Just sharing and excerpt from Bloomberg for educational purpose

source: Bloomberg

Why the Yen Is So Weak and What That Means for Japan: QuickTake

By Yoshiaki Nohara | Updated September 5, 2022

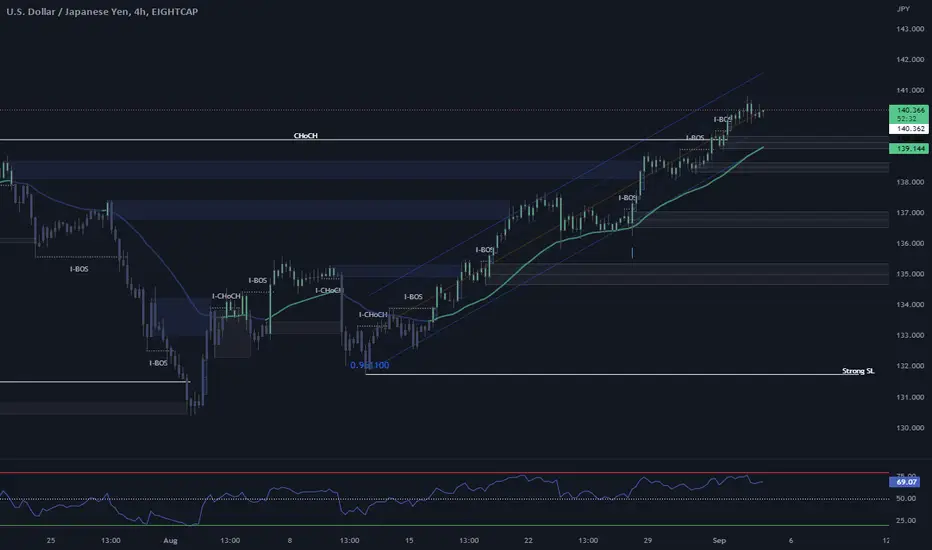

(Bloomberg) -- The yen has weakened beyond 140 per dollar for the first time in almost a quarter century, mainly because Japan’s central bank is keeping interest rates at rock-bottom levels while the Federal Reserve and other central banks are conducting outsized rate hikes. Price growth in Japan is much cooler than in the US, and the Bank of Japan believes it needs to do more to cement inflation in the minds of consumers and businesses after years of deflation. The yen’s historic slide has both benefited and harmed the economy, businesses and consumers. The steepness of its fall raises questions over whether policy makers need to curb its decline through currency intervention or a change in BOJ policy.

1. Why is the yen so weak?

The biggest reason is the US move toward higher interest rates, while Japanese rates remain low, making dollar-denominated assets more attractive for investors. Yields on Treasuries have climbed as traders bet the Fed will continue to raise rates aggressively, while the BOJ keeps a 0.25% cap on Japan’s 10-year government bond yield. Japan’s economic recovery remains relatively moderate and its ongoing trade deficit is also reinforcing downward pressure on the yen.

2. Why doesn’t Japan raise rates?

BOJ Governor Haruhiko Kuroda has repeatedly said it’s too early to cut back on monetary easing as the long fight against deflation isn’t yet over. Inflation has accelerated beyond the BOJ’s 2% goal, but the bank says the trend is not sustainable and expects inflation to slip below the target in the year starting April 2023. Kuroda insists stronger wage gains are needed to secure stable inflation.

Kuroda has voiced concerns about the yen’s abrupt weakening, but has made clear the currency won’t cause the BOJ to change policy.

3. What does the weak yen mean for the economy?

Generally, a weaker yen helps large Japanese companies with global operations because it boosts the value of repatriated overseas profits. Partly thanks to the yen’s drop, Japan’s corporate profits have risen to their highest levels since 1954. A weak currency can also help tourism by boosting the buying power of travelers from abroad, but Japan isn’t yet benefiting from this due to pandemic border controls. On the downside, a soft yen makes imports of energy and food more expensive, hitting consumers whose paychecks are not keeping up with the rise in living costs. Their growing angst has weakened public support for Prime Minister Fumio Kishida. The premier has backed the BOJ’s policy by boosting government spending to cap the impact of higher prices. This sets Japan apart from other major economies that have focused on monetary policy to curb inflation.

4. What does that mean for Kuroda?

With continued support from the government, Kuroda is largely expected to keep interest rates unchanged until his tenure ends in April even if the yen continues to weaken. The governor often points out it’s the finance ministry, not the BOJ, that is in charge of foreign exchange matters. Low borrowing costs also help Kishida to keep increasing public spending to help Japan’s economy recover from the pandemic.

