Hello everyone,

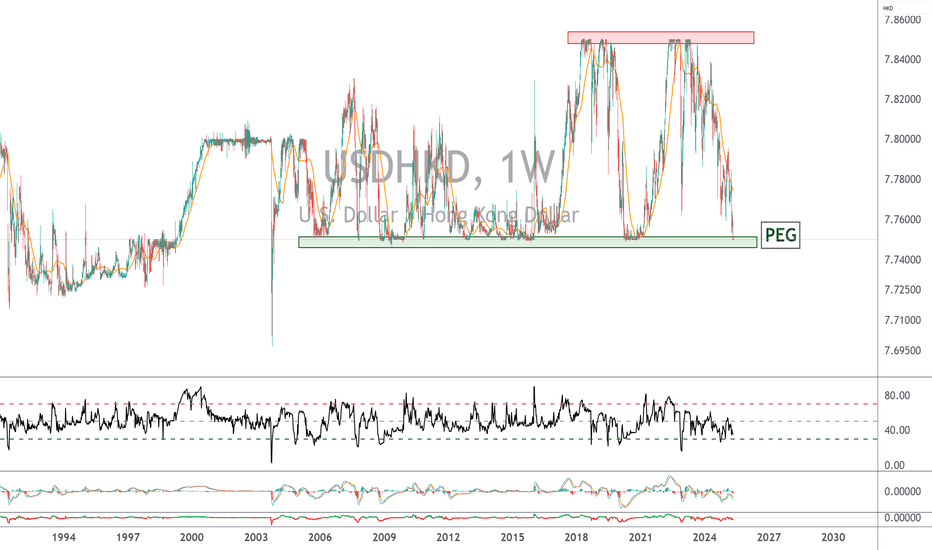

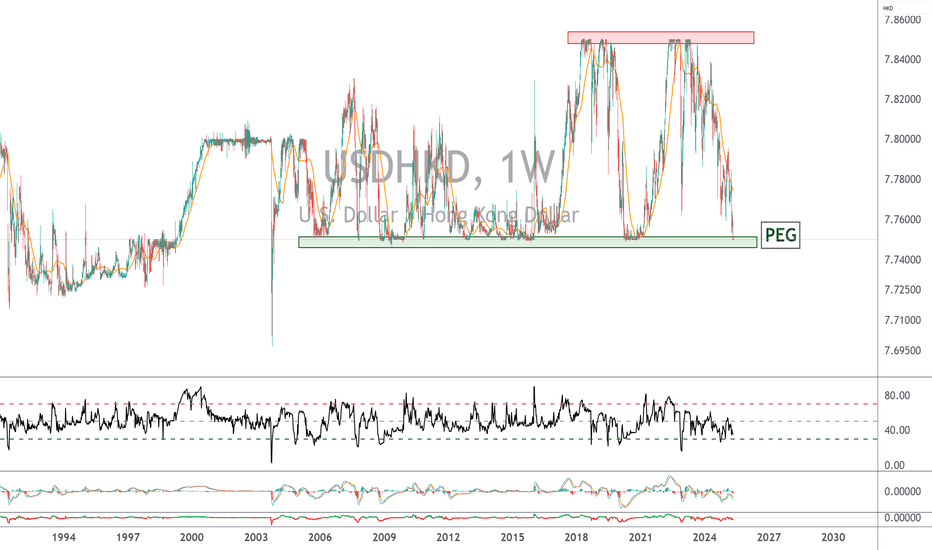

On May 6, we brought you a technical update on the USD/HKD rate (US dollar VS Hong Kong dollar), as the exchange rate was testing the PEG level of 7.75, defended by the Hong Kong monetary authorities. The PEG therefore provided solid support, and the exchange rate rebounded strongly. It is now under resistance. We'd like to take this opportunity to offer you an educational update on the notion of the PEG in Forex. The link to our May 6 article is just below.

What is a PEG and why use it?

A PEG, or fixed-rate exchange rate regime, consists of a central bank maintaining its currency at a stable value against a foreign currency, often the US dollar or the euro. This system aims to reduce exchange rate volatility, and is advantageous for a country's trade and investment. It promotes economic stability, particularly in countries that are heavily dependent on a stable currency. PEGs survive thanks to the considerable reserves mobilized by monetary authorities to support the target exchange rate. PEGs can thus create technical supports or resistances that can be worth exploiting, but caution is sometimes called for, as history has shown that some central banks can abruptly stop defending a PEG.

1) Interesting PEGs currently in force

Many countries, particularly in the Middle East, Africa and the Caribbean, maintain a fixed rate against the dollar:

Bahrain (BHD), Kuwait (KWD), Oman (OMR), Qatar (QAR), Saudi Arabia (SAR), United Arab Emirates (AED), Panama (PAB). The CFA franc (XOF/XAF), used in 14 African countries, is pegged to the euro at 655.957 CFA per euro.

Some PEGs use a currency board or fluctuation band, such as the Hong Kong dollar (HKD) via a band of 7.75-7.85 HKD per USD. This is the support we shared with you on May 6, and the price rebounded strongly.

The case of the Singapore dollar (the USD/SGD rate) illustrates yet another sophisticated form of intermediate exchange rate regime. Unlike a fixed-rate policy or a free float, the Monetary Authority of Singapore (MAS) steers the value of the SGD through a regime based on a basket of weighted commercial currencies, the exact composition of which remains confidential. This system is based on an unannounced fluctuation band around a central rate, also unpublished.

2) Historical and discontinued PEGs (the landmark episode of the 1.20 PEG on the EUR/CHF rate)

The 1.20 PEG between the euro (EUR) and the Swiss franc (CHF) is one of the most significant episodes in the recent history of European exchange rate policies. Here is a detailed summary of this PEG and its spectacular abandonment in January 2015.

