On chart.

Note

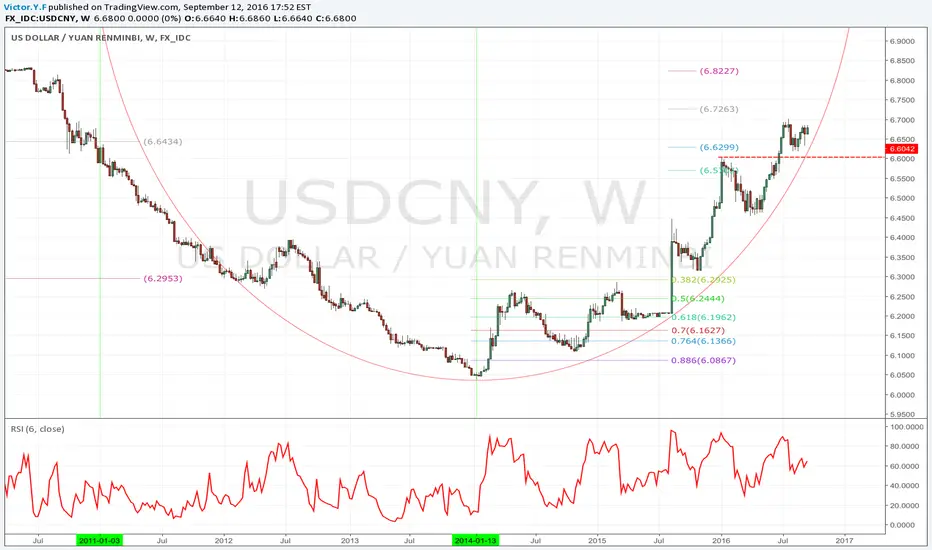

If no FRB rates hike in Sept. us dollar will fall. This one could be pegged or test 6.60 for another launching window 10th. Oct. We still have 4-5 weeks to reach the orbit. Be patient.Note

Weighted renminbi is breaking out lower because of stronger weighted JPY, believe it or not, in fact BOJ today has a rates hike. We'll have this launching window from 30th. Sep. to 10th. OCT. When it breaks capital squeezing happens. Global indexes, oil will tumble and gold will rise shortly then a fall. Capital flows into JPY(which is happening) and Euro then flows back to us dollar. We'll have next rates hike March next year. This orbit will be stabled there. After USDCNY is pegged then FRB will move.Note

I'm watching JPYCNY as leading signal. Launching window 0310- 0710. 0710 is more likely a weekend striking and next weekend 3009 is possible too but less likely.Note

If Trump is set renminbi will never get another chance for devalution because he's talking about the devaluation took jobs away from USA. I think that it's very likely in Oct. renminbi strike again for weighted JPY achieving it's purchase power at 8.4 (7.5 now and Anbei talked about "last step" today) as the inflation target above 2%. The political influences are very clear because of Yellen is a political person. So after the strike We can reach the inflation target by devaluations of JPY and USdollar in Oct. 2018.For those people don't believe renminbi. There're 1.3 billion populations in China and renminbi is consuming products all of the world includes USA and EU and Japan. It's devaluated 10% and will do another 10% for reach its target USDCNY 7.0 (7.2 high) soon...

Note

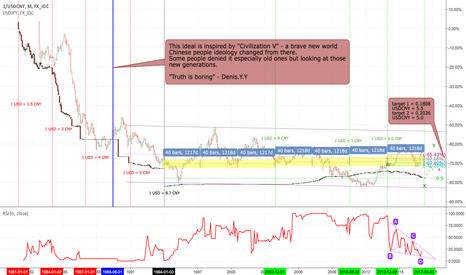

We're in the window. Click MAX then a huge head will be there.tradingeconomics.com/china/foreign-exchange-reserves

If this window is missed then a huge pull back, harmonic patterns were being built. It means something of fundamental changes, like BOJ intervention.