5. Could the government intervene?

Finance Minister Shunichi Suzuki hasn’t hinted at direct intervention in the currency market as an imminent possibility. If the government did step into markets to strengthen the yen, it would be the first time since 1998, when it and the US joined in a massive, coordinated yen-buying spree. Suzuki and other officials are hoping verbal warnings will be enough to slow the current slide of the yen. With the US focused on battling inflation and the yen’s weakness so closely linked to Japanese monetary policy, a joint intervention with the US faces a high bar. Unilateral interventions to prop up the yen in the past proved largely ineffective.

6. Can the yen fall further?

It’s largely up to how high the Fed will raise rates. The steeper Treasury yields go, the bigger the rate gap between Japan and the US will be as the BOJ maintains its lid on domestic bond yields. The Fed’s interest rate hikes earlier this year prompted investors to bet on Japan following suit. Speculation of eventual change still exists, but has mostly receded after the BOJ repeatedly showed a commitment to defending its yield cap. The yen’s slide may stop once investors finish pricing in the Fed’s rate hikes or the US falls into recession, weakening the dollar.

source: Bloomberg

Why the Yen Is So Weak and What That Means for Japan: QuickTake

By Yoshiaki Nohara | Updated September 5, 2022

(Bloomberg) -- The yen has weakened beyond 140 per dollar for the first time in almost a quarter century, mainly because Japan’s central bank is keeping interest rates at rock-bottom levels while the Federal Reserve and other central banks are conducting outsized rate hikes. Price growth in Japan is much cooler than in the US, and the Bank of Japan believes it needs to do more to cement inflation in the minds of consumers and businesses after years of deflation. The yen’s historic slide has both benefited and harmed the economy, businesses and consumers. The steepness of its fall raises questions over whether policy makers need to curb its decline through currency intervention or a change in BOJ policy.

1. Why is the yen so weak?

The biggest reason is the US move toward higher interest rates, while Japanese rates remain low, making dollar-denominated assets more attractive for investors. Yields on Treasuries have climbed as traders bet the Fed will continue to raise rates aggressively, while the BOJ keeps a 0.25% cap on Japan’s 10-year government bond yield. Japan’s economic recovery remains relatively moderate and its ongoing trade deficit is also reinforcing downward pressure on the yen.

2. Why doesn’t Japan raise rates?

BOJ Governor Haruhiko Kuroda has repeatedly said it’s too early to cut back on monetary easing as the long fight against deflation isn’t yet over. Inflation has accelerated beyond the BOJ’s 2% goal, but the bank says the trend is not sustainable and expects inflation to slip below the target in the year starting April 2023. Kuroda insists stronger wage gains are needed to secure stable inflation.

Kuroda has voiced concerns about the yen’s abrupt weakening, but has made clear the currency won’t cause the BOJ to change policy.

3. What does the weak yen mean for the economy?

Generally, a weaker yen helps large Japanese companies with global operations because it boosts the value of repatriated overseas profits. Partly thanks to the yen’s drop, Japan’s corporate profits have risen to their highest levels since 1954. A weak currency can also help tourism by boosting the buying power of travelers from abroad, but Japan isn’t yet benefiting from this due to pandemic border controls. On the downside, a soft yen makes imports of energy and food more expensive, hitting consumers whose paychecks are not keeping up with the rise in living costs. Their growing angst has weakened public support for Prime Minister Fumio Kishida. The premier has backed the BOJ’s policy by boosting government spending to cap the impact of higher prices. This sets Japan apart from other major economies that have focused on monetary policy to curb inflation.

4. What does that mean for Kuroda?

With continued support from the government, Kuroda is largely expected to keep interest rates unchanged until his tenure ends in April even if the yen continues to weaken. The governor often points out it’s the finance ministry, not the BOJ, that is in charge of foreign exchange matters. Low borrowing costs also help Kishida to keep increasing public spending to help Japan’s economy recover from the pandemic.

5. Could the government intervene?

Finance Minister Shunichi Suzuki hasn’t hinted at direct intervention in the currency market as an imminent possibility. If the government did step into markets to strengthen the yen, it would be the first time since 1998, when it and the US joined in a massive, coordinated yen-buying spree. Suzuki and other officials are hoping verbal warnings will be enough to slow the current slide of the yen. With the US focused on battling inflation and the yen’s weakness so closely linked to Japanese monetary policy, a joint intervention with the US faces a high bar. Unilateral interventions to prop up the yen in the past proved largely ineffective.

6. Can the yen fall further?

It’s largely up to how high the Fed will raise rates. The steeper Treasury yields go, the bigger the rate gap between Japan and the US will be as the BOJ maintains its lid on domestic bond yields. The Fed’s interest rate hikes earlier this year prompted investors to bet on Japan following suit. Speculation of eventual change still exists, but has mostly receded after the BOJ repeatedly showed a commitment to defending its yield cap. The yen’s slide may stop once investors finish pricing in the Fed’s rate hikes or the US falls into recession, weakening the dollar.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.