In September 2011, the Swiss National Bank (SNB) set a floor of CHF 1.20 to EUR 1, i.e. a unilateral PEG (not a classic fixed rate, but a floor rate). On January 15, 2015, the SNB abandoned the PEG without notice, citing the growing divergence between the monetary policies of the ECB (falling rates) and the United States. The immediate result: a historic crash on the Forex market.

The EUR/CHF rate dropped instantly from 1.20 to around 0.85-0.90, before stabilizing at around 1.00. The Swiss franc appreciates by almost 30% in a matter of minutes, causing forex intermediaries to go bankrupt, Swiss exporting companies to suffer huge losses and, above all, retail investors who had staked a lot on preserving the CHF 1.15 support level to suffer huge trading losses.

3) The case of the Yuan exchange rate against the US dollar

Another emblematic example is that of China, whose exchange rate regime against the US dollar is not a classic PEG, but a hybrid system often referred to as managed floating. Prior to 2005, the yuan (CNY) was firmly pegged to the dollar at a fixed rate of 8.28, maintained since 1994. In 2005, Beijing decided to make this mechanism more flexible, allowing the yuan to appreciate gradually. However, in the face of the global financial crisis, the People's Bank of China (PBoC) once again froze the rate at around 6.83 until 2010. Since then, the regime has evolved towards a more sophisticated system: every morning, the central bank publishes a USD/CNY reference rate, around which the currency is allowed to fluctuate within a narrow band of plus or minus 2%. This daily fixing is based both on recent market movements and on a basket of strategic currencies. Although this system is not a formal PEG.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

On May 6, we brought you a technical update on the USD/HKD rate (US dollar VS Hong Kong dollar), as the exchange rate was testing the PEG level of 7.75, defended by the Hong Kong monetary authorities. The PEG therefore provided solid support, and the exchange rate rebounded strongly. It is now under resistance. We'd like to take this opportunity to offer you an educational update on the notion of the PEG in Forex. The link to our May 6 article is just below.

What is a PEG and why use it?

A PEG, or fixed-rate exchange rate regime, consists of a central bank maintaining its currency at a stable value against a foreign currency, often the US dollar or the euro. This system aims to reduce exchange rate volatility, and is advantageous for a country's trade and investment. It promotes economic stability, particularly in countries that are heavily dependent on a stable currency. PEGs survive thanks to the considerable reserves mobilized by monetary authorities to support the target exchange rate. PEGs can thus create technical supports or resistances that can be worth exploiting, but caution is sometimes called for, as history has shown that some central banks can abruptly stop defending a PEG.

1) Interesting PEGs currently in force

Many countries, particularly in the Middle East, Africa and the Caribbean, maintain a fixed rate against the dollar:

Bahrain (BHD), Kuwait (KWD), Oman (OMR), Qatar (QAR), Saudi Arabia (SAR), United Arab Emirates (AED), Panama (PAB). The CFA franc (XOF/XAF), used in 14 African countries, is pegged to the euro at 655.957 CFA per euro.

Some PEGs use a currency board or fluctuation band, such as the Hong Kong dollar (HKD) via a band of 7.75-7.85 HKD per USD. This is the support we shared with you on May 6, and the price rebounded strongly.

The case of the Singapore dollar (the USD/SGD rate) illustrates yet another sophisticated form of intermediate exchange rate regime. Unlike a fixed-rate policy or a free float, the Monetary Authority of Singapore (MAS) steers the value of the SGD through a regime based on a basket of weighted commercial currencies, the exact composition of which remains confidential. This system is based on an unannounced fluctuation band around a central rate, also unpublished.

2) Historical and discontinued PEGs (the landmark episode of the 1.20 PEG on the EUR/CHF rate)

The 1.20 PEG between the euro (EUR) and the Swiss franc (CHF) is one of the most significant episodes in the recent history of European exchange rate policies. Here is a detailed summary of this PEG and its spectacular abandonment in January 2015.

In September 2011, the Swiss National Bank (SNB) set a floor of CHF 1.20 to EUR 1, i.e. a unilateral PEG (not a classic fixed rate, but a floor rate). On January 15, 2015, the SNB abandoned the PEG without notice, citing the growing divergence between the monetary policies of the ECB (falling rates) and the United States. The immediate result: a historic crash on the Forex market.

The EUR/CHF rate dropped instantly from 1.20 to around 0.85-0.90, before stabilizing at around 1.00. The Swiss franc appreciates by almost 30% in a matter of minutes, causing forex intermediaries to go bankrupt, Swiss exporting companies to suffer huge losses and, above all, retail investors who had staked a lot on preserving the CHF 1.15 support level to suffer huge trading losses.

3) The case of the Yuan exchange rate against the US dollar

Another emblematic example is that of China, whose exchange rate regime against the US dollar is not a classic PEG, but a hybrid system often referred to as managed floating. Prior to 2005, the yuan (CNY) was firmly pegged to the dollar at a fixed rate of 8.28, maintained since 1994. In 2005, Beijing decided to make this mechanism more flexible, allowing the yuan to appreciate gradually. However, in the face of the global financial crisis, the People's Bank of China (PBoC) once again froze the rate at around 6.83 until 2010. Since then, the regime has evolved towards a more sophisticated system: every morning, the central bank publishes a USD/CNY reference rate, around which the currency is allowed to fluctuate within a narrow band of plus or minus 2%. This daily fixing is based both on recent market movements and on a basket of strategic currencies. Although this system is not a formal PEG.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.