Note

We're at 6.7263 equal leg, taking profits zone. Be careful now if we couldn't pass this zone quickly. Sentiments of speculations are slowly turning into against the trend. Harmonic patterns are playing.Note

We're on the orbit.Note

The second major class engine is working. We should reach 6.90 at the end of Oct.Note

The most interesting thing is why the metal isn't rising yet. Last year when the devaluation began we had 2 months metal bull running. Followed with the weakness of purchase power we had 2 months bear running and FRB rates hike for pushing inflation up for 5 months. We could have stagflation now like Greenspan warned us. I'd like to see Trump wins. It will stop the madness.Note

We're at some profits taking now. Ten years renminbi bunds future market is crashing down for 3 days with huge volumes. I think the interest rates are rising from interbank market in China and the money is tightening. A shares should be down because of the tightening.Note

Look 2008- 2010 we have 6.8 platform for 2 years. And now we have confirmed that Renminbi is tightening and huge selling from 10 years renminbi funds future market. We have seen some rates hike from real-estate credits market for suppressing the house price.Note

We could have pegged USDCNY at 6.8 platform for 2 years from 2017-2019 like 2008-2010. When USDCNY is stabled then the EURUSD will catch up weighted JPY.Note

The most interesting thing is when USDCNY is pegged and Dollar is dropping the Renminbi is still falling because of the pegged price. So the inflation rates will be much more higher in China than it in USA. Like old days it's average higher 4% than USA.Note

This is a special reading for Chinese.ftchinese.com/story/001069948

Note

Obviously weighted JPY is stepping in intervention during US election week for saving SPX500 ass but it's temporary. We're watching CFETS very very carefully these days. There're 3 renminbi indexes, CFETS BITS and SDR weighted Renminbi indexes. we now have CFETS broke down to new low already and we're expecting BITS and SDR will follow. That means USDCNY should keep launching. From one our Japanese analyst it should reach 7.0 (7.20 top) soon. From my longer term view the target is at 8.0. We had weighted JPY 5.8 when USDCNY was at 6.0. The weighted JPY top is at 7.8 after Brexit that means weighted JPY is leading USDCNY should reach 8.0 in the future. And now small BOJ movings are allowed.Note

A hint for Chinese people, use your purchase power at 1111 as soon as possible. This is launching for target 7.0- 7.2. The inflation rates will be very high and so high that we could get rates hike from renminbi next year. Don't buy A share it's very dangerous market.Note

Again as predicted, we are on orbit. Hope you guys used purchase power 1111. We will see CFETS dropping quickly. A shares should be down 1000 points from here Shanghai composite index 23**.Note

CFETS is stable temporarily. We shall have the peg next year spring after Trump negotiates a trade deal with China for the reasonable USDCNY rate where is about 7.0- 7.2 considering JPY is weakening at target 7.0- 7.2 level. We don't think FRB will rise rates in Dec. before Trump is set. March 2017 is more likely or the season Spring.Note

Today we have confirmed that Renminbi will be tighten in 2017 and should rise rates in the next year. yahoo.com/news/china-set-slower-growth-tighter-policy-2017-government-101536655--business.html

I think this pair should be pegged at 7.0-7.2 next year. Trump will talk about the peg with China but it's already there. The platform is forming because Renminbi is expecting a hike. Not like USA, China has a huge reserves the hike could be huge too. If Renminbi and weighted JPY rise and EURO is ending QE. I don't think DXY will go too far now. Be careful, stocks will fall like last year and could be worse because the inflation rising.

Note

It's confirmed that Renminbi is strengthening. CFETS, SDR basket, BIS basket, are all rising.Note

PBOC rose MLF (mid-term lending facility 3 months) by 0.1%, it's the first time in 6 years cycle. Hope you guys are at right side of the Renminbi's market. It's just beginning. Rates hike is like some kind of human sexual behavior when it begins it's hard to stop till the orgasm. Central banks tend to add the interests into the inflation data for balancing the purchase power by Fisher's equation. It'll bring more inflation expectation and the self fulfill machine is on working.

