% local level is broken, the second scenario comes into play, with the mitigation of the 4H order block in conjunction with the 78.6% level of the local correction, and a reversal reaction from there.

► Invalidation: A break of this level with the price finding acceptance above it would invalidate the short idea from this POI. In that case, the correction on the higher timeframe would continue higher, aiming to capture additional liquidity, at least from the June 19th high, which is also the daily structure's break level.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this insightful trading community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setups that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setups are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always apply a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView to get real-time updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Note

UPDATE: USDCHFThe pair has begun to play out according to the first short scenario. The daily order block and the 61.8% Fibonacci retracement level were mitigated, and an entry point was available after the price found acceptance below it.

Upon mitigating the daily order block, a new 4H order block was formed, from which the price received a further reaction today, confirming the start of the bearish order flow and the intention to continue the downward move. Therefore, the stop-loss has been moved to break-even.

The minimum target remains the initial one: reaching the upper boundary of the daily FVG, which will coincide with a liquidity sweep of the August 4th low. The possibility of a continued move down after that will depend on the Dollar Index (DXY), which has a strong correlation with the USDCHF pair. DXY is approaching a support area in the form of a daily order block in conjunction with the 78.6% daily Fib level. In the case of a reversal reaction from there, the index could pull USDCHF up with it after the FVG rebalancing, continuing its corrective upward move.

Therefore, one can either place a take-profit at the upper boundary of the FVG or watch the DXY's reaction upon reaching its specified POI and close the trade manually if a reversal is confirmed. If DXY finds no support and the August 4th low on USDCHF is decisively broken instead of just swept, then the global downtrend will continue.

Note

UPDATE: USDCHFThe price has paused its bearish move and is stuck in a local consolidation. I believe this is because large capital needed additional liquidity to continue the move. Just before today's US unemployment claims news, the price shot up sharply and swept local internal liquidity.

My more probable scenario now is a continuation of the downtrend during the Asian session and on Friday during the London and NY sessions. However, we don't know if "smart money" has gathered enough liquidity for this or if they have fully met their goals of closing the losing positions used for the manipulation at the daily order block above.

I am not yet ruling out the possibility that the price could still move up to the remaining 4H order block within the daily one and the 78.6% local Fibonacci retracement level. If that happens, a short from Scenario 2 would still be possible if the original conditions are met. So, if the price continues its local correction up towards the 78.6% level, the trade from Scenario 1 will be automatically closed at break-even, and I will then look for a potential entry based on the second short scenario.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.