Trading Style & Timeframe Compatibility

When selecting a timeframe for your trading strategy, it's essential to understand how that timeframe interacts with your chosen approach. Not every timeframe works well with every style — and the reason is rooted in time itself.

Each strategy — scalping, day trading, intra-week trading, or swing trading — is defined by how long you intend to hold a position:

-Scalping involves entering and exiting within minutes.

-Day trading means you're flat by the end of the day.

-Intra-week trading covers trades held for several days, but typically wrapped within one or two weeks.

-Swing trading extends beyond that timeframe, sometimes lasting weeks to months.

So before anything else, your timeframe should reflect your intended holding period. If that alignment is off, the edge you're trying to build may be fundamentally flawed.

Timeframes and Institutional Risk

Here’s where it gets interesting: the lower the timeframe, the closer you are to current price action — and that proximity increases your exposure to short-term liquidity grabs by institutional players.

Institutions don’t just push price around randomly. They insert large capital into the market with calculated precision, typically aiming to sweep liquidity (aka stop hunts) before executing their real positions. But there's a limit: institutions can only inject so much money at a time before it becomes inefficient or risky for them.

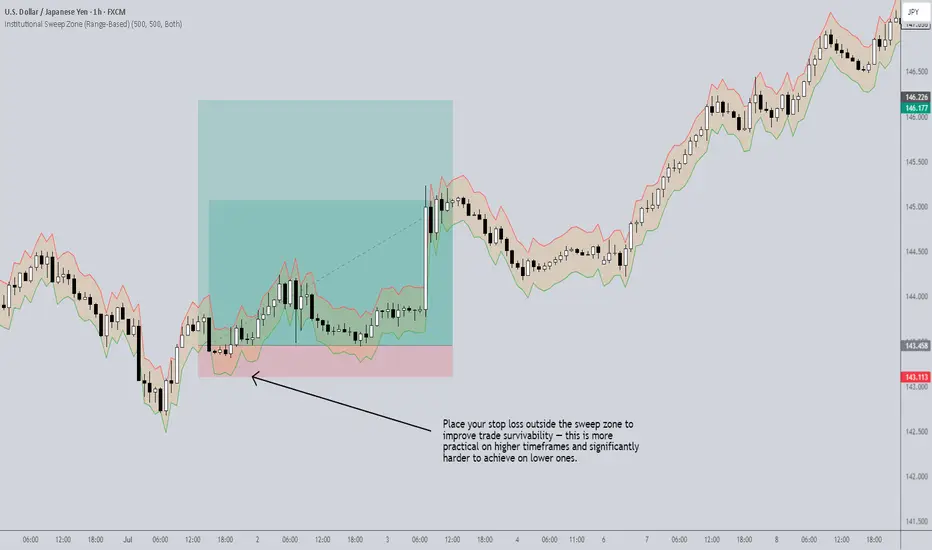

This is where tools like the Institutional Sweep Zone indicator come into play. It estimates how far price can move given a range of institutional capital (e.g., $500M–$1B). It calculates the potential sweep distance based on the pair you're trading, and visually maps the zone where stops are most vulnerable.

For example:

A sweep zone that stretches 20 pips might represent the range where $1B could realistically push price.

If your stop is inside that range, you're at higher risk of getting swept.

If your stop is well outside of it (often found on higher timeframes), the risk decreases substantially — because it would require too much capital to reach your level.

So, higher timeframe strategy stop-losses tend to sit outside these high-risk zones naturally, making them less likely to be manipulated by institutional moves. That’s why:

-Lower timeframe = higher risk of being swept

-Higher timeframe = lower risk, higher survivability

-More Trades ≠ More Profit

One of the biggest traps new traders fall into is believing that more trades will generate more returns. In reality, more trades just amplify risk — especially when you’re relying on low timeframes that are constantly under pressure from liquidity sweeps and volatility.

Patience is a skill. Eager traders often gravitate to the 1-minute, 5-minute or 15-minute charts, thinking they’re catching more opportunities. In truth, they’re exposing themselves to more noise, more traps, and more stop-outs.

Final Thoughts

If you’re serious about aligning your strategy with institutional mechanics, be intentional about your timeframe. Think in terms of:

-Risk exposure to sweeps

-Capital required to invalidate your position

-Holding power relative to time classification

And remember: fewer, higher-quality trades on appropriate timeframes often outperform dozens of rushed trades on lower ones.

For more concepts like this — along with access to unique tools like the Institutional Sweep Zone — check out my TradingView page: The_Forex_Steward. If this post helped clarify your thinking, give it a boost to let others benefit too.

When selecting a timeframe for your trading strategy, it's essential to understand how that timeframe interacts with your chosen approach. Not every timeframe works well with every style — and the reason is rooted in time itself.

Each strategy — scalping, day trading, intra-week trading, or swing trading — is defined by how long you intend to hold a position:

-Scalping involves entering and exiting within minutes.

-Day trading means you're flat by the end of the day.

-Intra-week trading covers trades held for several days, but typically wrapped within one or two weeks.

-Swing trading extends beyond that timeframe, sometimes lasting weeks to months.

So before anything else, your timeframe should reflect your intended holding period. If that alignment is off, the edge you're trying to build may be fundamentally flawed.

Timeframes and Institutional Risk

Here’s where it gets interesting: the lower the timeframe, the closer you are to current price action — and that proximity increases your exposure to short-term liquidity grabs by institutional players.

Institutions don’t just push price around randomly. They insert large capital into the market with calculated precision, typically aiming to sweep liquidity (aka stop hunts) before executing their real positions. But there's a limit: institutions can only inject so much money at a time before it becomes inefficient or risky for them.

This is where tools like the Institutional Sweep Zone indicator come into play. It estimates how far price can move given a range of institutional capital (e.g., $500M–$1B). It calculates the potential sweep distance based on the pair you're trading, and visually maps the zone where stops are most vulnerable.

For example:

A sweep zone that stretches 20 pips might represent the range where $1B could realistically push price.

If your stop is inside that range, you're at higher risk of getting swept.

If your stop is well outside of it (often found on higher timeframes), the risk decreases substantially — because it would require too much capital to reach your level.

So, higher timeframe strategy stop-losses tend to sit outside these high-risk zones naturally, making them less likely to be manipulated by institutional moves. That’s why:

-Lower timeframe = higher risk of being swept

-Higher timeframe = lower risk, higher survivability

-More Trades ≠ More Profit

One of the biggest traps new traders fall into is believing that more trades will generate more returns. In reality, more trades just amplify risk — especially when you’re relying on low timeframes that are constantly under pressure from liquidity sweeps and volatility.

Patience is a skill. Eager traders often gravitate to the 1-minute, 5-minute or 15-minute charts, thinking they’re catching more opportunities. In truth, they’re exposing themselves to more noise, more traps, and more stop-outs.

Final Thoughts

If you’re serious about aligning your strategy with institutional mechanics, be intentional about your timeframe. Think in terms of:

-Risk exposure to sweeps

-Capital required to invalidate your position

-Holding power relative to time classification

And remember: fewer, higher-quality trades on appropriate timeframes often outperform dozens of rushed trades on lower ones.

For more concepts like this — along with access to unique tools like the Institutional Sweep Zone — check out my TradingView page: The_Forex_Steward. If this post helped clarify your thinking, give it a boost to let others benefit too.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.