Note

Renminbi's hiking is always huge, for example in 2007 -2008 cycle, the interests rates was raised every 1- 2 month by 0.3% for lasting 9 months. It's not like us dollar's weak hike and the real inflation is incoming soon.Note

The first round inflations are very high with Renminbi's hike, about 8%- 10%. You should be ready for the huge rising price in China with interests going higher. USDCNY target 6.4, 5.5, 5.0 long term yearly.Note

PBOC rose SLF (short-term lending facility 1D,7D,1M) by 0.1%, ( 1D by 0.35%) the Renminbi 10Y bonds market is falling and the interests going higher, a tightening among those big banks. It's very soon that the long term interests shall rise and we should have a rising channel in Spring 2017. It's a good sign of the A shares and the global inflations.Note

China CPI ( inflation rates) rose form 2.1% to 2.5% that it's the highest price in 3 years and it's as the same level as Dec. 2013 where the Renminbi's beginning of devaluation date (check the chart green vertical line). We can see now the USDCNY is at 6.9 and in 2013 it was 6.0 so the purchase power is weak and the interests is too low for comparing with DXY. Also check the 3 indexes of Renminbi the 2nd. wave is completed from monthly time frame, we're going to hike, guys......There's an important bank meeting is holding now in China which has been scheduled in every 5 years from 1997. We're waiting for the results. I predict that Mr. Zhou will be replaced and following with the hike window in 13th. March. 2017.

An very healthy cycle is coming.

Note

tradingeconomics.com/china/producer-pricesHere's some opportunities, PPI is leading the CPI, the PPI now is as high as the year of 2011 if you guys can see it. That means the factory costs will be distributed into consumers prices for pushing the CPI higher to force an inevitable hiking.

I suggest buying A shares from some inflation sensitive sectors. The durable consumers sector and the consumer staples sector like electric applications and auto mobiles. Also the basic raw material sectors could be forming a profits taken area for the pullback in several months.

The hike is good for the rich people but not those unfortunates. If you don't invest something then your purchase power will be still weakening from inflation going higher as the same the devaluation of the currency. The good investment is the key to your financial success but not bank saving or begging form rich people for free, right?

Note

To be clear, I don't underestimate poor people and I don't know how much you can invest into A shares and every one can buy it in China. No matter poor or rich. It's so much cheaper than US indexes now and some of those sectors are really too cheap... it's undervalued... like Renminbi.Note

I posted some opportunities 8 days ago. Now the sector auto mobiles of A shares is in a major wave especially in the Shenzhen index. I hope you guys colud have taken them and should be in big profits now.Note

And the iPad input programme is suck......Note

We're having some back fire from Renminbi devaluation, be careful guys, the Yuan currency could have an hike in March 2017. (the 13th March is a time window or before the 23rd. March if not, we look forward to it in June) After the PBOC raises the interests of Renminbi at first time from 7th. July 2011, all of the global markets will be dropping for about 11 weeks in 3 months and the second hike will be following. I suggest holding cash and taking all your profits now from assets before the hike. We can buy them back after the purchase power recovering. Then you could buy all kind of assets but artificial one because the real inflations comes and the later one is failed. The oil and the food correlated with the artificial inflations, BTW.

Note

The weekly time window starts from 13th. March is very sensitive for the global market as I predicted it 2 months ago. After I checked the central banks calendar today I realized it's a storm week where full of the interests rates decisions. I'd like to wait for them.Note

A warning !!! Renminbi is gonna collapse in March!!! We now know in the meeting PBOC is showing the stupid again and again by refusing to hike. CFETS, SDR basket, BIS basket, are all near the edge of Abyss!!! Be careful! Sell all of your A shares !!!Note

Expecting President Trump's team will teach PBOC a hard lesson in Washington. Who's your friend and who's not? PBOC has been played for a while. They will get it soon. The funny thing is nowadays in many fields people couldn't realize who's their friend too. April fool...Note

Source: White House Website whitehouse.gov/the-press-office/2017/04/07/statement-press-secretary-united-states-china-visit

whitehouse.gov/the-press-office/2017/04/07/briefing-secretary-tillerson-secretary-mnuchin-and-secretary-ross

"SECRETARY ROSS: And the most interesting thing to me was they expressed an interest in reducing their net trade balance because of the impact it’s having on money supply and inflation. That's the first time I’ve heard them say that in a bilateral context."

I want to make this simple and clear. USDCNY and USDCHN will be pegging at some where for several months and the Renminibi will be getting stronger. China foreign reserves shall flat and will decrease.

North Korea nuclear will be deleted with or without China's permission. Good for China's safety long run.

Note

Thank you BOE and U.K! For saving Renminbi! Thank you BOJ and Japan! For saving A shares!

