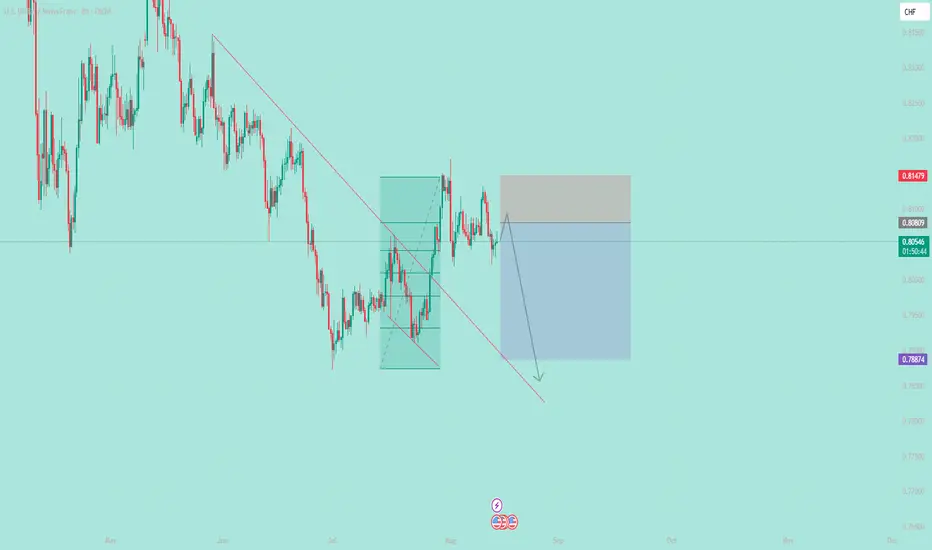

Bearish Market Structure

After the recent spike above 0.8100, the price showed clear selling pressure, rejecting the key resistance area coinciding with the 200 EMA on the 8-hour chart. This area acted as a technical barrier, generating a new lower high.

Hello, I'm Andrea Russo, an independent Forex trader and prop trader with $200,000 in capital under management. Thank you in advance for your time.

Liquidity Sweep Already Occurred

The bullish move has already collected stops above the previous high. With liquidity removed, the downside potential increases, as institutional traders have fewer obstacles to push towards lower support.

Retail Sentiment Opposing

The latest data indicates that over 80% of retail traders are long USD/CHF. From a contrarian perspective, this condition favors bearish scenarios.

Technical Target and Demand Zones

The TP at 0.7890 is located near a significant demand area, visible on higher timeframes. It is the most likely level where the price could find support and begin a new rebound.

Risk Well Managed

The SL at 0.8148 is positioned above key resistance and any remaining stop-hunting levels, reducing the likelihood of intraday spikes.

The setup offers an attractive risk/reward ratio and directionality consistent with institutional positioning. A break below 0.8050 could accelerate the decline towards the final target of 0.7890.

If you're looking for:

✅ Precise TAKE PROFIT

✅ Precise STOP LOSS

✅ Real-time Trade Updates

🚀 Telegram Channel: t.me/swipeuptrading

👉 MY WEBSITE: andrearussoforextrader.com

Start investing like the banks — for free.

✅ Precise TAKE PROFIT

✅ Precise STOP LOSS

✅ Real-time Trade Updates

🚀 Telegram Channel: t.me/swipeuptrading

👉 MY WEBSITE: andrearussoforextrader.com

Start investing like the banks — for free.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

If you're looking for:

✅ Precise TAKE PROFIT

✅ Precise STOP LOSS

✅ Real-time Trade Updates

🚀 Telegram Channel: t.me/swipeuptrading

👉 MY WEBSITE: andrearussoforextrader.com

Start investing like the banks — for free.

✅ Precise TAKE PROFIT

✅ Precise STOP LOSS

✅ Real-time Trade Updates

🚀 Telegram Channel: t.me/swipeuptrading

👉 MY WEBSITE: andrearussoforextrader.com

Start investing like the banks — for free.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.