- Timeframe: Weekly chart shows RSI Divergence

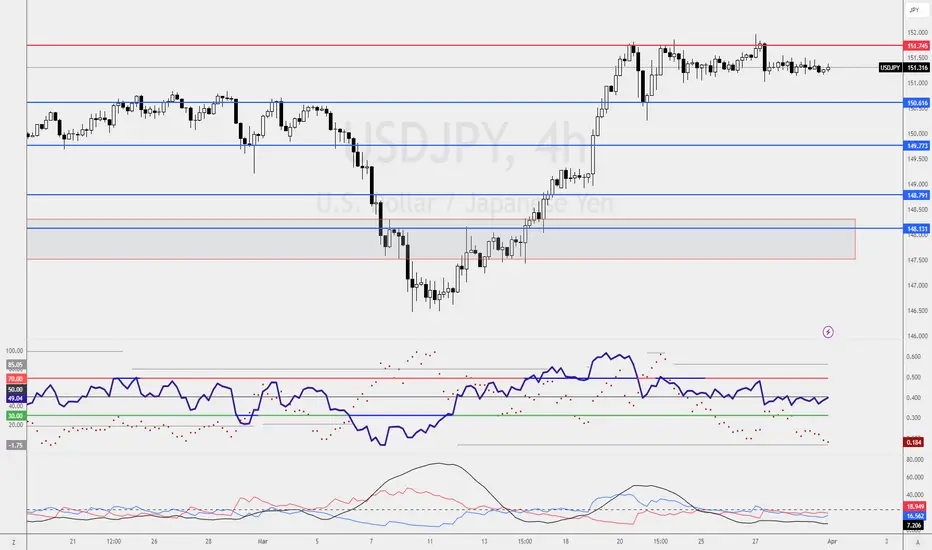

- Trade Bias: Shorting opportunities favored

Analysis:

- Weekly Chart: RSI Divergence signals potential reversal

- 4-Hourly Chart: Waiting for retest of previous resistance at 151.74 for short entry

- Combo Trade Strategy: Stretching targets for lower risk and higher returns

Combo Trade Strategy Explained:

- Definition: Trade management system to extend targets for enhanced risk-reward ratio

- Benefits: Lower risk exposure, higher potential returns

Trade Plan:

- Shorting opportunities identified on USDJPY

- Entry upon retest of 151.74 resistance level on 4-hourly chart

- Utilize combo trade strategy for optimized risk management and profitability

Additional Insights:

- Trading strategy not limited to shorting USDJPY; open to opportunities aligning with trading strategy

- Flexibility in trading approach across multiple currency pairs

Final Thoughts:

- Market dynamics are not constrained by directional movements of specific currency pairs

- Focus on trading opportunities presented by price action and technical indicators

- Adaptability and versatility are key to successful trading in dynamic market conditions

💡 Your Thoughts?

What are your views on the potential shorting opportunity on USDJPY? Share your insights and trading strategies in the comments below!

👍 Like if you appreciate this analysis! Remember, always conduct your own analysis and manage risk responsibly. Trading involves risks.

- Trade Bias: Shorting opportunities favored

Analysis:

- Weekly Chart: RSI Divergence signals potential reversal

- 4-Hourly Chart: Waiting for retest of previous resistance at 151.74 for short entry

- Combo Trade Strategy: Stretching targets for lower risk and higher returns

Combo Trade Strategy Explained:

- Definition: Trade management system to extend targets for enhanced risk-reward ratio

- Benefits: Lower risk exposure, higher potential returns

Trade Plan:

- Shorting opportunities identified on USDJPY

- Entry upon retest of 151.74 resistance level on 4-hourly chart

- Utilize combo trade strategy for optimized risk management and profitability

Additional Insights:

- Trading strategy not limited to shorting USDJPY; open to opportunities aligning with trading strategy

- Flexibility in trading approach across multiple currency pairs

Final Thoughts:

- Market dynamics are not constrained by directional movements of specific currency pairs

- Focus on trading opportunities presented by price action and technical indicators

- Adaptability and versatility are key to successful trading in dynamic market conditions

💡 Your Thoughts?

What are your views on the potential shorting opportunity on USDJPY? Share your insights and trading strategies in the comments below!

👍 Like if you appreciate this analysis! Remember, always conduct your own analysis and manage risk responsibly. Trading involves risks.

🕒 15mins workday for Young Parents

🏦 Qualify Junior Analyst within 90days

🎤 Keynote Speaker

Get into our 15mins workday community

discord.gg/AKDr9vPqH7

Live session & Trading Tips on the GO

instagram.com/raynlim/

🏦 Qualify Junior Analyst within 90days

🎤 Keynote Speaker

Get into our 15mins workday community

discord.gg/AKDr9vPqH7

Live session & Trading Tips on the GO

instagram.com/raynlim/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🕒 15mins workday for Young Parents

🏦 Qualify Junior Analyst within 90days

🎤 Keynote Speaker

Get into our 15mins workday community

discord.gg/AKDr9vPqH7

Live session & Trading Tips on the GO

instagram.com/raynlim/

🏦 Qualify Junior Analyst within 90days

🎤 Keynote Speaker

Get into our 15mins workday community

discord.gg/AKDr9vPqH7

Live session & Trading Tips on the GO

instagram.com/raynlim/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.