Thank you FRB and President Trump and America people! For supporting always!

This publish ends here! 40 months cycle completed!

Note

Today we have news from Bloomberg says the PBOC is adding a parameter in Renminbi's middle rate which is called "counter-cycle parameter". After I check out this news and the equation of Renminbi, I want to make this simple for traders: 1, It's pegging for 1 more year as I predicted to make sure that the USA and China are sharing the same core inflation. If the PBOC called it "counter-cycle parameter", that means Renminbi and US dollar shall fall together ( From currency cycle perspective Renminbi should be rising with new cycle now).

2, From 2013- 2017 DXY rose 30% and USDCNY rose 15%, this told us that Renminbi rose 15% during 3 years period which is typical 40 months cycle of it. If we have the pegging for 1 more year and DXY drops 15% then we go back to 2013 Renminbi's purchase power where USDCNY was at 6.0.

3, Again I'm expecting the USA growth reaches 3-4% GDP target and 3-4% inflation target. The China will benefit from 15% devaluation of Renminbi too, for the inflation and markets both are rising, the economic statistics shall be surprising the traders. We're still watch for the A shares rising like always have different point of view with speculators, the investors' view.

4, The PBOC minister has an seriously father-son attitude problem from no communication and no explanation but only punishments, to markets and traders , to investors, to people. This has to be stopping ASAP, expecting a new minister has good communications and better people relations in several months.

Note

In a natural pyramid of a food chain the predator's healthy is the key signal of the healthy in the total environment. Now it looks like in China, the predator is dying in the market. Soon those lower level grass eater will die too. Let's see if the IMF's warning of an huge credit crisis will happen in China or not, by the PBOC's suicide money policy.

I urge the China top authorities replacing the PBOC's minster ASAP or an huge crisis could be on the edge.

Note

Today we have a news about Mr. Zhou will be replaced in this summer. After 15 years he's worked for the PBOC, he's too old to finish the best job. Frankly speaking, it's too long for such an important position without changing leader, if you guys think about Greenspan's leaving... The PBOC now really needs a new minister not only because Mr. Zhou did it wrong in 2015 but also a fresh blood is a better choice for an healthy cycle.

Note

Source: ( in Chinese) news.21so.com/2017/hongguan_0629/1431910.html

Please pay more attention to Mr. Jiang Chaoliang, he has a good relationship with the HSBC. Expecting he takes the place and the China shall build a supper administration central bank for good financial security like the BOE structure. A new Renminbi's cycle should have begun.

Note

Guys, expecting an first Renminbi's hike in the Aug. 2017, the only hike for this year.Note

Moving down to the 55 months SMA.Note

Source: it is your culture leading the way of your influence but not the money, right? China needs better wisdom desperately. It's called no "wenhua" in Chinese. cnbc.com/2017/08/10/chinas-economic-problems-are-exactly-why-its-global-influence-is-expanding.html

Note

The CFETS index (92.74 a second wave) , BIS basket (93.56 a second wave), SDR basket (93.54 harmonic double bottom) are all rising. This's a signal for all Chinese traders, please take your last chance, for investment consideration...

Note

This is a signal for Chinese traders. Be careful, the OCI currencies or saying crypto currencies have been announced as an illegal money laundry behavoir by the PBOC in China from administration tightenning measures. Because most of the BTCUSD is traded by Chinese OCI platform from Renminbi capital squeezing into US dollar. We suggest selling all of your fancy crypto currencies in case your money is trapped in a wasted technology which is only as a collection without any "value".Source: ( in Chinese)

sohu.com/a/169184063_260616

Note

We'll very quickly pull back to 6.80-6.81 ( 0.786 of the first impulse) for pushing China inflation then Chinese investors shold sell US dollar and buy Renminbi back before it's too late. An long term harmonic top shall be forming.Note

We're doing a pull back to 6.83 plat form soon, this may be pegging with US dollar for 20 months, with sharing a same inflation with USA.Note

A Renminbi's small rates cut on Nov. 2017 is predicted today, there might be a second cut on Dec. 2017, then a flat and a pegging with US dollar. Bullish signal for China stocks market in 20 months but chose your sectors wisely ( chuangye sector may be the best one). This's the newest prediction which will meet the 6.83 plat form and an USDCNY pegging for 20 months for sharing the same inflation with the USA (will be lower after 20 months pegging).

President Trump prefers regularity and force, this is what he wants and also fulfills the China new dictator's growing appetites... ugly than Trump.

Note

The pegging or the fallen, later one is worse. If China hikes the US hikes shall be paused soon, they let the risks open fire at will.Note

A new target around 5.3 has been predicted from long term perspective.Note

With the DXY stable USDCNY may rise back to 6.80 then 6.96 to form an harmonic pattern top in a complex wave. The 5.3 target is still our long term target.Note

This maybe higher to 6.83-6.9 to form an harmonic top and the 4th. wave complex.Note

We may have reached the important low point at 6.50 here.Note

Now we're going to 6.80-6.90. Funny thing is PBOC still doing it wrongly, culturally.Note

Source link: TV (This looks like a devaluation but not an hike) finance.qq.com/a/20180213/017152.htm

Note

Traders! RISK OFF mode! Please leave stock market or hedge your shares now!

Please look back 2015 crashing. DXY may go down to 86.50 then rises to receive capital squeezing!

1; VIX above 20 again.

2; EA crossed 1.5800 EU zone inflation may go to -2%.

3; Renminbi's devaluation like the Aug. 2015.

4; China incident on March.

Scalpers in forex market should hold short term. It's enough to avoid this kind of risk.

Note

Chinese Renminbi should hike in deposit interests and devaluation to the core inflation. We're waiting for Mr. Yi Gang for more clues.Note

Now the pegging, during a trade tariffs negotiation. ( 6.3-6.4)Note

The Renminbi’s rising may have been over now be careful here. After checked the CFETS BIS and SDR.Note

The Renminbi BIS and the SDR have repealed the US hike, the CFETS has some lagging, a rising of Chinese Yuan since 2017 May will be over soon. It will devaluate again but not for the US dollar ( believe it or not, they will sink together. )Note

Now it’s a good time window for Renminbi basic deposite hike in 2 months, July or August. The April action from PBOC has been proven a failure, they’re always wrong like predicted before. Those politicians don’t understand the forex market, they have no idea what and where is the market at all. (Too old to understand it) We should be prepared for the worst scenario in China, if the PBOC make a second mistake. No one will make the same mistake by twice, believe it or not, they can make it worse.

Note

moving nicely, should have more weaknessNote

Prediction now is supporting a raise in the Yuan's basic deposit interests ( 1.5% annually) in August to catch up with the fed's personal deposit rate ( 6.7% annually) : possibilities is more than 50 percent by now) See? China has lost already, inflation too high, Chinese people are poor by 5.2% now. USDCNY should go higher until FRB supply it.

Note

The RMB SDR is at new low 92.70 after last week close where has been lower than previous double bottom ( formed in 2017 May and August) where was at 93.54. The RMB BIS and CFETS index has not dropped into new lows yet but we will watch it closely in this monthly close.

Technically speaking in SDR measuring, RMB index should go lower after the new low has been created.

Note

Chinese Yuan SDR basket is showing a top near the neck line, the USDCNY pegging should work now. Like 2008 QE, the global core inflation will be synchronized. This's saying the major central banks are working together to push the core inflation in every country. The pegging should work until PBOC hikes due to the China stock market is too high. It's very low now, right?Note

For some reasons, looks like the PBOC is defending the 7.0 in USDCNY, so if the US dollar is still going up during the Brexit risk off, they may have to raise the Renminbi’s personal deposit interests to defense it.Note

We persist in this USDCNY 7.0 is an unbreakable. The forex market major US dollar pairs are pulled back to the same level like 2015 also China stock market is in a comfortable zone for release the risks. At this time PBOC will act to raise Renminbi’s personal deposit interests (in fact, it’s happened already, an hidden one)the hike in Chinese Renminbi should be announced soon. We’ve seen western market crash right? Capital is flowing into China here.Note

focus on the 6.20 take back, 10% precious.Note

The Renminbi's devaluation cycle is ending now, 6.20 should be taken back in the future. Please focus on the capital flowing back to EEM market from here, it will be squeezed many months later.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.